From HSAs to Hot Yoga: Investing in America’s Wellness Revolution

“Wellness is more important to consumers than ever,” declares a recent McKinsey & Company article, with 84% of U.S. consumers calling wellness a “top” or “important” priority. MIT’s Age Lab head Joseph Coughlin agrees, calling wellness an “unprecedented investment opportunity”: “The next generation of older people believes there is a pill, a product or a policy that isn’t just going to help them live longer, but live better.”

That said, “wellness” is a big space whose specialties can range from functional nutrition to beauty to medical care for age-related chronic diseases. So where might the investable opportunities lie? To answer that question, I turned to three senior research analysts on Baird’s top-rated equity research team: Mark Altschwager, who covers Fashion and Wellness companies; Jonathan Komp, who covers Active Lifestyles; and Mark Marcon, who covers Human Capital Services.

Mark Marcon, do you agree with these bullish outlooks in the wellness and longevity space? What opportunities do you see for investors looking to profit from these trends?

Mark M.: Absolutely. We know lifespans are generally increasing, and one area where we see evidence of consumers preparing for greater longevity is through the rapidly increasing participation in health savings accounts (HSAs). Health savings accounts are quadruple-tax-advantaged accounts consumers can use to address current-year healthcare expenses and, just as importantly, to save and invest for their medical needs during their retirement years.

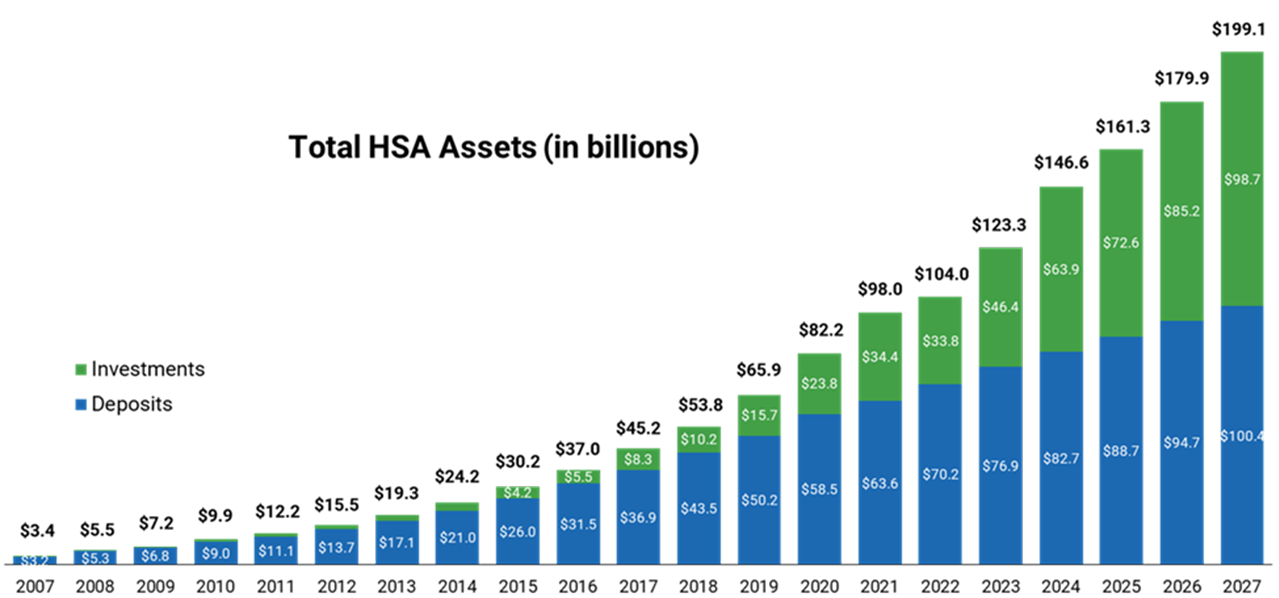

HSAs are growing nationally at a rate of 5% per year, having reached nearly 40 million total accounts at the end of 2024. And these accounts are increasingly being used for long-term savings: Total HSA assets grew by 19% to $146.6 billion in 2024 as participants increasingly realized the benefit of using HSAs to save for their medical needs in retirement. Industry forecasts from Devenir and HealthEquity, as well as Baird’s internal research, suggest the market could grow to 50 million to 55 million accounts with between $500 billion and $1 trillion in assets under management within ten years.

I believe you cover a “pure play” company in the HSA administration space.

Mark M.: That’s right. HealthEquity (HQY) is the leading administrator of HSA accounts in the U.S., with 9.8 million accounts and over $31 billion in assets under management. Due to multiple competitive advantages, including scale, technology and the most comprehensive network of health plans available, HQY has been a consistent share-gainer within this growing space. During the last fiscal year, adjusted earnings grew 73% on 20% revenue growth, and adjusted earnings per share this fiscal year are projected to grow 91% to $3.73 per share. Given the dynamics of asset growth, the company is positioned to continue to be a serial compounder.

How about you, Mark Altschwager? What are you seeing in Fashion and Wellness?

Mark A.: We are also seeing shifts in consumer spending patterns with a greater focus on wellness. Some of this is driven simply by a greater awareness of the health benefits and risks of certain products and behaviors – social media plays a role here – plus, as Mark mentioned, people are living longer. The Global Wellness Institute has estimated the Global Wellness Economy at over $6 trillion, and a recent Nielsen IQ survey of consumers across 19 countries found that 55% are ready to spend more than $100 per month on their total wellness, including self-care, physical health, mental health, nutrition and other related categories. The McKinsey study you outlined shows that Gen Z and Millennials over-index in terms of discretionary wellness purchase, which is a promising sign in terms of future revenue growth opportunities.

There are a few themes within wellness that have significant appeal. While apparel is a mature category overall, the athletic and athleisure categories are growing at a faster rate and taking share. Personal care is growing annually, and beauty and wellness brands within cosmetics, skincare and haircare are introducing products with new ingredients to emphasize health benefits and anti-aging. Clean skincare has also been a big theme, as consumers demand more transparency regarding the ingredients in the products. Vitamins and supplements are seeing increased shelf space at retailers.

What stocks do you like that fit with these themes?

Mark A.: I have a few in mind:

- Ulta Beauty (ULTA), a leading beauty products retailer in the U.S., is positioned to benefit from steady growth in the personal care space, and they have a platform to launch and nurture emerging brands in these expanding wellness categories. Over the last few years, the company has rolled out dedicated “wellness shops” in its stores, featuring new and expanded product categories.

- e.l.f. beauty (ELF) focuses on developing high-quality, clean-beauty products at accessible price points.

- TJX Companies (TJX), the leading off-price retailer that operates the TJ Maxx and Marshalls banners, is one of the fastest-growing areas of the business. Many who shop those stores notice more space dedicated to beauty & wellness categories.

- Birkenstock (BIRK) has positioned itself as a brand focused on total foot health rather than simply fashion.

Overall, when wellness becomes a need-to-have versus a nice-to-have, the trend becomes more durable. That said, this is a highly competitive landscape, and it can be hard to predict what is a fad and what is a durable trend.

Jon, what are your thoughts on the Active Lifestyles space?

Jonathan: We also see signs of how a commitment to healthy living is driving consumer trends across all stages of life. For example, in the U.S., gym membership is estimated to have risen more than 20% since 2019, according to the Health & Fitness Association, reaching an estimated 77 million Americans. The RunSignup RaceTrends report also showed growth in running race participation accelerated to 8% in 2024, and Strava, an internet service that tracks physical exercise, noted a 59% increase in running club participation last year.

On one end of the age spectrum, “Gen Active” consumers (primarily Gen Z) are increasingly aware of the benefits of leading healthy and active lifestyles – and are voting with their pocketbooks. According to a recent survey from ABC Fitness, more than 70% of these consumers are a member of or are using a gym or fitness facility. Young consumers report prioritizing fitness to relieve stress and maintain mental health while also incorporating wellness into social settings. This group also is most likely to use wearables and newer advanced monitoring devices (for metrics such as glucose levels and sleep quality) and are more open to emerging AI-powered fitness solutions.

At the other end of the spectrum, roughly 1 in 6 Americans are 65 years or older today (compared to less than 1 in 20 American 100 years ago), leading to significant rise in demand for solutions that enable active aging and recovery. This population is also exploring new clinical solutions to improve wellness, including GLP-1 hormone therapy compounds that project to reach tens of millions of consumers as access broadens and use cases expand. All this data is consistent with a recent comprehensive scientific study that showed a link between maintaining physical activity and social connections and significantly reducing mortality from disease tied to lifestyle factors (including liver disease and diabetes).

Interestingly, we are also seeing government bodies begin to take a more proactive view of incentivizing active populations as a means to reduce the impact of chronic disease. Though the provisions were eventually dropped from the final bill, we were encouraged to see the House version of the recently passed One Big Beautiful Bill include provisions to allow pre-tax funds in health savings accounts to be used for gym memberships – highlighting progress toward one day finding a legislative approach to incentivizing healthy lifestyles.

What companies in your space would you highlight?

Jonathan: Across our coverage, several companies are poised to help enable healthy and active lifestyles by providing footwear and apparel that enable physical activity:

- On Running (ONON) is a high-growth company positioned as a premium, performance-based sportswear brand on pace to significantly exceed $3 billion of revenue with improving margins while maintaining a long runway for future growth.

- Wolverine Worldwide (WWW) is a compelling turnaround story based in part on a major recent breakout for the Saucony brand, which recently has enhanced its appeal with performance running athletes as well as lifestyle consumers.

Moving outside the apparel space, Planet Fitness (PLNT) now counts more than 20 million members globally as the brand broadens access to premium fitness equipment in a quality environment. They also continue to attract seasoned operators within its highly franchised model.

I’d also echo Mark’s comments about the unpredictability of the space: Consumers’ fitness routines notoriously can be fickle and at times subject to trend-like behavior, so any wellness and longevity themes tied to fitness can be exposed to shifts from one routine to the next.

Mark, Mark and Jonathan, thank you all for your time. I’d like to give the last word to Liz Clark, the CEO and President of Health & Fitness Association, who I recently had the pleasure of speaking with on the emergent opportunities in health and wellness. Liz, the floor is yours.

“People are looking for solutions that are more holistic, that encompass not just exercising but eating, sleeping and working. The recovery sector is exploding with things like red-light therapy, cold plunges and spa experiences. And this space will continue to evolve. There will be new modalities that are introduced alongside pilates, yoga, barre, cycling, including more for the ‘handi-capable’ community, and for women, for whom manufacturers are creating new types of equipment.

“People are also exercising more for mental health than for physical health. Gym-goers tell us they would sacrifice travel and restaurants (eating out) to spend more on their gyms. The focus is on preventative health care. It’s not far-fetched to see trainers in the gym as frontline healthcare professionals. It’s all super exciting.”

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action. The views and opinions expressed here are those of the speaker and do not necessarily reflect the views or positions of the firm. Baird and/or its affiliates managed or co-managed a public offering of securities of Birkenstock Holding plc in the past 12 months. For more disclosures about Birkenstock, or any of the other companies mentioned, please visit Baird’s Research Coverage page.