Notes from the Road: 6 Trends in Traffic Management

Baird’s Takeaways from the ATSSA Annual Convention

Ardis Tabb and Brad Page of Baird’s Facility, Industrial, Residential and Environmental Services (FIRE) team recently attended the American Traffic Safety Services Association (ATSSA) Annual Convention and Traffic Expo in San Diego. Throughout the multi-day conference, Baird connected with traffic management executives and investors to discuss the latest market trends.

Read on for our learnings and key takeaways from the conference.

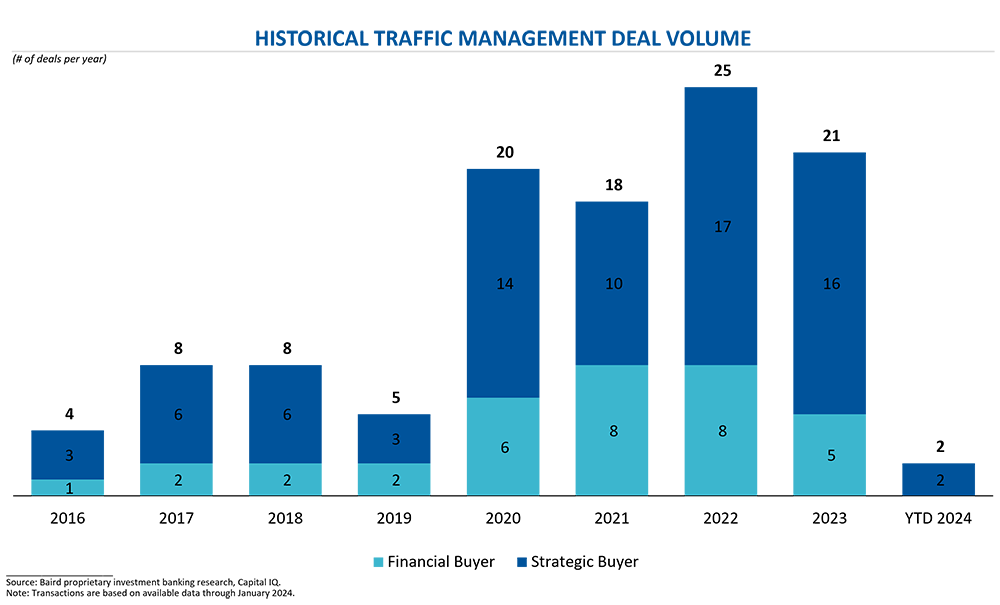

M&A Bouncing Back

M&A activity is continuing to recover as sellers gain more conviction on taking assets to market. There’s been continued activity for traffic management platforms and add-ons (see chart below). Competition for add-ons persists as existing platforms look to deploy capital by making strategic additions, and because there are more sponsor-owned assets in the sector seeking to pursue buy and build strategies. Further, sponsors looking to build new platforms by acquiring smaller targets are aggressively pursuing those assets.

Emerging Technology

The introduction of Automated Flagger Assistance Devices (AFADs) presents an opportunity to improve safety. While AFADs are not widely adopted by all states, they are deployed in small numbers by service providers. Although helpful in the field, it is believed that AFADs will not completely replace the people in the field that are critical to service delivery. This is especially true for certain end markets (e.g., utilities) that will find it even more challenging to implement AFADs. AFADs still require people for operations and set up, particularly in remote locations and along utility lines under repair.

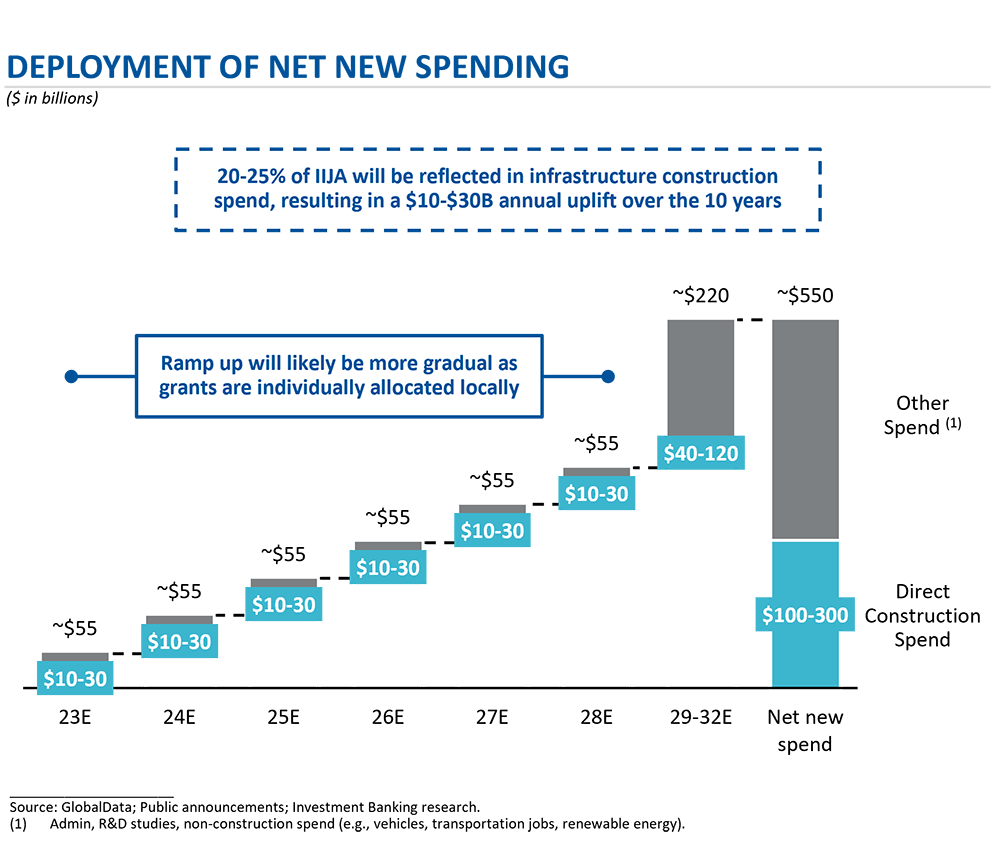

Infrastructure Tailwind Gathering Strength

The traffic management market is poised for an uplift from additional infrastructure spend. The pace of spend has been somewhat slow to date, and funding can vary drastically by state. However, operators are beginning to see some modest impact from federal infrastructure spending. The monumental infrastructure bill will have a multiyear impact on project growth as funding is deployed over the next decade.

Labor Challenges Have Subsided

For the past few years, labor challenges persisted and the war for talent affected providers’ ability to take on new projects and execute on existing projects. Access to labor has now started to improve, and labor inflation is beginning to ease. Providers with strong cultures, good reputations, leading training programs and good safety track records are often viewed as employers of choice, and, in turn, attract talent. Retention has become crucial in this environment. Companies are using novel recruiting and retention tactics to attract and retain talent. Simply put, providers that lack the human capital to deploy in the field struggle in taking on new projects and executing on existing ones. Those who have found a way to address the human capital void are finding success.

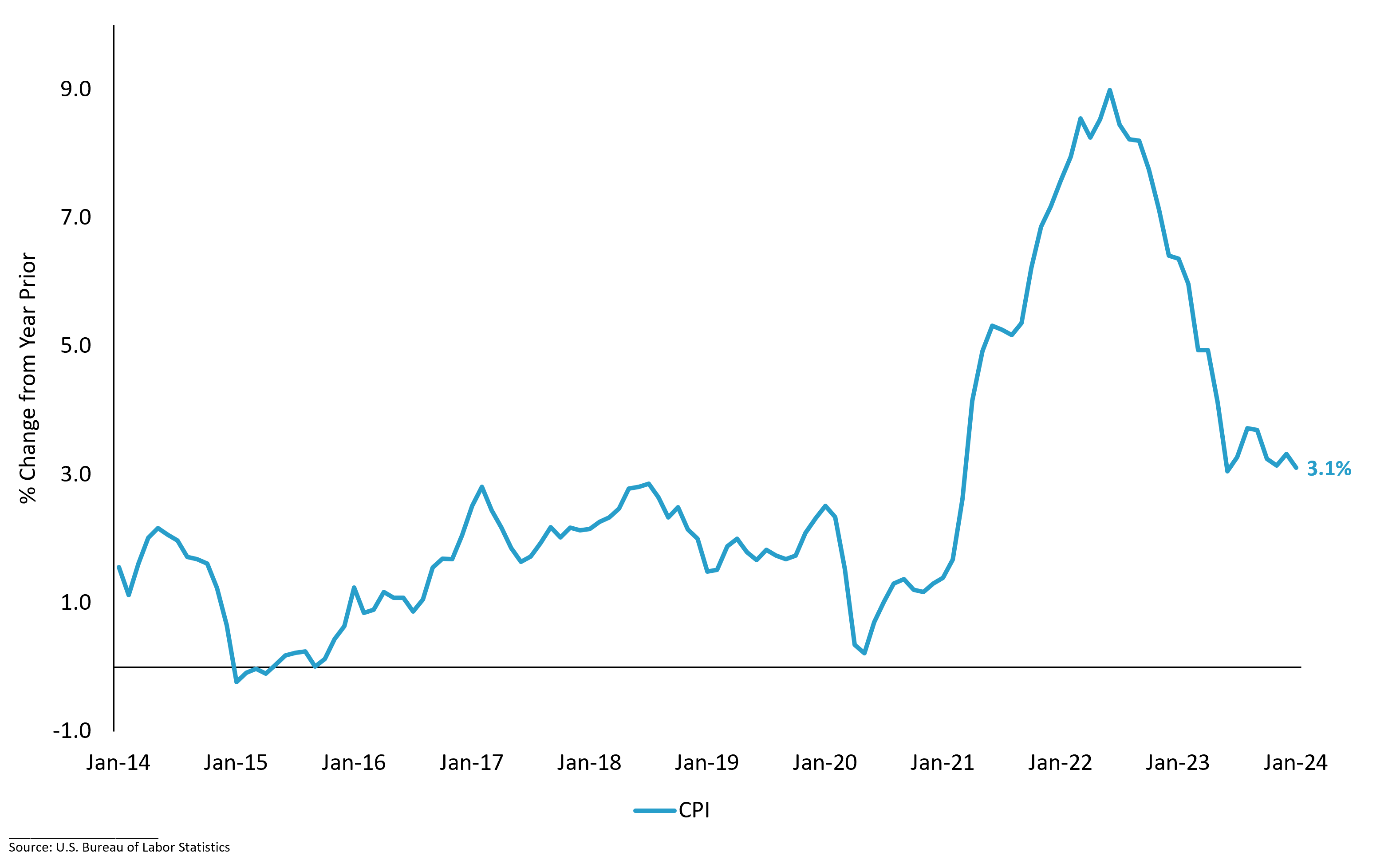

Finally, Inflation Has Less Bite

Inflationary pressures have improved from the recent years. Older, more expensive inventory is being turned. Cost increases for equipment and raw materials have normalized, and operators are no longer under pressure to either push through large price increases or absorb costs increases.

To Diversify or Not to Diversify?

For many traffic management providers, diversification of service offerings and end markets is a key area of focus. Operators and investors are asking themselves if they should stick to their traditional focus areas or whether they should broaden their offering and end markets. The question comes down to whether there’s ample white space opportunity in continuing to pursue the existing strategy and whether a diversion from the traditional strategy should be pursued organically or via M&A. While the answer is situation- and company-specific, there is reason to believe that diversification is a good thing (e.g., margins, market share, cross-sell, etc.) and that continued long-term growth necessitates some degree of diversification.

Interested in learning more? Connect with Baird Global Investment Banking.