M&A Recovery Depends on Improved Macro Outlook

Investment Banking

In the wake of last year’s declines in M&A activity, we see potential for the global M&A market to rebound through the course of 2023 once PE firms and corporates have a better read on the direction of the global economy and the peak level of interest rates. We anticipate a slow start to this year as buyers and sellers continue to contend with elevated inflation, rising interest rates, tighter debt financing, and heightened recession concerns. However, reaching an inflection point for the macroeconomic outlook as 2023 unfolds could serve as a catalyst for M&A activity by enhancing buyer sentiment and unlocking a large supply of targets.

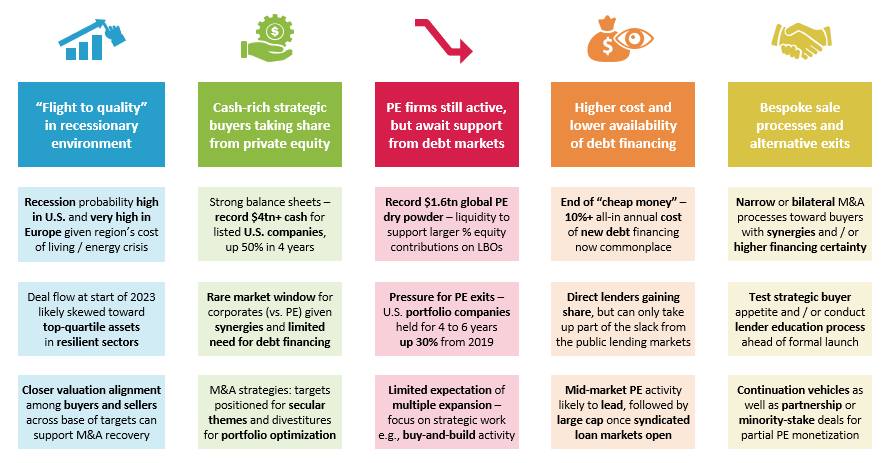

Key Considerations in 2023 M&A Market Outlook

2022 M&A Market Review – Down from Record 2021

M&A trends in the first part of 2023 could carry forward from last year. While the M&A market was always unlikely to reach the high transaction counts and record deal values achieved in 2021, activity in 2022 missed initial expectations due to factors such as persistently high inflation, spiking interest rates, slowing economies, and geopolitical shocks.

Summary of 2022 M&A market metrics:

- Global deal value decreased 34% on a 12% decline in the transaction count.

- Contraction was larger in the U.S.: deal value down 44% and deal count lower by 19%.

- For deals with disclosed value of $100 million to $1 billion, the 2022 deal value fell 26% globally on a 21% decrease in the number of transactions.

- Relative to 2021’s record deal value, the global value decline of 34% in 2022 is consistent with the average post-peak contraction of 2016 vs. 2015, 2008 vs. 2007, and 2001 vs. 2000.

- Global and U.S. deal values were comparable to the averages of 2016-2019 (a strong period for M&A), indicating significant buyer demand for upper-tier assets and leading platforms.

- Global M&A activity weakened over the course of 2022; compared to first-half totals, the second-half deal count dropped more than 20% and deal value fell nearly 40%.

- The M&A market may have bottomed during the latter part of 2022, as Q4 metrics were similar to Q3 figures.

- In a rare bright spot, public-to-private (P2P) M&A activity in 2022 was the highest since 2007, with deal value up 70% from 2021, partly driven by strong private equity appetite for large technology deals at relatively attractive valuations.

2023 M&A Market Overview – Potential Pickup After Slow Start

Headwinds that impeded M&A during 2022 could limit the pace of deal agreements until the macroeconomic picture becomes clearer. Questions persist about the ability of the global economy to achieve a “soft landing” following a series of substantial interest rate hikes; leading macro research provider Strategas (part of Baird since 2018) estimates the probability of a U.S. recession during 2023 at 50%, while certain CEO surveys and intermittent stock market rallies suggest cautious optimism. Better visibility to the terminal value of the U.S. Federal Reserve’s benchmark rates is likely an essential step toward reducing the impact of economic uncertainty on M&A appetites.

Recent data room activity suggests the M&A deal count in early 2023 is likely to remain below year-ago levels. According to data room provider Datasite, the number of sellside project launches declined an average of 7% year over year during the September-November period. Based on the usual cycle time for sellside processes, this implies further contraction for transaction announcements in the first few months of this year.

Amid the challenging near-term M&A environment, more potential sellers could engage in bilateral discussions with a single prospective buyer. Due to concerns about an unsatisfactory outcome from a broad auction, some sellers are conducting narrow outreaches oriented toward buyers featuring synergies and / or higher financing certainty, thereby preserving the option of a full sellside process once the M&A market fully reopens. With some sellers hesitant to test the waters, inbound approaches from possible buyers having full financing capacity should have a higher hit rate than usual.

While the number of financial deal announcements in Q1 2023 will almost certainly be lower than in Q1 2022, we expect a substantial proportion of deal flow to involve top-quartile assets in resilient sectors. Deal momentum will likely begin in the middle market ahead of large cap, which should follow once the syndicated loan markets open more broadly. We foresee private equity fundraising pressure in 2023 driving certain sale processes to facilitate attracting additional capital. Structured transactions, such as partnership or minority-stake deals, could be more popular in 2023, enabling PE firms to monetize a portion of their assets while retaining upside.

We expect M&A activity to ramp up during the course of 2023 as macro clouds begin to lift.

- Once M&A market participants have greater clarity on central bank actions and the global economy, improved sentiment could jump-start the market given the expansive supply of targets already under sellside mandates as well as latent demand among strategic and sponsor acquirors.

- Buyers and sellers often execute on planned M&A upon signs of progress in the backdrop even if conditions remain far from optimal; for example, M&A activity began to rebound strongly in the latter part of 2020 as the COVID pandemic persisted.

- Also of note, year-over-year comparisons ease after Q2, as first-half 2022 M&A metrics significantly exceeded second-half activity. Early reports of an M&A rebound could stimulate further gains by encouraging additional buyers and sellers to return to the market.

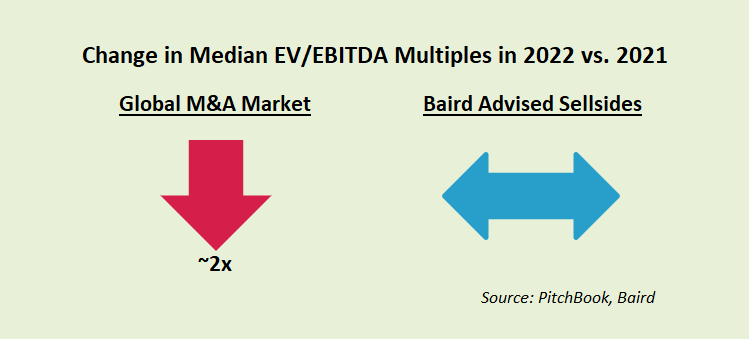

Valuations – Expectations Gap Should Narrow

A rebound in the M&A market depends largely on better alignment of views on valuation among buyers and sellers.

- After pursuing targets aggressively during 2021, prospective buyers became more conservative last year, when bid multiples often failed to meet the heightened expectations of sellers. Unless bringing recession resilient “A”-rated assets to the M&A market, sellers faced a lower valuation environment that reflected higher interest rates, lower leverage levels, reduced public market multiples, and mounting buyer concerns about recession risks along with the associated impact on the target’s financial performance.

- On a global basis, the preliminary median EV/EBITDA multiple of 9.5x for 2022 fell short of 10x for the first time since 2015 and was well below the 14-year high of 11.4x in 2021. Publicly disclosed M&A valuation data could understate the actual degree of multiple contraction, as we believe announced deals were skewed toward higher-quality targets.

Data from Baird Global Investment Banking advisory transactions demonstrates the flight to quality within the 2022 M&A mix.

- The median EV/EBITDA multiple in 2022 for our completed sellsides essentially matched the record level of 2021, benefiting from continued strength in buyer demand for best-in-class business models across sectors despite the overall M&A market cooling down.

- While encouraged by the sustained appeal of top-quality assets, we believe an M&A recovery requires more closely aligned valuation perspectives among buyers and sellers across the broad base of available targets.

- Our prediction of a pickup in activity as 2023 progresses is based partly on expecting the valuation gap to narrow, thereby catalyzing stronger deal flow as more participants adjust to the multiples that are feasible during this phase of the M&A market cycle.

Strategic Buyers – Well Positioned for Busy Year

Corporate M&A could be increasingly active during 2023. In view of current M&A market conditions, early 2023 likely represents a rare market window for corporates to proactively approach targets at the top of the priority list while facing less aggressive sponsor competition. Companies with operating momentum, low leverage balance sheets, and good visibility into positive revenue trends are in best position to lean into the M&A market.

In our recent processes, we have seen sellers sharpen their focus on well capitalized strategic buyers given higher hurdles faced by sponsors in the financing markets. This dynamic is evident in broader market data, as the strategic acquiror contribution to the transaction mix in Q4 2022 was more than two percentage points higher than in Q1-Q3, driven largely by a six-point share shift in the consumer sector, which experienced the most significant impact from economic factors in 2022.

Many corporates have the balance sheet capacity required to pursue M&A in this environment. U.S. public company cash positions totaled $4+ trillion as of late 2022, rising 50%+ over the past four years. While debt is under a larger spotlight given the increased cost of capital and economic uncertainty, recent leverage ratios for larger corporates appear healthy, as the average net debt/EBITDA of 1.0x for the S&P 500 was below the levels of 2015-2020 and only slightly above the year-end 2021 figure.

In view of significant declines across equity markets during 2022, analysis of public company stock performance following announcements of large acquisitions during periods of equity market weakness is instructive in highlighting the potential for outsized returns.

- As detailed below, public companies undertaking major acquisitions* experienced significant outperformance relative to the S&P 500 on a 1-year and 3-year basis.

- This analysis suggests the potential for higher rewards from acquiring during periods when many buyers are in risk-off mode due to focus on capital preservation amid increased financing costs and concerns about operating results.

Total Shareholder Return of Public Company Acquirors vs. S&P 500 After Large Deals During Market Weakness

| Relative Outperformance | 1 Year After Announcements | 3 Years After Announcements |

| Median | 2% | 7% |

| Average | 4% | 16% |

Source: Capital IQ, Dealogic

* Analysis focuses on U.S.-based public companies announcing $500+ million acquisitions that represented at least 10% of market capitalization during 2001-2002 and 2007-2008 in the Consumer, Healthcare, Industrial, and Technology & Services sectors.

Corporate deal making should also include a substantial level of divestiture activity, as companies seek to sell non-core businesses to reposition for future growth opportunities and to shore up balance sheets using proceeds.

- As a recent example, Emerson agreed to divest a 55% stake of its climate technologies business to an investor group led by Blackstone for $11.8 billion, with Emerson providing a $2+ billion seller note to facilitate the deal’s funding.

- Public companies undertaking divestitures should be more willing to accept the current M&A valuation environment after experiencing lower trading multiples last year, when the average EV/EBITDA for S&P 500 companies fell to 12.5x from 16.7x at the end of 2021.

- We expect continued divestiture activity in 2023 to be driven by corporates looking to monetize non-essential assets while pursuing additional investments in higher-growth areas that capitalize on positive secular trends.

Financial Sponsors – Awaiting Broader Support from Debt Markets

After capital deployment and exit activity for financial sponsors increased substantially as a proportion of overall M&A activity during the extended low interest rate era, 2023 should be a transition year as PE firms adjust to a new age of more normalized rates. Nevertheless, private equity is a deep and liquid market now relative to prior economic downturns, with proven ability to transact in changing macro environments (including through COVID), suggesting an active year ahead for sponsors.

M&A activity in 2022 underscored the importance of the lending markets to deal making by PE firms.

- Following a hectic 2021, U.S. deal counts for sponsor acquisitions and portfolio company M&A exits decreased roughly 20% in 2022.

- Many PE firms delayed their buying and selling plans due largely to reduced liquidity, increased pricing, and lower leverage in the credit markets after indications that the Fed’s rate hikes would far exceed initial expectations.

- While direct lenders thrive during periods of market dislocation, private credit was able to take up only some of the slack caused by much lower issuance volumes in the public lending markets, as direct lenders turned more conservative on hold sizes through the course of 2022.

A faster pace of sponsor buying and selling in 2023 will depend largely on conditions in the debt financing markets.

- As the year begins, lending markets remain bifurcated, with M&A financing more available for high-quality credits than for second-tier borrowers.

- Credit availability should broaden as the market gets a firmer grasp on when the Fed will stop raising its benchmark rates and as the shape of the economic cycle becomes clearer.

- Even if public markets revive over the course of 2023, we expect direct lenders to gain incremental share, powered by a strong value proposition for borrowers (featuring speed of execution and certainty of close) and further backing from investment allocators, as assets under management for private credit more than doubled to $1.3 trillion over the past five years.

- Nevertheless, recent dynamics translate to direct lenders avoiding large holds on any single credit, resulting in significantly reduced availability for larger unitranche deals relative to a year ago. With pressure on hold sizes increasing the complexity of financings, an assessment of this trend in early 2023 will be an important indicator of how much support direct lenders will provide to the M&A market.

Private equity firms continue to have the means and motivation to transact when the lending markets are cooperative.

- Dry powder for private equity funds represents a record level of $1.6 trillion on a global basis, nearly doubling over the past five years and up moderately from the year-ago level. With lenders currently requiring larger equity contributions for buyouts, sponsors are well stocked to secure prized platforms and to execute the add-on strategies often favored in 2022.

- Following a slower year for selling, PE firms will seek exit opportunities for numerous holdings if market conditions are constructive, as the number of companies still owned by a U.S.-based sponsor after a hold period of 4-6 years exceeds the year-end 2019 figure by more than 30%.

- Fundraising dynamics also could encourage PE firms to explore exits in 2023. Based on preliminary data, aggregate capital raised by buyout funds in 2022 dropped to a four-year low, putting more fundraising pressure on 2023, when a normalized fundraising cycle could create a more pressing need for exits. PE firms in fundraising mode might be inclined to boost performance metrics by selling their best assets in an effort to offset markdowns taken elsewhere in portfolios due to the challenging valuation and operating environment.

In recent years, a large portion of PE value was created through valuation expansion. With limited expectation of significant multiple expansion in the near term, focus is shifting to more strategic and operational work to generate value. As an example, M&A add-on activity will continue in 2023 despite debt constraints, as PE portfolio companies typically have a certain amount of capacity before needing to open up credit facilities to current interest rates.

Our recent report detailing the drivers of the best exit transactions achieved by PE firms over the past 18 months highlights the M&A expectations of sponsors for the upcoming year.

- When asked to identify the likely impact of the macro environment on M&A activity, many PE professionals projected lower valuations and constraints in debt financing as factoring into a slowdown in deal making.

- Some sponsors cited potential for the tough backdrop to create acquisition opportunities, while others noted greater focus on making their businesses more resilient as well as the likelihood of holding onto assets for longer periods.

- The report notes that sponsor investments made during past periods of economic weakness (for example, in 2001 and 2009) demonstrated superior returns, a point reinforced by one of numerous insightful quotes from PE professionals: “In my 20+ years of experience in private equity, I have reflected on every period of downturn wishing I invested more.”

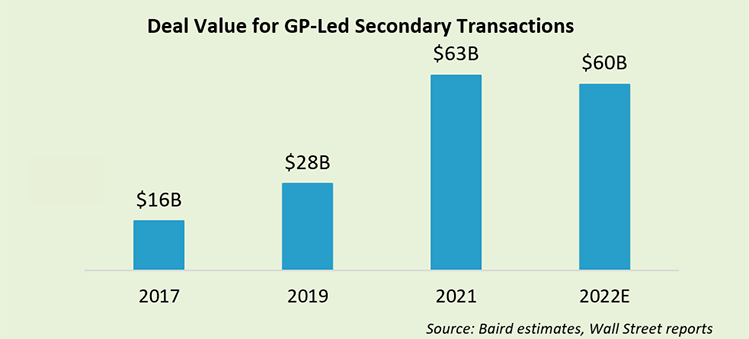

Alternative PE Approaches – Gaining More Traction

While control-stake sales will remain the large majority of exits, we expect a substantial level of less conventional sponsor transaction activity in this environment. Indeed, PE firms are already finding creative ways to complete deals under more difficult conditions, with these approaches likely to sustain momentum in 2023, as indicated by recent strength for GP-led secondary sales as well as partial-stake transactions.

Continuation vehicles

We anticipate further growth in the number of PE firms utilizing continuation funds, either for single assets or multi-asset / full fund portfolios, as an alternative to traditional M&A sales or IPO exits. These vehicles enable sponsors to address fund / LP liquidity considerations and still maintain ownership of key assets, thereby allowing them to extend hold periods and partnerships with management teams, raise incremental dry powder to pursue M&A, crystalize carried interest, and retain future upside. In most instances, these transactions do not trigger a change of control, and the existing debt is portable, which means sponsors are not reliant upon choppy financing markets to effect a transaction, further making this an attractive alternative in today's environment, as evident in their outperformance relative to the overall M&A market in 2022.

While the continuation vehicle market has matured over the last several years and the technology has proven to be an effective portfolio management tool for sponsors, we believe that we are still in the early innings of what this market will ultimately become based on increased market acceptance, continued buyside capital formation, and further evolution in the structuring and processes by which assets are moved into continuation vehicles. In view of the rapid growth potential for this segment of the M&A market, Baird Global Investment Banking recently established our new Global GP Solutions Group, hiring highly accomplished co-heads with extensive GP secondary market expertise and transaction experience.

Majority sale with retained minority stake

During 2022, the number of majority stake M&A sales to other PE firms with a financial sponsor retaining a minority interest was 40%+ above the average of 2015-2019 (excluding the unusual M&A period of 2020-2021). In such transactions, the existing sponsor’s continued investment helps bridge any gap in financing capital. In addition, the majority-stake seller remaining along for the ride provides a boost of confidence to the investment committee of the acquiring PE firm.

Minority equity recapitalizations

Financial sponsors are also increasingly utilizing minority equity recapitalizations to lengthen ownership periods and raise growth capital for favored holdings, largely in response to reduced valuation expectations for control-stake transactions. As evidence of the rising popularity of this alternative, the deal count for minority-interest sales by financial sponsors during 2022 exceeded the 2015-2019 mean by 40%+. Minority equity recaps are often combined with other financing solutions, including debt (with incumbent lenders or new sources), structured equity (hybrid securities with elements of equity and debt), and continuation vehicles (detailed above). A minority equity recap can work in conjunction with a continuation fund by delivering needed liquidity while also providing a third-party mark.

Public-to-private (P2P) deals

Last year saw the highest P2P deal value since 2007 (according to PitchBook), up 70% from 2021, driven by lower (thus more attractive) public company valuations and a willingness by large-cap sponsors to deploy dry powder on bigger targets, many of which are publicly listed.

- The average global P2P deal size doubled in 2022 to $4 billion, driven by 33 deals worth more than $3 billion. The largest rise in P2P activity (for deals valued above $100 million) came from the U.S., accounting for 75% of all P2P deal value in 2022.

- The average deal size in the U.S. was 80% higher than in 2021, as PE firms deployed significant capital in the technology sector, such as the take-private of Citrix Systems for $17 billion by Vista Equity Partners and Evergreen Coast Capital. An abundance of publicly listed technology assets of scale remains relative to the number of privately-owned unicorns, many of which are not yet near profitability.

- Healthcare also took more share of P2P activity in 2022, proving that PE firms are allocating a greater share of their funds to sectors with resilience to economic cycles.

- European P2P activity decreased in 2022 given Russia’s invasion of Ukraine, but the UK continued to dominate, accounting for the majority of activity in the region.

PE firms that see a meaningful disconnect between public and private market valuation levels are more likely to target publicly listed takeovers in 2023. The typical benefits of acquiring high-quality, publicly listed companies remain, such as robust operational and financial system infrastructure, access to readily available information, and high-quality management teams. That noted, P2P activity in 2023 is unlikely to match 2022 given the lower availability and higher cost of debt financing, particularly for multi-billion-dollar deals.

Regional Considerations – Major Markets Could Contribute to Global M&A Revival

In addition to the M&A market drivers detailed above, we note the following factors that are relevant to deal activity in key regional markets.

Europe

- 2022 was a year of two halves for the European M&A market – H1 2022 continued the strong deal momentum of 2021, while H2 2022 metrics plummeted compared to H1 2022, with deal count down 24% and deal value 44% lower.

- The ECB estimates the probability of a Eurozone and UK recession during 2023 at 80%, and any recession is expected to last longer than in the U.S. given the impact of Europe’s energy crisis on consumer spending.

- A meaningful recovery in the European M&A market could therefore lag a potential M&A recovery in the U.S. by three to six months, similar to prior economic downturns, including the GFC and COVID.

- Relatively strong sellside pitch activity in the middle market throughout H2 2022 built a pipeline of mandates in Q1 2023, although it could be later in the year before deals are announced, as many of the M&A processes have yet to launch.

- Europe remains attractive for inbound M&A, particularly for cash-rich U.S. strategic buyers benefiting from higher equity market valuations than in Europe, strong dollar currency, and limited need for debt financing.

- We anticipate increased seller willingness to test strategic buyer appetites and / or to conduct a lender education process ahead of any formal sale process to better construct a highly customized and flexible sale process.

- The M&A market should remain highly competitive for the best / resilient assets, with “flight to quality” in its third phase (recessionary environment across Europe), on top of two potentially ongoing phases (Brexit and COVID).

Japan

- Japanese outbound M&A deal count in 2022 was comparable to the depressed 2021 mark and remained nearly 40% below pre-pandemic levels.

- After rebounding strongly in early 2022 once Japan lifted COVID-related travel restrictions, Japan’s outbound M&A activity was hampered by weakness in the Japanese yen, which declined about 20% against the U.S. dollar in Q1-Q3 2022 before rebounding in Q4.

- We expect outbound activity by Japanese buyers to pick up in 2023 as international travel normalizes and if the yen continues to stabilize.

- Continued drivers of outbound M&A activity include strong corporate balance sheets, favorable interest rates, and the lack of domestic economic growth related to Japan's declining population.

- Japanese buyer interest in overseas targets – with North America and Europe the most preferred destinations – is broad across sectors, including technology and services, industrial, consumer, and healthcare.

China

- Due to the challenging macroeconomic environment and strict COVID curbs, China’s inbound and outbound M&A deal counts both declined 15%+ in 2022. Inbound contraction also reflected heightened caution related to investing in China-based assets, while outbound weakness was partly a function of due diligence limitations caused by COVID policies.

- Certain factors point to a rebound for China’s cross-border M&A in 2023:

- Barring sustained waves of COVID cases, China’s GDP growth would benefit from eased COVID testing requirements and mobility restrictions across major cities, supporting inbound activity and the financial health of outbound buyers.

- More established Chinese enterprises are increasingly looking outward to deploy capital and reduce China market exposure amid longer-term domestic growth deceleration.

- China’s outbound corporate buyers strive to enhance technical and supply-chain capabilities, expand product portfolios, and access new markets. Strategics are targeting higher-growth opportunities related to health and wellness, the aging population, energy transition, automation, digitization, and the circular economy.

We encourage buyers and sellers to prepare for targeted activity despite current market hurdles, as the M&A market could rebound sharply later in 2023 if the macroeconomic environment and financing markets become more supportive, similar to the scenario in the second half of 2020. Please contact Baird’s Global M&A team to discuss your M&A plans for the new year and over the longer term.