A Decade of Leadership in the Consumer Sector

Global Consumer Investment Banking

DOWNLOAD OUR BROCHURE »

Our Global Consumer Investment Banking Franchise

Over the last decade, Baird Global Consumer Investment Banking has partnered with some of the world’s most admired companies and brands – guiding them through challenging market cycles, amplifying their stories and helping them achieve their next chapter of growth.

As one of the most experienced advisors in the sector, Baird’s Global Consumer team knows what it takes to achieve an exceptional outcome. Our team’s deep industry expertise allows us to understand our clients’ businesses, provide tailored, honest advice and execute with earnest passion and care.

This unique edge in the sector – combined with the power and integrity of Baird’s 100+ year platform – enables us to navigate complexity and deliver superior results.1

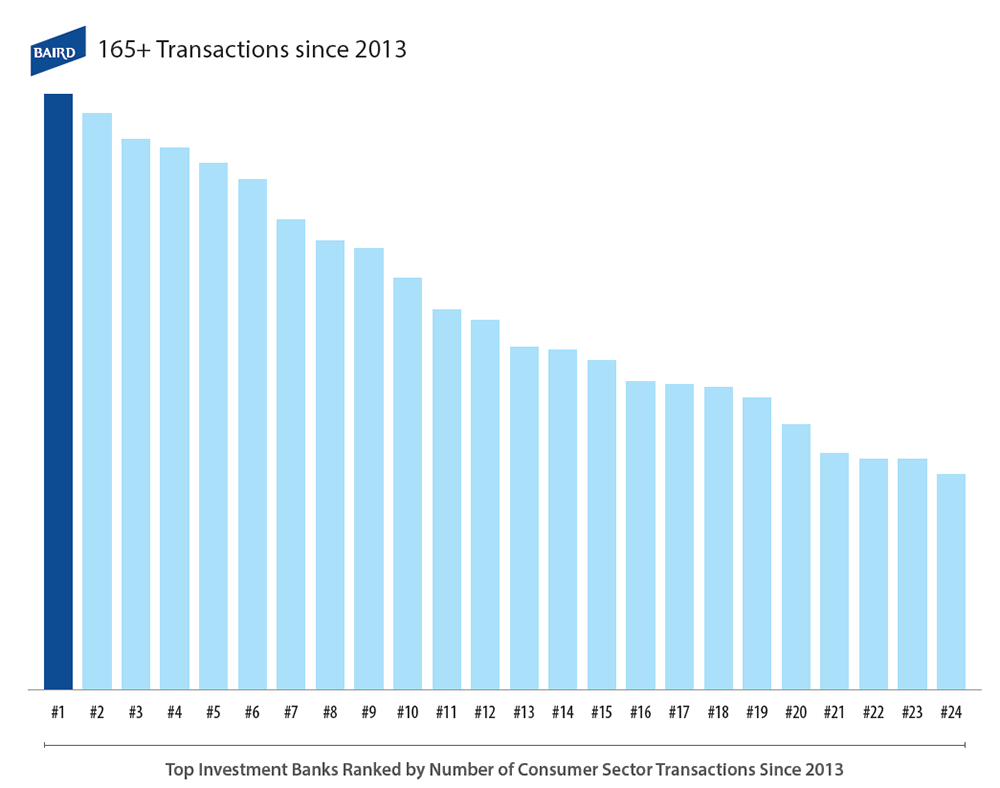

The Most Prolific Advisor of the Last Decade2

We are the #1 most active consumer-sector financial advisor in the US based on the number of M&A and IPO transactions from 2013-2022. In that timeframe, our number of completed M&A transactions has grown >50%, and we have significantly increased our coverage areas.

The Leading Consumer Investment Banking Team Across Peers3

Expanding our Team, Coverage and Activity4

400+

Clients Served

>2X

Increase in Average Transaction Size

>50%

Growth in Consumer M&A Transactions

>3X

Increase in Team Headcount

>2x

Dedicated Subsector Coverage Expansion

>40%

Public Company Research Coverage Expansion

Storytelling that Delivers Superior Results1

The “Baird Difference” makes the difference for our clients as we focus on achieving superior outcomes.1 By combining our deep sector expertise and relationships with our passion for impactful storytelling – and bringing together the right team from across the Baird platform – we have delivered outcomes that exceed the market by two or more turns of EBITDA on average.

Canyon Sale to GBL

World-class road bike, mountain bike and e-bike brand

An unparalleled understanding of the cycling landscape allowed Baird to focus management’s attention on a targeted, value-added investor group with the confidence to complete a transaction amidst the pandemic.

Fox Sale to Vista Outdoor

Global icon and a leading voice in the adventure sports community

As a FOX partner for 10+ years, Baird knew how to communicate the evolution of FOX in a tailored, immersive way and achieve an industry-benchmark valuation despite a challenging market backdrop.

Good2Grow Sales to:

Wind Point Capital and Kainos Capital

Better-for-you kids nutrition platform that is both fun and healthy

Baird captivated a broad group of investors pursuing the business from different angles to create competitive tension that led to a benchmark outcome (twice!).

Stasher Sale to SC Johnson

Founder-led, certified B-Corporation on a mission to bring more sustainability to food storage and cooking

Baird amplified Stasher’s mission-driven ambition, break-through innovation and stellar growth potential to convince the leader of single-use plastic bags to acquire a brand at the forefront of sustainable food storage.

Knix Equity Investment from TZP Group

Pioneer in women’s intimates on a mission to redefine wellness, inclusivity and body positivity

The Knix founder’s objectives and timeline were non-negotiable; Baird rose to the challenge to deliver the best partner to support the brand’s mission at the highest value and certainty, which culminated in a transaction a day before the founder welcomed newborn twins.

WSS Sale to Foot Locker

Differentiated footwear retailer serving a growing demographic and uniquely poised to address a large whitespace opportunity

Baird positioned WSS as a critical acquisition for strategic consolidators seeking to access an underserved and high-growth end market.

More From Our Team

1Based on average EBITDA sellside multiples for Consumer transactions with enterprise values of more than $100M from 2021-2022.

2Based on number of Consumer M&A and IPO transactions from 2013-2022 in the US.

3Source: Dealogic and publicly available data; Includes M&A transactions <$1B in enterprise value and all IPO transactions in the US across all consumer sectors, 2013-2022.

4Statistics since 2013.