Strong 2022 expected for European private equity M&A

Investment Banking

Drivers for a robust M&A market remain intact after a record 2021

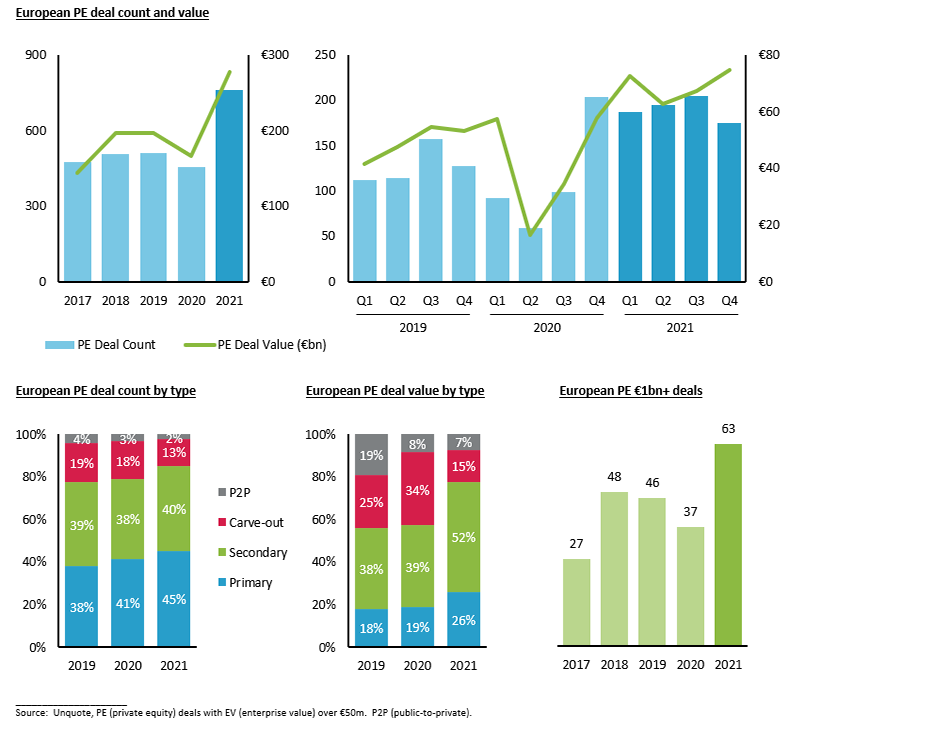

- Record European PE activity – 760 mid-market deals worth €277bn, including 63 €1bn+ deals in 2021

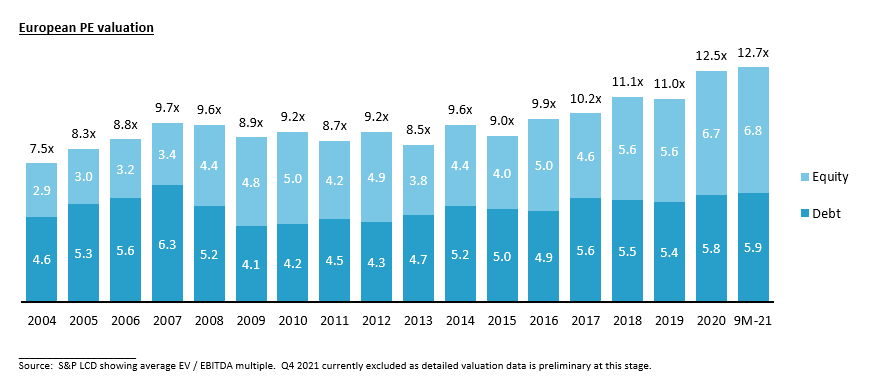

- Average LBO valuation of 12.7x EBITDA, driven by ever increasing valuation premiums for high quality assets

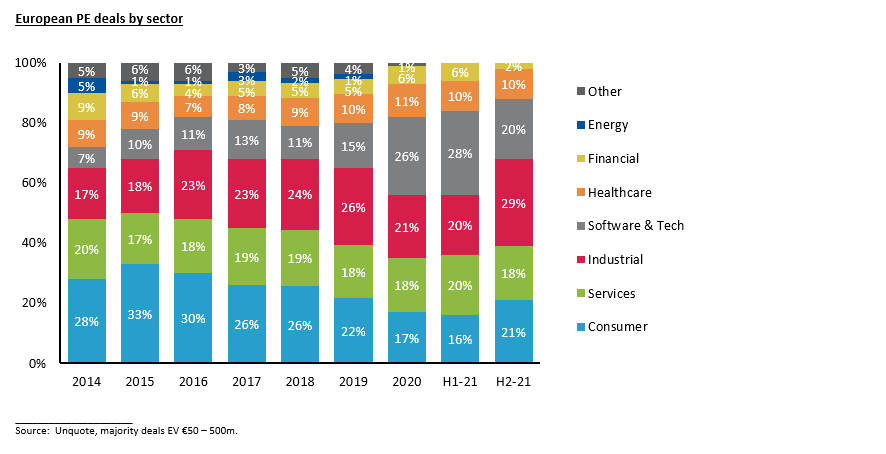

- Record 28% share of software & technology deals in H1 2021, before settling to a new normal of 20% in H2

- Normalisation of sector mix in H2 as industrial and consumer returned to their pre-Covid combined share of 50%

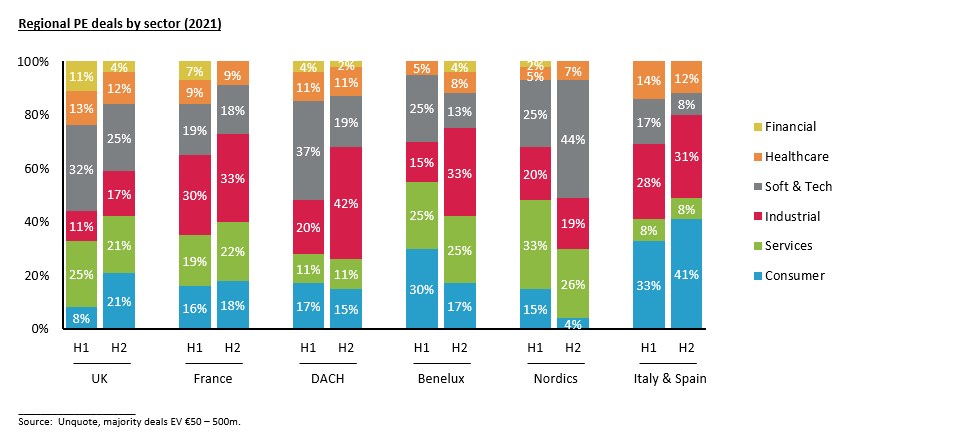

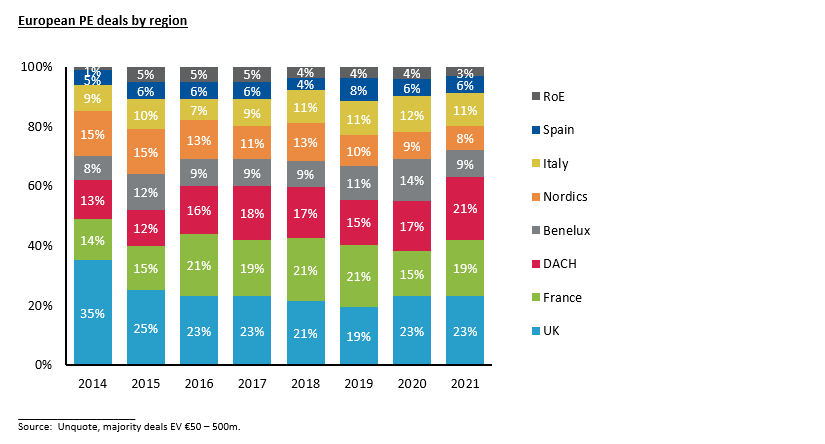

- UK, France and DACH accounted for a combined 64% of European PE deals, a new high watermark

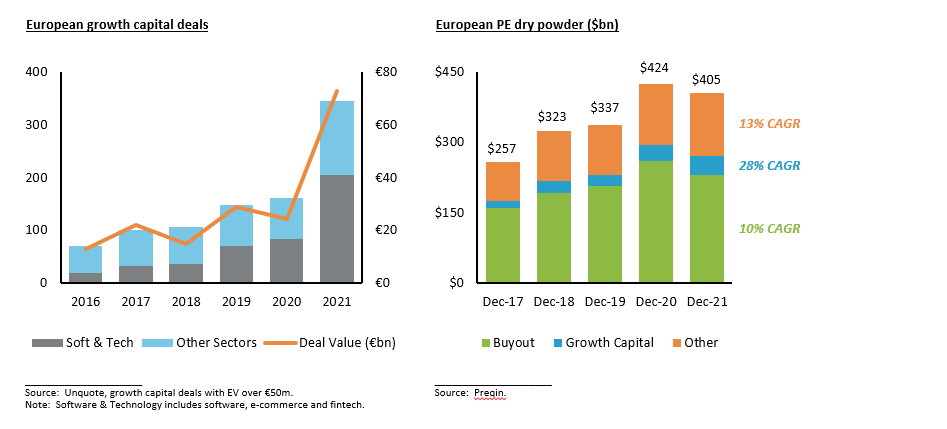

- Acceleration in growth capital – 375 mid-market deals worth €73bn, primarily in software, e-commerce, fintech

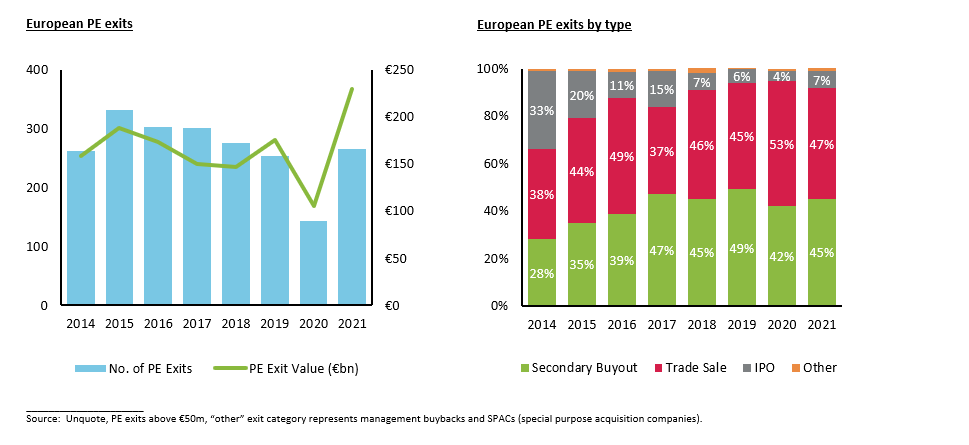

- Record PE exit value of €229bn as firms reap opportunity to sell quality portfolio companies at high valuations

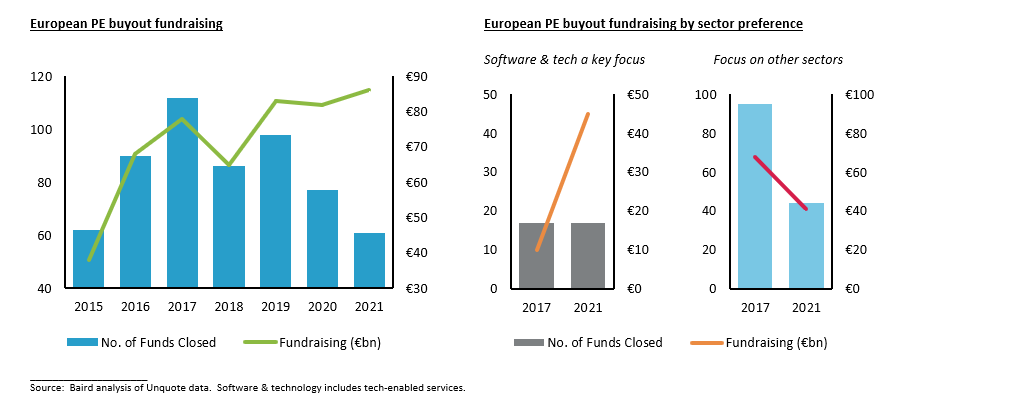

- Bigger buyout funds – record €86bn raised from just 61 vehicles closed, the lowest number since 2013

- PE firms are increasingly looking to benefit from secular growth themes associated with ESG investments

- Baird expects PE deal velocity to remain high in 2022, supported by $405bn of dry powder in Europe

Record private equity deal activity and value

Europe saw record PE deal activity in 2021 with 760 deals (EVs over €50m) worth €277bn, surpassing 2007 deal value. This elevated level of activity was driven by a combination of pent-up M&A demand after the Covid pause in H1 2020 and inflated M&A supply ahead of anticipated tax rises. Larger secondary (and tertiary) buyouts were completed, including in Q4 2021 which saw the highest quarterly deal value despite a fall in the number of deals.

2021 was the first year to see capacity constraints across much of the M&A market. Popular due diligence advisors and consultants were “sold out” in 2021 and the sheer volume of W&I (warranty & indemnity) insurance led to capacity constraints in the underwriting market, increasing pricing and coverage exclusions. Many lenders deployed their full budget for 2021 before year end, becoming more selective in Q4 2021. All lenders and are now ready to utilise their 2022 budget, though some will continue to shy away from credit opportunities in more difficult or cyclical sectors.

Ever increasing valuation premiums for high quality assets

The average EBITDA multiple was at a record level in 2020, driven by the high proportion of Covid-resilient technology and healthcare activity. Valuations continued to expand in 2021, driven by an increasing “valuation premium” between top quartile and median assets. These elevated valuations were supported by a strong European debt market with leverage and pricing at pre-Covid levels given healthy competition from both banks and debt funds.

Sector mix normalisation – a year of two halves

PE activity by sector changed considerably between H1 and H2 2021. In H1 2021, the 28% share of software & technology PE deal activity was double pre-Covid (2019) and quadruple 2014. Software & technology and healthcare will remain to be the sectors of choice for PE firms willing to pay up for high quality / growth businesses. We expect these sectors to maintain a share of mid-market PE activity in 2022 similar to H2 2021, reflecting a new normal in the region of 20% for software & technology and 10% for healthcare.

In H2 2021, non-tech sectors returned to their pre-Covid share of deals. We saw a normalisation in sector mix as industrial and consumer targets, many of which were negatively impacted by Covid in 2020, transacted in H2 2021.

In the industrial sector, there was strong PE appetite for consumer-facing industrial subsectors (e.g. packaging, building products) in H2 2021. Some industrial sale processes launched in 2021 have not yet signed as potential buyers, both strategic and private equity, conduct further due diligence on the target’s ability to maintain profitability margins through the supply chain and inflation crisis, which peaked in Q4 2021. We expect heavy-industrial subsector activity to return in 2022 as supply chain disruptions ease in mid-2022, providing a clearer financial outlook for targets.

In the consumer sector, disruptive high growth business models are attracting attention (e.g. direct-to-consumer / e-commerce, digitally native vertical brands, natural / free-from foods, consumer wellness) from acquirors as such companies continue to take market share from large traditional CPG (consumer packaged goods) players. If Covid related restrictions are largely removed post-Omicron, we envisage more M&A activity within in-person consumer subsectors (e.g. restaurants, gyms) in 2022. Potential buyers will focus their due diligence on the financial impact of Covid over the last two years as well as the validity of the target’s business plan reflecting the new normal.

Sector mix by region shows the story of two halves in 2021, especially in DACH where software & technology was at a record 37% of deal count in H1 before quickly switching back to industrial as the most active sector in H2. We expect DACH PE activity in 2022 to be similar to H2 2021. Meanwhile in the Nordics, industrial activity is unlikely to be the most active sector in 2022 as the region’s software businesses are scaling up, attracting more private equity attention.

Evolving regional trends

The UK, France and DACH accounted for a record 64% of mid-market PE deals in 2021. Since Covid, DACH has overtaken France as the second largest region for mid-market PE deals, after the UK. With so many private equity firms to choose from, target companies looking for capital are also looking to their PE partners for proven expertise in internationalisation, add-on acquisitions, digitisation and increasingly ESG. PE firms with a proven track record in these areas have a competitive edge over their peers when convincing founder-managers to partner with them. This is particularly true in DACH where 50% of PE activity is primary deals compared to near 40% for the rest of Europe.

Over the last decade, an increasing number of European companies have been acquired by Transatlantic PE firms or PE firms with offices only in the US. 2021 saw a marked rise in acquisitions of European assets by US headquartered portfolio companies of US based PE firms. Buy-and-build platforms are taking a global approach, and are able to pay high valuations for add-on acquisitions, benefitting from potential synergies as well as capital from their PE owners.

Continuation funds – increasingly used for the best assets

There was a marked increase in the use of single asset continuation vehicles by GPs (general partners) in 2021, who saw clear benefits of holding onto prized assets for longer when their existing fund-life may be limited:

- Continue to grow an asset they know and avoid reinvestment risk

- Maintain or increase AUM (assets under management), while “realising” a return and carry

- Earn incremental economics on new secondaries capital, while offering LPs (limited partners) optional liquidity

- Provide a third party validation of valuation for the asset, aiding track record and future fundraising for the GP

This trend is likely to continue in 2022, supported by $40bn of dry powder in the European secondaries market. Many secondaries investors are pursuing single asset standalone funds to cherry pick the best assets currently held by GPs. A few years ago, continuation vehicles were primarily used by large-cap sponsors, and is now increasingly adopted by mid-market GPs, providing an alternative to selling their best asset(s) to a strategic buyer or PE firm.

Acceleration in growth capital, primarily supporting tech companies

After steady rises in European growth capital activity in recent years, 2021 saw an exponential surge, doubling mid-market activity to 375 deals and tripling deal value to €73bn. 60% of this activity was supporting tech companies.

Venture capital firms and growth equity funds are writing larger checks in late stage companies, following a similar trend in the US. European growth equity dry powder has almost tripled since 2017 to $40bn, allowing a greater number of companies to stay private for longer, especially in the software & technology sector where an IPO (initial public offering) is a well-trodden route. There are now 120 private unicorns in Europe, 70 of which graduated in 2021.

Record private equity exit value

2021 saw a record PE exit value of €229bn, 40% above the five year pre-Covid average (2015 – 2019) despite a 10% fall in the number of exits. PE firms have increasingly created supply and demand for one another in the form of secondary (and tertiary) buyouts, reaping the opportunity to sell quality portfolio companies at high valuations in 2021. We expect a similar PE exit activity in 2022 from strong 2016 – 2018 vintages and a robust valuation environment.

Record buyout fundraisings

While fundraising by European buyout firms in 2021 reached a record €86bn, the number of funds closed was the lowest in 8 years. PE firms with successful track records continue to attract a higher proportion of LP money:

- Successful PE firms are fundraising above their targets, resulting in larger equity tickets than prior funds

- Record European PE dry powder of $405bn – preference for platform deals with add-on opportunities

- Increasing proportion of mid-market sector specialists relative to generalist funds, following trends in the US

The number of fundraisings by European PE firms that have software & technology as a key focus has remained flat in 2021 compared to 2017. However, the amount raised by such firms has quadrupled in the last four years. Over the same period, PE firms that focus on other sectors (e.g. generalist, consumer) have seen their fundraising reduce 40%. Success breeds success – several new healthcare focused PE firms, set up over the past decade, have now raised larger second and third funds after the successes of their first funds.

ESG and private equity’s risk averse approach

As our wider society becomes more aware of environmental, social and governance (ESG) issues, ESG is becoming an imperative for investors, including PE firms. As consumers, corporations and governments allocate more capital to products, services and infrastructure that are ESG compliant, PE firms seek to benefit from the secular growth themes associated with ESG investments. New “impact” funds are being raised with a broad remit from a sector perspective.

Whether or not a fund has an ESG focus, PE firms are taking a risk averse approach by actively avoiding investments in companies that may garner negative media attention or is difficult to sell in the future due to ESG misalignment. PE portfolio companies, like many other corporations, are increasing transparency through annual sustainability reports.

The view that there is no or very limited trade-off between impact investing and financial returns is now widespread. Supporting businesses in (sub)sectors where there is an alignment between shareholder value and the fundamental positive purpose to society or the environment, offers potentially high returns through transformational improvements.

![]()

Robust 2022 outlook – PE M&A drivers remain in place

After a record level of global M&A activity in 2021, many participants in the M&A market, both in Europe and the US, are taking a slight pause to catch their breath and evaluate priorities in 2022. We may therefore see a lower level of European mid-market PE activity in Q1 2022, followed by a stronger Q2 and H2 2022.

Analogous to the end of 2020, there is a huge amount of PE dry powder at the end of 2021 despite record capital deployment throughout the year. This provides a backdrop of strong M&A demand in 2022, similar to 2021. If the supply of high quality targets in 2022 is lower than 2021, we could see M&A valuation levels tick up even further. PE firms will therefore continue to be very selective, choosing which companies they are willing to pay up for, which is changing from targets that are “Covid resilient / beneficiaries” to targets with “post-Covid secular growth themes”.

If a new coronavirus variant does not take hold after Omicron, 2022 will bring normality back in Europe, easing Covid restrictions. With the vast majority of adults in Europe vaccinated, in-person consumer subsectors and travel & leisure are expected to recover, creating an environment ripe to initiate M&A sale processes for companies in these sectors.

Pressures from the macro environment, such as global supply chain disruption and high inflation, are starting to dissipate, creating the foundation for a more stable economic recovery in 2022. Private equity as an asset class has demonstrated its resilience in the last two years, and continues to outperform public markets over long periods of time.

Baird Global Investment Banking – record year in 2021

- More than doubled activity in 2021 – 214 M&A deals worth $105bn, 85% with private equity involvement

- Great client outcomes – 15.4x average sell-side EBITDA multiple and $530m average sell-side deal size

Contact a member of our European team to discuss these trends in further detail:

Robert W. Baird Limited is authorised and regulated in the United Kingdom by the Financial Conduct Authority. Robert W. Baird & Co. Incorporated. Member SIPC.