Runway Ahead: Outlook & Growth Opportunities in Traffic Management

Investment Banking

Ardis Tabb and Brad Page of Baird’s Facility, Industrial/Infrastructure, Residential and Environmental Services (FIRE) team recently attended the American Traffic Safety Services Association (ATSSA) Annual Convention and Traffic Expo in Phoenix. Throughout the multi-day conference, Baird was able to connect with traffic management professionals to hear the latest market trends and opportunities in traffic management services.

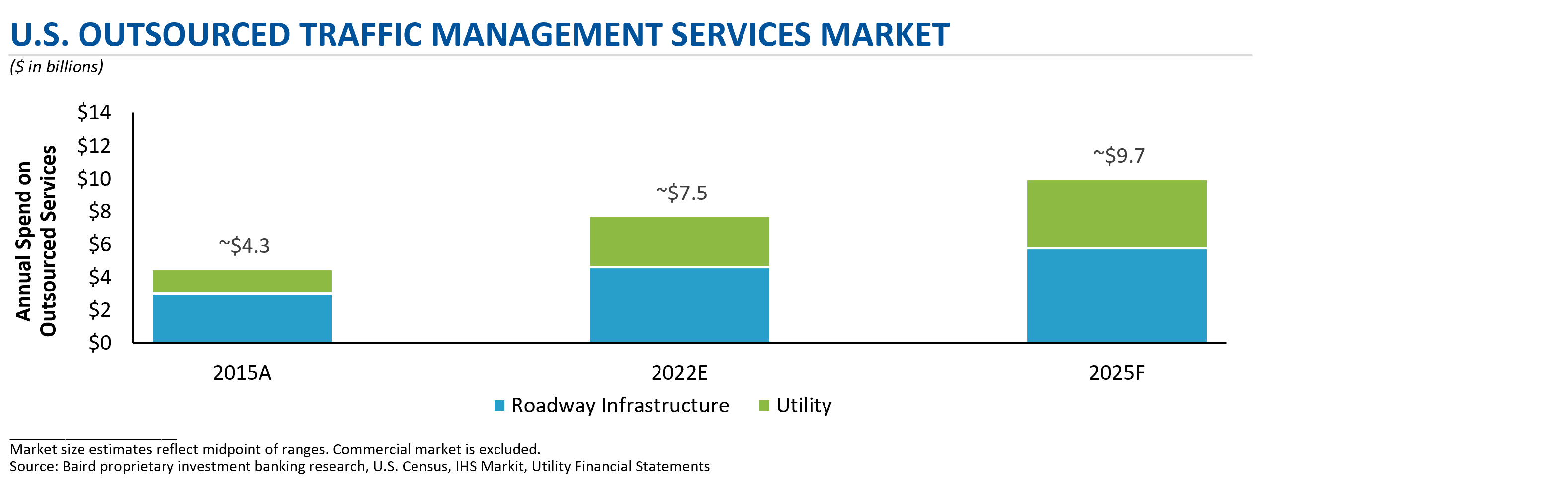

Overall, the traffic management services market is showing continued signs of strong growth, and the industry itself is undergoing meaningful consolidation as demand continues to increase and companies seek to strengthen their market position. Like other industries, the continued challenges of rising prices, labor shortages and delayed funding continue to be anticipated market headwinds. Read more on our learnings and key takeaways from the conference.

- Continued Growth and Rising Demand.

The outlook for the traffic management market is incredibly positive, as strong market tailwinds (i.e., infrastructure spend, end market activity, outsourcing, etc.) persist. Many industry players have recovered from the short-term lull they experienced during COVID shutdowns and are experiencing significant year-over-year growth. Well-positioned local, regional and national players are taking share from their competitors by gaining more wallet share from clients and winning new clients. These well-positioned businesses are characterized as those that prioritize and have a culture around safety, training and service, have the necessary people and equipment to deploy to jobs, and have strong relationships and brands in the markets they compete. The Department of Transportation (DoT), as well as utilities and infrastructure clients (e.g., airports, etc.) have demonstrated strong demand for traffic management services (i.e., traffic control, flagging, pavement marking, signs, etc.) due to the increasing amount of work they must complete. Many market participants are seeing growing backlogs and an increasing number of new project bids; in some cases, demand is outpacing supply and projects are being pushed out to future dates.

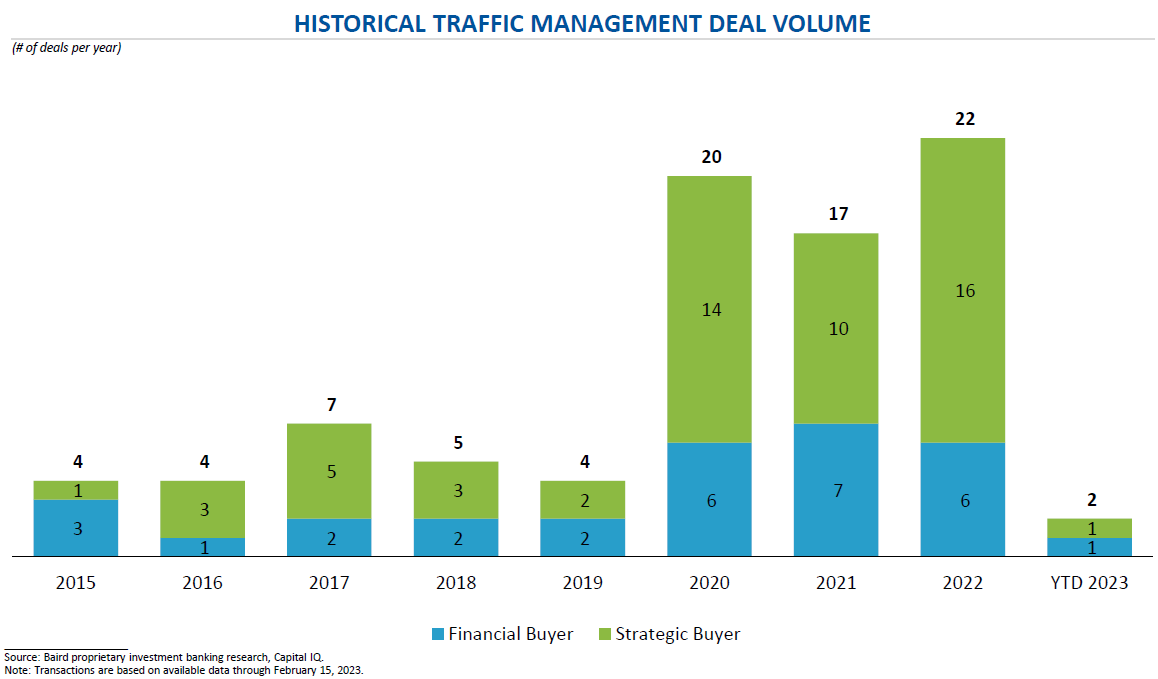

- Meaningful Consolidation to Transform Industry.

The industry has undergone a wave of consolidation over the past several years. Private equity has been aggressively investing into the industry and successfully backed companies have expanded their footprint and service offerings. The opportunity to partner with a well-capitalized financial sponsor has become more appealing as competition has become fiercer and client expectations have increased. The access to talent, capital and scale of these large platforms has made it difficult for smaller, single-location or regional players to compete. Furthermore, clients – whether they be utilities or DoT entities – are seeking a highly professionalized offering (e.g., cross-selling, heightened safety standards, accounting, reporting, etc.) that requires significant resources, training and capital to deploy. As a result, many players are finding it a logical path to sell and partner with the private equity-backed companies with these resources and capabilities in place. In addition, there have been several local and regional players that have found good private equity partners in recent months that are looking to build multi-regional and national platforms, which will drive further consolidation. Lastly, attractive valuation multiples and the opportunity to invest equity in a larger enterprise presents a potentially enriching opportunity that has enticed many owners.

- Increased Pricing Has Finally Arrived.

Rising costs have become commonplace in the current market climate, and many traffic management service providers have successfully increased prices to stabilize margins. Prior to the recent inflationary environment prices held steady as companies were not able to push through price increases for many of their long-term clients. However, in the current environment rising costs have become commonplace, which has made clients more willing to accept price increases. Further, given the mission-critical nature of the work, clients would prefer to pay a higher price to a highly reputable company rather than pay a lower price to a potentially less reputable and less skilled company. Note that the total cost of traffic management is estimated at approximately 2-3% of total project costs, so a modest increase in costs has a minimal impact on total project costs. - Labor Shortage Limiting New Projects.

The challenges of the labor market have affected many businesses across a variety of industries, and the traffic management services market has not been immune. However, given the importance of safety and training required to perform the work, the impact of the labor shortage is more pronounced to this market. As government programs (e.g., American Rescue Plan) wound down many operators expected the labor supply to open up; however, the supply has been slow to recover. With talk of a potential recession there is optimism that job seekers will seek out jobs in recession-resilient markets such as traffic management. Companies have taken on fewer jobs, have longer lead times and have had to bid jobs more aggressively to navigate the tight labor market. Companies with strong cultures that are able to attract and retain talent are well-positioned to take advantage of this current state of affairs. Moreover, they are able to displace competitors by taking on projects that their competitors cannot due to lack of labor supply and by performing higher-quality work due to a more consistent workforce. - Slow Start in Federal Infrastructure Spend.

Federal stimulus dollars are just making their way through the system and are expected to fuel projects for the next several years. The $1.3T U.S. infrastructure bill was widely looked at to drive market activity. However, the deployment of those funds has been slow to be released (as of February 2023, $195B announced funding), but traffic management companies report they are just starting to see these dollars flow through the system and drive project activity. DoT projects have been in company backlogs for long periods of time (e.g., 12 months). Further, traffic management companies are seeing their backlogs grow as demand increases.