Positive M&A Market Fundamentals Should Offset Fed Rate Increases

Investment Banking

With the Federal Reserve planning to raise benchmark interest rates for the first time in more than six years later in March, Baird Global Investment Banking believes an evaluation of the potential impact on M&A is worthwhile, even amid increased uncertainty related to Russia’s invasion of Ukraine. Before providing details on our analysis, we want to acknowledge that the situation in Ukraine is extremely dynamic and that the derivative effects of the conflict with Russia are still very much unknown, with potential to impact global M&A activity.

With the Federal Reserve planning to raise benchmark interest rates for the first time in more than six years later in March, Baird Global Investment Banking believes an evaluation of the potential impact on M&A is worthwhile, even amid increased uncertainty related to Russia’s invasion of Ukraine. Before providing details on our analysis, we want to acknowledge that the situation in Ukraine is extremely dynamic and that the derivative effects of the conflict with Russia are still very much unknown, with potential to impact global M&A activity.

The experience of the past two cycles indicates that upcoming rate hikes could correspond to a short-lived M&A slowdown relative to the strength of 2021. That noted, we have not seen a material impact from shifting rate policy or geopolitical turmoil in our current processes, and we continue to expect favorable fundamentals to drive healthy performance for the M&A market in 2022.

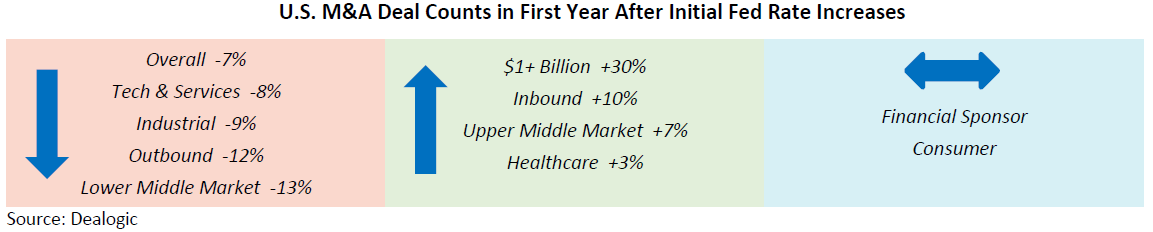

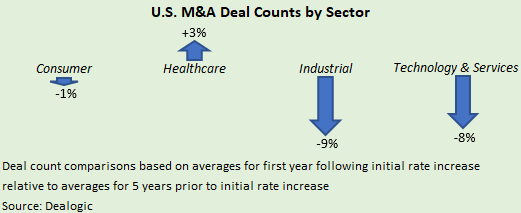

The graphic presented below summarizes deal count comparisons in various segments during the first year of the last two rate increase cycles relative to average activity levels in the preceding five years, with the following content providing further details and analysis for each category.

The M&A market is contending with varied cross-currents in early 2022 after strong tailwinds drove record deal values last year.

- Following its late January meeting, the Fed clearly indicated its intentions to raise benchmark rates several times in 2022, with the capital markets now pricing in an initial increase in March followed by four or more additional hikes before the end of the year.

- In early March, Fed Chairman Powell cited plans to move forward with the first hike at the March 15-16 meeting while noting that the fall-out from Russia’s invasion of Ukraine results in heightened economic uncertainty that could impact the Fed’s subsequent policy actions.

- The Fed is shifting to tightening mode in reaction to inflation surging to a 40-year high along with unemployment approaching historically low levels. The potential ramifications of Russia’s invasion of Ukraine for the global economy include the inflationary effects on oil and natural gas as well as key agricultural commodities such as wheat.

- Recent macroeconomic challenges include global supply-chain disruption, which has been exacerbated by restrictions related to the Omicron COVID variant, with the Russia-Ukraine conflict also likely to cause supply shortages.

While we continue to anticipate a good year for the M&A market (as detailed in this 2022 M&A outlook piece) based on strong demand from financial sponsor and corporate acquirors as well as constructive credit markets, impending Fed rate increases warrant a closer look into M&A activity during the previous two rate hike cycles. We believe the insights provided here apply to M&A during periods of monetary tightening in large markets such as Europe and Asia; our analysis focuses more on U.S. M&A activity (which represented 55% of disclosed global deal value over the past decade) due to the closer tie to Fed rate actions.

M&A Activity After Past Fed Rate Increases

As shown below, the previous two Fed rate hike cycles corresponded to a moderate downturn for M&A activity during the first year after the start of tightening. (In the charts and text, “first year” / “Year 1” / “year one” refers to the first 12 months after the initial rate increase – i.e., July 2004-June 2005 and January-December 2016.)

The historical data for both cases suggests potential for a relatively short-lived slowdown for M&A activity during 2022. Importantly, M&A transaction counts experienced significant rebounds in the second year after the first rate increase even as benchmark rates rose further, pointing to pent-up demand among buyers as well as the ability of market participants to adjust quickly to anticipated Fed actions.

With the capital markets now discounting actual and expected events as quickly as ever, a brief M&A downturn might already be underway.

- As inflation readings remained concerning over the past several months, expectations for the first Fed rate increase moved forward on the calendar while the market also priced in more 2022 hikes in advance of the Fed’s late January messaging.

- Over the same period, M&A activity began to subside from the rapid pace seen for most of last year. For the past three months through February 2022, the average number of announced U.S. deals was an estimated 12% under the monthly mean of the previous five years.

- As noted in our 2022 M&A outlook piece, we have anticipated a softer start of the year on the heels of 2021’s strength, followed by acceleration as 2022 progresses based on continued robust demand from buyers as well as improving results for prospective targets with recent performance hindered by broader economic factors.

- Accordingly, the recent dip in M&A activity is consistent with our full-year outlook, whether due to deal-makers taking a breather after a significant pull-forward into 2021 or related to macroeconomic issues.

- Of note, in our sellside processes, we have not seen a material impact from shifting interest rate policy on M&A valuations or buyer appetite to date.

Our analysis also includes assessments of M&A by size segment, buyer type, sector, and region, as well as M&A valuations, following initial rate increases.

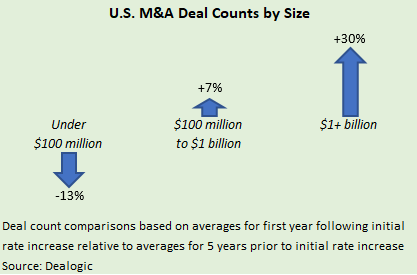

M&A by Size Segment

For both rate increase cycles, year-one declines were concentrated among smaller deals, as larger deal activity held up well.

- On a combined basis, the number of transactions with disclosed values below $100 million was down 13% in year one compared to the average of the prior five years.

- In contrast, deal counts rose 30% in the $1+ billion segment and 7% for the $100 million to $1 billion group, with both segments also seeing growth in year two.

- This dynamic suggests that larger deals, which generally involve seasoned and highly motivated participants such as corporate buyers, financial sponsors, lenders, and M&A advisors, were able to work through a foreseeable issue such as the onset of Fed rate increases.

M&A by Buyer Type

- Nearly all of the year-one decreases in M&A occurred among deals with strategic acquirors, which represented a much larger share of the buyer mix in 2004 (81% in the U.S.) than today (57% in 2021).

- Most of the short-term contraction occurred in the smallest deal size category, implying relatively low impact on larger acquisitions, as corporates continued to pursue prized strategic targets in these scenarios.

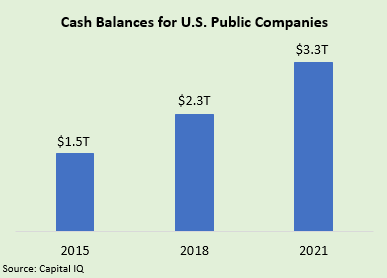

- We expect corporates to remain focused on strategic acquisition priorities during 2022, fueled by $7+ trillion in cash on corporate balance sheets globally (including $3+ trillion for U.S. public companies).

- Financial sponsor activity was relatively flat in year one in both of the cycles that we analyzed.

- However, given the long-term trend of large market share gains for sponsor buying (i.e., from 19% of U.S. deals in 2004 to 43% in 2021), these pauses in growth may indicate modest pressure from rate hikes.

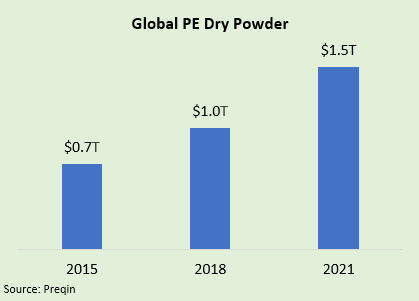

- Nevertheless, we expect solid buying demand from PE firms in 2022, particularly with dry powder at peak levels and given the expansive M&A financing capacity of the private and public lending markets.

M&A by Sector

Short-term fall-offs in M&A were more prominent in certain sectors.

- Industrial M&A dropped an average of 9% in year one before rebounding strongly in year two.

- Technology & Services also experienced downturns, with year-one decreases averaging 8%+; valuations in the technology sector appear more sensitive to interest rate assumptions, as seen recently in the relative underperformance of the technology-oriented NASDAQ index.

- Healthcare M&A was up slightly on average, consistent with the lower impact of macroeconomic factors on demand in the healthcare sector.

- The level of M&A activity in the Consumer sector averaged near flat in year one, followed by moderate growth in the second year.

- In the current environment, broader economic dynamics, such as supply-chain constraints, labor shortages, and inflation-driven price/cost mismatches, could cause delays for assets in affected sectors (e.g., portions of Industrial and Consumer) being brought to market. In such scenarios, we expect M&A activity to rebound quickly given recent signs of normalization in global supply chains (Russia-Ukraine developments notwithstanding) as well as widespread pricing actions now being taken by companies.

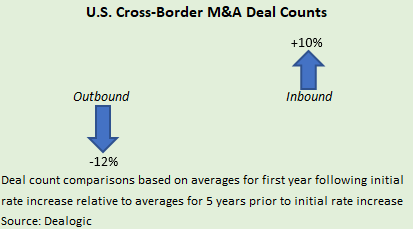

Cross-border M&A Flows

Fed interest rate increases seem to have an influence on cross-border M&A involving U.S.-based companies.

- In the first year after the initial rate hike, U.S. companies slowed their outbound deal-making, as the number of transactions with targets based outside the U.S. declined 12% on average from activity in the comparison periods.

- The U.S. dollar index dropped an average of 3.5% over the first six months after the initial rate hikes, hindering the buying power of U.S.-based acquirors while making U.S. targets more attractive to buyers in certain foreign markets.

- With the pullback for the U.S. dollar increasing the appeal of U.S.-based businesses, the year-one inbound count for deals with non-U.S. acquirors averaged 10% above comparison period figures, followed by 24% growth in year two.

- Major countries responsible for higher inbound M&A in both year-one periods included Canada (leading inbound acquiror nation by a wide margin; averaged +12%), Japan (+33%), and Australia (+48%).

- For companies based in Europe, activity by country varied greatly, while overall inbound M&A from Europe declined slightly on average during the year-one periods.

In addition to listing historical cross-border M&A patterns above, we note that the invasion of Ukraine could impact cross-border activity between the U.S. and Europe as well as prospective deals involving targets with significant European exposure due to more acute effects on the European economy in the near term.

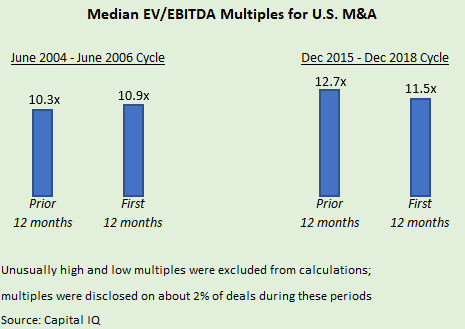

M&A Valuations

M&A valuations held up quite well overall in year one after initial rate hikes.

- In the 2004 case, the median U.S. multiple was up about half a turn from the median of the previous 12 months.

- The median multiple for 2016 (after the December 2015 increase) declined about a turn from the unusually high 2015 valuation, which represents the highest full-year figure (from Capital IQ database) prior to 2021.

- In both instances, the weakest three-month period for M&A activity following the first rate increase corresponded to modest valuation declines.

- Public equity markets were mostly supportive for M&A valuations during year one. The largest drawdown for the S&P 500 after the first rate increase averaged only 8% and was experienced within the first two months in both cases. In addition, the S&P 500 rebounded to the level posted at the time of the initial rate hike within six months in each case and subsequently remained above this mark.

- In general, M&A valuation adjustments lag changes in the equity markets. Given that equity valuations have been at historically high levels in several sectors, many clients on our current engagements believe that M&A valuations can withstand a moderate correction in the equity markets.

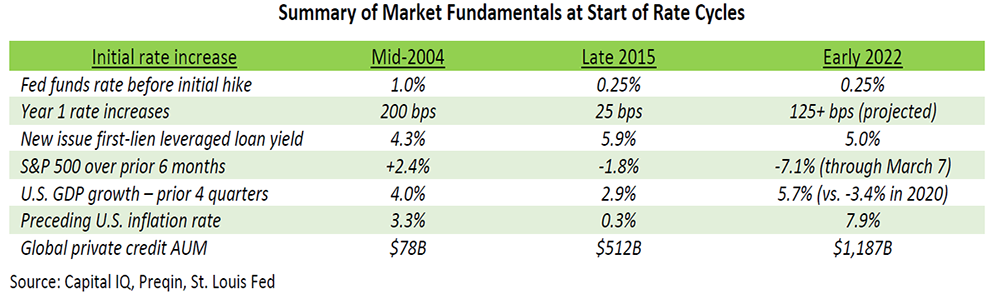

Comparison to Macroeconomic Environment in Previous Cycles

In assessing how upcoming rate hikes could impact the M&A market, we evaluated the similarities and differences of the current macroeconomic backdrop relative to the past cycles. Overall, we believe the precedent analysis is largely applicable to 2022 in view of several important commonalities.

Factors that are relatively similar include:

- Low starting points: Imminent rate increases will begin from 0.25%, which is comparable to 1.0% in mid-2004 and 0.25% in late 2015. Current credit market rates remain close to the low end of historical ranges, contributing to constructive M&A financing conditions.

- Equity markets before first hike: In the prior two cases, the S&P 500 value at the time of the initial hike was roughly in line with the level six months earlier, suggesting a relatively stable period for public company valuations (which influence M&A activity) leading into the rate increase cycle. In the current scenario, equity markets have lost ground to date in 2022, offsetting gains from the latter part of last year; the S&P 500 was flat on a six-month basis through mid-February before the most recent pullback stemming from Russia’s invasion of Ukraine.

- Economic expansion: As with the prior two rate increases, the U.S. economy is entering the latest cycle in moderate growth mode.

- GDP growth was in the lower single digits (3-4%) in the four quarters before both previous rate increases, with expansion decelerating slightly during year one of the last two cycles.

- The more recent economic story is more complicated, as 5%+ GDP growth in 2021 incorporated (1) a rebound from the COVID-related decline of 2020, (2) an extreme imbalance between demand for goods and services, and (3) headwinds from supply-chain disruption, labor shortages, and inflation since the latter part of 2021.

- While low-single-digit GDP growth is projected for 2022, quarterly contraction is possible, including in Q1. For targets facing the challenges noted above, sellside engagements might begin later in 2022, as these companies want to demonstrate stronger results in order to get credit for expected improvement in performance. The resulting growth in the supply of targets would benefit M&A activity later in 2022.

Important differences from past cycles include:

- Peak inflation: In contrast with prior cycles, upcoming rate hikes are largely designed to help bring inflation under control. In recent months, the dominant economic story in the U.S. and across much of the world has been the rise of inflation to levels not witnessed for several decades. The potential for inflation to persist during 2022 could weigh on the willingness of buyers and sellers to execute on planned transactions until prospective targets show the ability to sustain profitability through price actions.

- Pace of rate increases: The previous tightening cycle started slowly, with only one rate hike in each of the first two years. The current scenario is expected to include several rate increases during 2022, although possibly fewer than from mid-2004 to mid-2006, which witnessed eight hikes (totaling 200 bps) in the first year and another nine (225 bps) in the second year.

- Highly developed private credit market: While the public leveraged loan market performed very well amid prior rate increases, the expanded presence of direct lenders will represent incremental financing support for financial sponsor buyers during the upcoming period.

- In the broadly syndicated leveraged loan markets, year-one issuance following initial hikes averaged 32% above the prior-year level, reflecting the appeal of this floating rate asset class in a rising rate environment.

- In addition, spreads and leverage ratios were relatively stable over those periods. Similar performance for the public leveraged loan market would be constructive for M&A activity in 2022.

- With private credit AUM doubling over the past four years, direct lenders are poised to gain additional share in both the middle market and upmarket.

- The emergence of direct lenders played a key role in historically low pricing on new broadly syndicated loans during 2021; as a result, we expect strong competition among lenders in the public and private markets to mitigate upward pressure on loan pricing from higher benchmark Fed rates.

Based on our analysis, we believe any rate-related slowdown in the M&A market experienced during 2022 should be relatively short-lived and would create valuable buying opportunities for financial sponsors and strategic acquirors, which are well equipped to capitalize. Please contact Baird’s Global M&A team to discuss current market dynamics in further detail.