Record European private equity M&A set to continue

Investment Banking

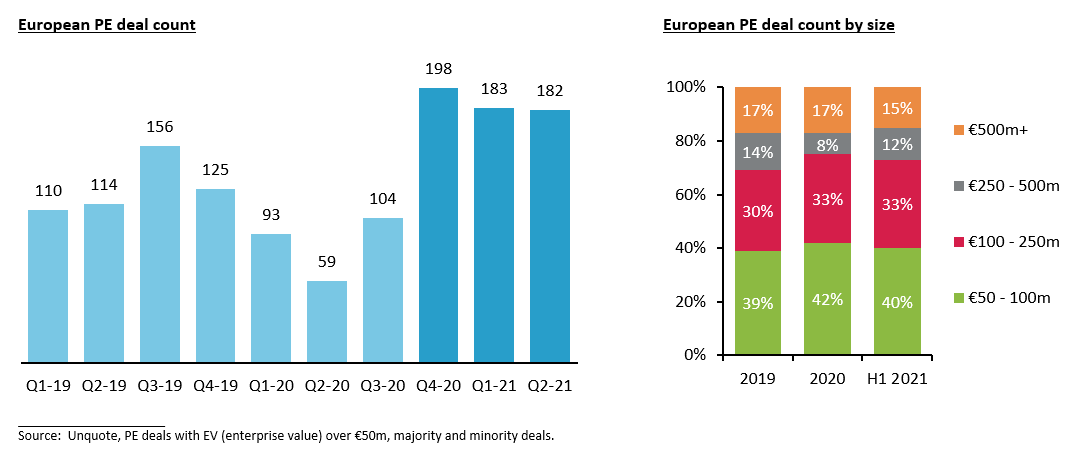

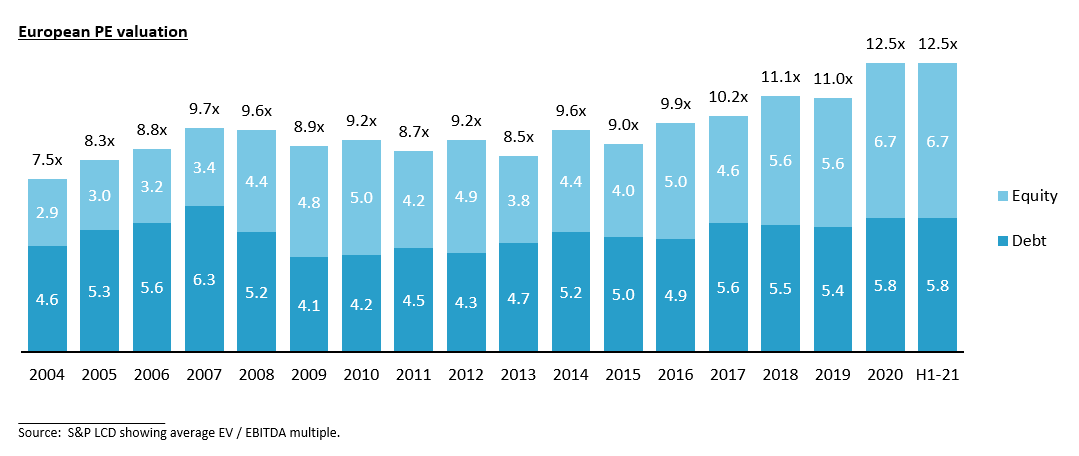

- Record European private equity (PE) deal activity in last 9 months and record valuation levels at 12.5x EBITDA

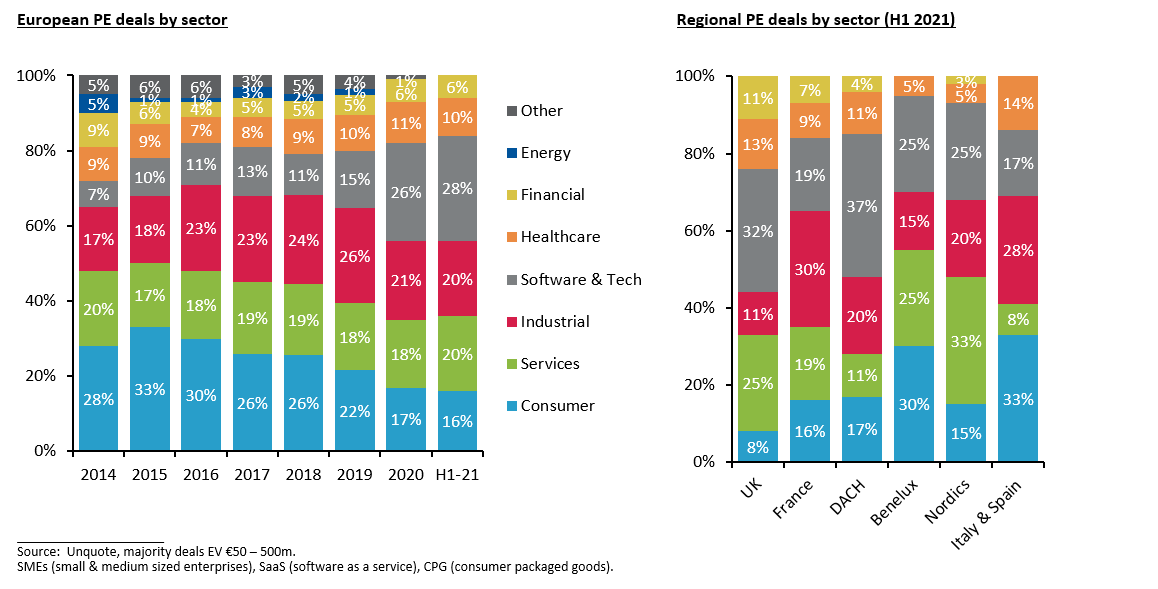

- New high 28% share of software & technology PE deal activity in H1 2021 – double its pre-Covid (2019) level

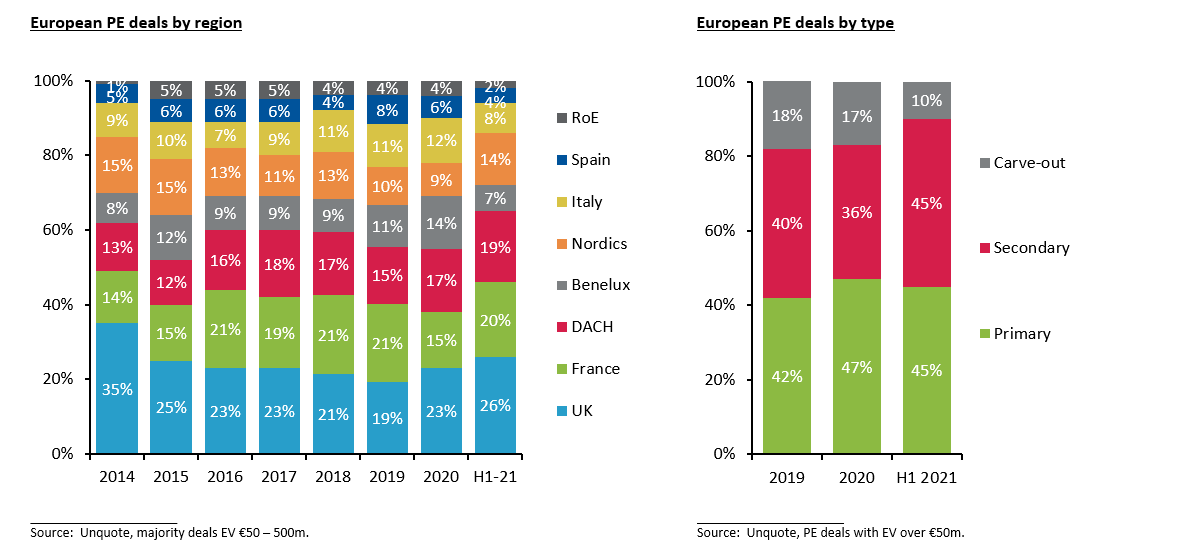

- UK, France and DACH accounted for a combined record 65% of mid-market European PE deals in H1 2021

- Sharp rebound in European PE exit value in H1 2021, setting up the full year of 2021 to be a new record high

- Larger, yet fewer, fundraisings – PE firms with successful track records are attracting even more LP capital

- Deal velocity likely to remain high in Q4 2021, and 2022 could see deals from a broader range of subsectors

Record private equity deal activity

Europe saw record PE deal activity in the last 9 months with more than 180 deals (EVs over €50m) in each quarter. European buyout value, at over €130bn in H1 2021, was the highest half year since 2007. In a crowded market, PE firms and lenders are picking their spots carefully. There is a greater divide between deals, manifesting itself in sector allocation – technology and healthcare leading, along with high quality industrial, consumer and services assets.

We are seeing capacity constraints across all parties, including a number of due diligence (DD) advisors who are completely “sold out” for the next few months. Many lenders are already near their budget for the full 2021 year and are thus likely to be more selective in H2 2021.

High valuations for quality assets

The average EBITDA multiple was at a record level in 2020, driven by the high proportion of Covid-resilient technology and healthcare activity. H1 2021 remains the same at 12.5x EBITDA, supported by a strong European debt market with leverage and pricing at pre-Covid levels given healthy competition from both banks and debt funds.

Evolving M&A sale processes

The high velocity of activity is being supported by largely virtual execution of M&A transactions. Many M&A processes in the last 9 months have evolved, including more potential buyers willing to pre-empt a formal process, supported by:

- Greater information sharing and buyer access earlier in processes while maintaining a level playing field

- Technology / IT vendor due diligence (VDD) reports for a higher proportion of broad / targeted processes

- Scoping corporate buyers pre-process to enforce readiness and get to synergy discussions early on

Interestingly in H1 2021, transatlantic M&A activity has flourished despite the ongoing coronavirus pandemic, international travel restrictions and repeated national lockdowns. This has been supported by high public company valuations in the US, enabling valuation arbitrage when US corporates acquire lower valued European targets.

Sector appetite skewed to technology

The 28% share of software & technology PE deal activity in H1 2021 is double pre-Covid (2019) and quadruple 2014. Even in the DACH region, the sector now accounts for almost double industrial activity. In Europe, expenditure on software was growing at 3x GDP pre-Covid, a trend now accelerated by Covid. More business processes are becoming digital and software adoption, especially amongst SMEs, is low, driving growth of SaaS at over 6x GDP.

A relatively high proportion of healthcare sale processes were not put on hold in Q2 2020 and represented a record 20% of PE deal activity in the height of Europe’s first lockdown. Its share has since normalised at 10% of activity.

Outside of technology and healthcare, selected high quality industrial, consumer and services assets, that have recovered since and shown resilience to Covid in 2020, are seeing strong potential buyer interest. We have seen an uptick in consumer-facing industrial M&A (e.g. packaging, building products) while heavy-industrial activity remains relatively muted as owners of such businesses are waiting for a fuller recovery in financial performance as well as a more certain outlook.

While the share of consumer deals has fallen to a record low, M&A activity has accelerated in subsectors that are Covid-beneficiaries such as hygiene, wellness, home & garden, active lifestyle and digital fitness. PE firms are also acquiring disruptive high growth business models (e.g. direct-to-consumer / e-commerce, digitally native vertical brands, natural / free-from foods) that are taking market share from the large traditional CPG players.

Evolving regional trends since Covid

The UK, France and DACH accounted for a record 65% of mid-market PE deals in H1 2021. The UK regained share since Covid and clarification of the final Brexit deal. Like in the US, an anticipated increase in capital gains tax accelerated shareholder decisions to launch sale processes, particularly for companies below €150m EV in the UK where founders were realising liquidity in Q4 2020 and Q1 2021. Record DACH PE activity was driven by family / founder vendors – just 30% of PE deals in DACH were secondary buyouts compared to 45% for the rest of Europe.

Benelux was an active M&A market in 2020 with numerous Covid-resilient assets. Its share of PE deals halved in H1 2021 as other regions, such as the Nordics, saw sale processes that were put on hold in 2020 come back to market. Italy and Spain have over 60% of activity in consumer and industrial sectors, but their active subsectors since Covid have changed from apparel to food & beverage and from automotive components to diversified industrial machinery.

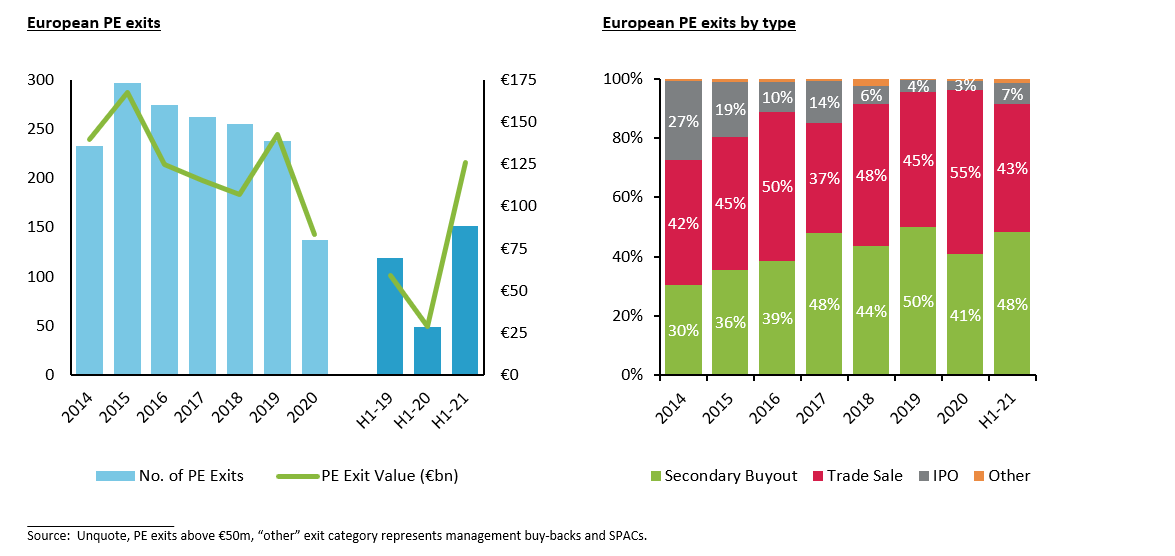

Private equity exits – sharp rebound in deal value

There was significant growth in PE exit activity in H1 2021 compared to pre-Covid (H1 2019). The private equity exit value in H1 2021 is already 75% of the level for the whole of 2015, setting up the full year of 2021 to be a new record high. Over the medium term, PE firms have increasingly created supply and demand for one another in the form of secondary buyouts, taking share from IPO exits. IPO activity of PE portfolio companies has somewhat returned in H1 2021, driven by strong equity market appetite for high growth technology and e-commerce consumer businesses.

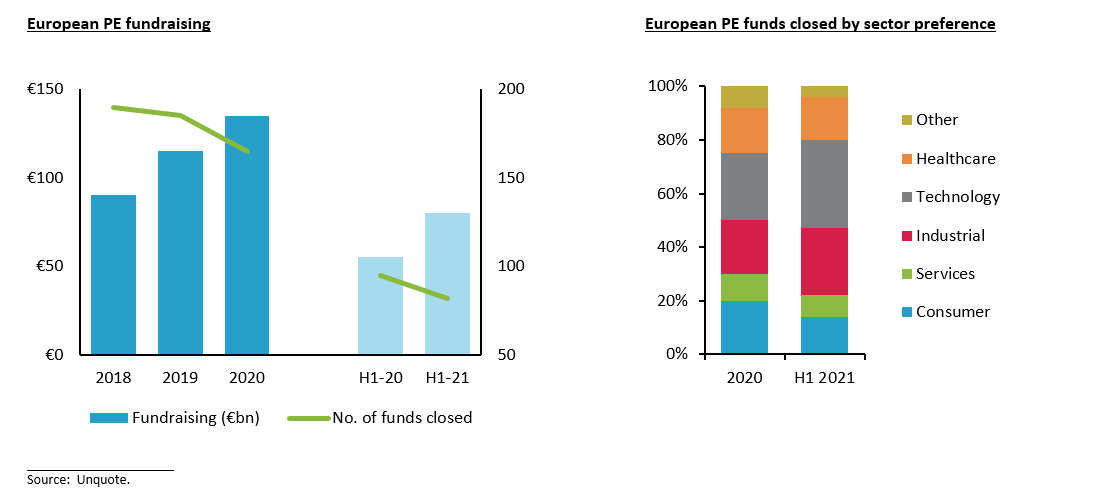

Larger, yet fewer, private equity fundraisings

Global private equity assets under management are now over $3tn, representing a 10% CAGR since 2000. Robust fundraising through Covid illustrates LP appetite to back the PE industry to generate returns, including in times of economic uncertainty. PE firms with successful track records are attracting an even higher proportion of LP money – fundraising was higher in 2020 and H1 2021, but the number of vehicles closed was lower in than 2018 and 2019:

- Successful PE firms are fundraising above their targets, resulting in larger equity tickets than prior funds

- Record European PE dry powder of over $350bn – preference for platform deals with add-on opportunities

- Increasing proportion of mid-market sector specialists relative to generalist funds, following trends in the US

The number of technology focused PE fundraisings in Europe has increased in recent years to over 30% in H1 2021 while consumer focused PE fundraisings has fallen to below 15%. Several new healthcare focused PE firms set up over the past decade, which have now raised larger second and third funds after the successes of their first funds.

PE firms are raising new “impact” funds with a broad sector remit to benefit from secular growth themes associated with ESG investments. Whether or not a fund has an ESG focus, PE firms are increasingly and actively avoiding investments that may garner negative media attention or is difficult to sell in the future due to ESG misalignment.

Robust outlook – PE M&A drivers remain place

The pressure to deploy capital continues. There is also a record number of PE portfolio companies, providing 45% of the supply for European mid-market PE deals in the form of secondary buyouts. As economies fully open up across Europe, we expect M&A deal velocity to remain high in H2 2021. Q3 2021 will likely be lower than Q4 as PE firms digest their recently acquired portfolio companies and M&A advisors use the summer break to prepare new sale processes for launch in Q4 2021. We expect 2022 to see sale processes across a broader range of subsectors within industrial, consumer and services, assuming Covid can be tamed with increasing vaccine rollouts.

Contact a member of our European team to discuss these trends in further detail:

Robert W. Baird Limited is authorised and regulated in the United Kingdom by the Financial Conduct Authority. Robert W. Baird & Co. Incorporated. Member SIPC. Please visit our website at bairdeurope.com or rwbaird.com for important information and disclosures.