Global Industrial Group 2025 Year in Review

Industrial Team Momentum Carries Into 2026 With Record Backlog

Baird’s Global Industrial Investment Banking Group delivered another successful year in 2025, completing a number of landmark transactions across all 20 industrial sub-sectors. As a leader in Industrial sellside M&A,1 our team delivered outsized growth relative to the market and is continuing this momentum into 2026, supported by a strong backlog. Read our 2025 highlights below.

2025 Key Industrial Group Highlights

- 67 signed or closed advisory and financing transactions

- $26B+ in total M&A transaction value

- 45% of our sellsides delivered strategic outcomes

- 25%+ share of sellside value from cross-border transactions

- 100+ dedicated Industrial bankers covering 20 subsectors

- 20 Industrial sub-sectors completed transactions in 2025

- Deal size ranging from <$100M to ~$7B

- ~2.5x sellside valuation median multiple premium achieved versus the overall industrial market

Select 2025 Transactions

View More Industrial Transactions

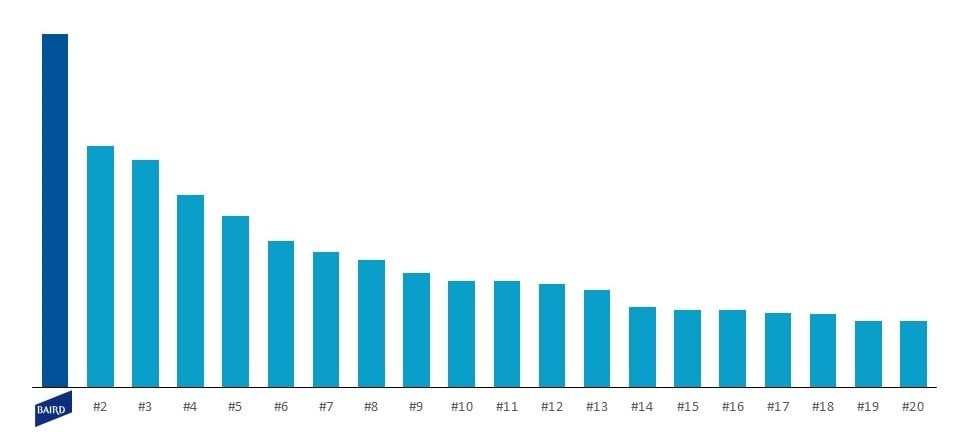

Most Prolific Industrial Sellside Advisor of the Last Decade

Top Investment Banks Ranked by Number of Industrial Sellside Deals Over the Past 11 Years1

300+ industrial sellside transactions since 2014 (1)

Baird has Transacted with the “Who’s Who” of the Global Industrial Marketplace

Decades of Leadership in the Industrial Sector

The longevity and consistency of our industrial practice is unique in the market. With decades of high-quality industrial transactions, we are able to bring differentiated sector expertise and deep buyer relationships to each of our transactions. Our senior bankers have proven their ability to identify specialized strategies that deliver great outcomes for our clients.

Explore Our Areas of Expertise

Select your area of interest below.