Your Partner for Charter School Financing

Providing custom financial solutions to charter schools across the country since 2003.

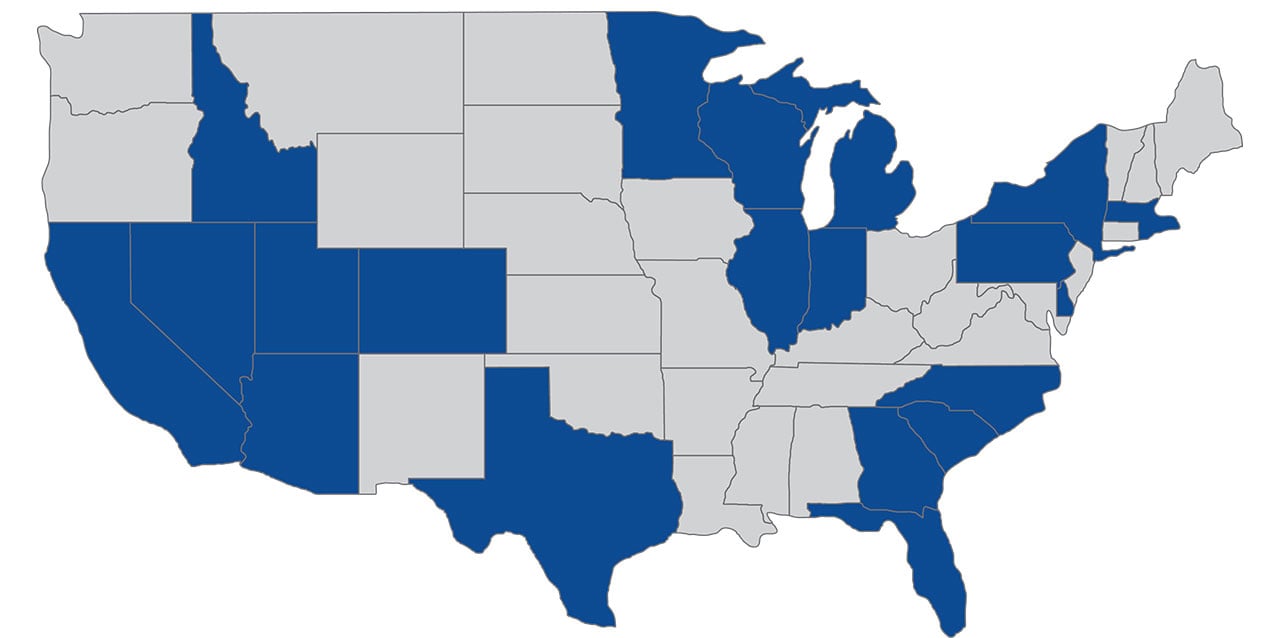

As a national leader in charter school financing,* we know how to assess a school’s financing needs and create financing solutions that are right for you. With a team of tenured professionals solely dedicated to charter school financing, we implement innovative financing techniques to create solutions tailored to the charter schools we serve.

Our Services

Baird's Charter School team provides the following services and solutions:

- Tax-exempt and taxable bonds

- New Markets Tax Credits

- Interim and gap financing

- New construction financing

- Debt refinancing

- Capital planning

- Debt capacity analysis

Highlights

By clicking Submit, you authorize us to contact you regarding a potential business relationship as well as for occasional marketing communications. To learn how to opt-out or for more information about how your information is shared view our full privacy notice.

Baird's Charter School Team

Contact a member of Baird’s Charter School team to explore your planning and financing options.

Contact Us

Business: Public Finance

One Sarasota Tower, Two North Tamiami Trail, Suite 1200

Sarasota, FL 34236

Learn More About Our Areas of Expertise

Connect with Baird Fixed Income Capital Markets to stay up to date on important information, including transactions, new hires, market updates and other significant announcements.

*Source: Refinitiv, by both number of financings underwritten and by par amount as of January 1, 2009 - December 31, 2023