The Science of WHealth: Accounting for Risk Tails in Predictive Health Modeling

This is the final post in a four-part series on the intersection of wealth and health. To continue the conversation, be sure to check out these earlier posts:

In exploring the topic of “WHealth,” I discussed how wealth and wellness are inextricably linked, especially as we age and come to rely on increasingly expensive health technologies to maintain (or improve!) our quality of life. My most recent WHealth post considered a data-centered approach to planning – one that applies predictive modeling to your own health history to create a personalized roadmap that anticipates your most likely future health scenarios. Understanding where your health journey will most likely take you lets you prepare both financially and emotionally.

But as we know, predictive modeling is not an exact science – if you’re going to plan for and optimize your future “WHealth,” you need to account for the outliers. To do that, it helps to understand what statisticians call “Gaussian distribution” – or, more commonly, the “bell curve.”

Understanding the Bell Curve – and Why It Matters to Your Health and Wealth

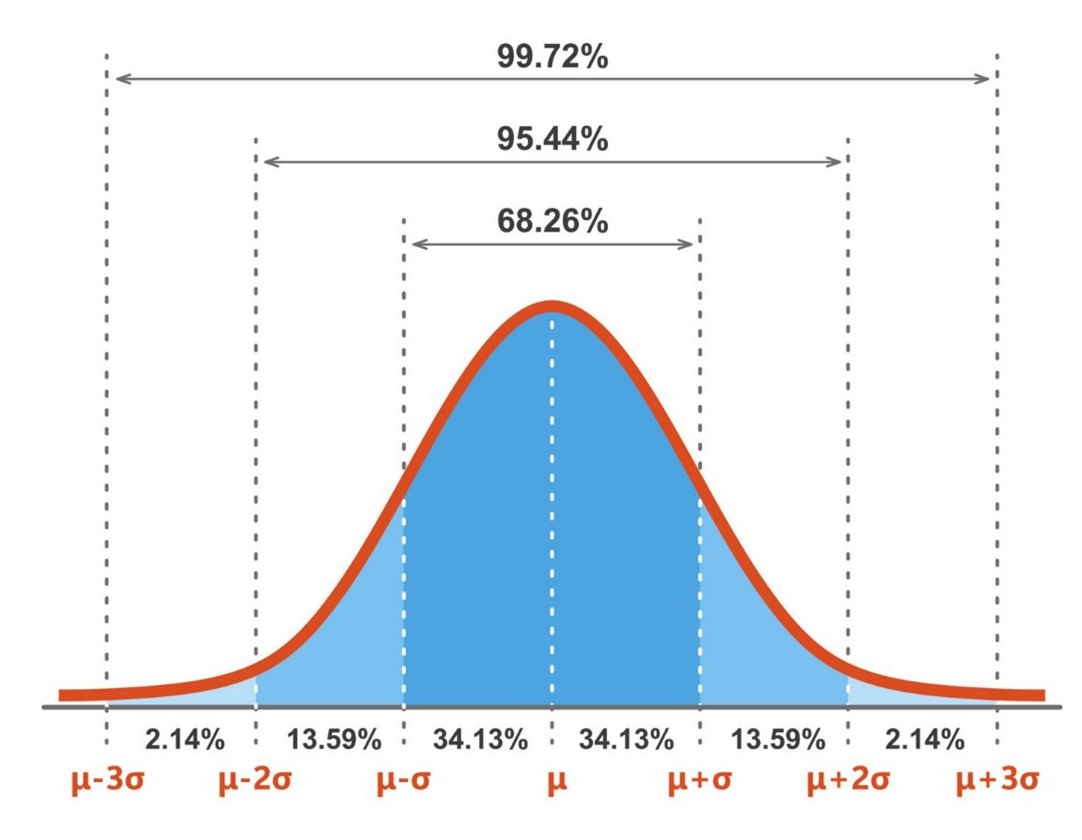

You might remember hearing your college professors talk about a “normal distribution,” especially in the context of class grades. The bell curve is just a way of showing how things tend to cluster around an average, with fewer occurrences as you move away from the center. In plain English: it’s a model of how things usually happen when everything is, well, normal.

In the normal distribution of a bell curve, the most common data points tend to cluster around the center (the mean) with fewer and fewer occurrences as you move toward the outer edges (the tails). When plotted in graphical form, this distribution resembles a bell.

In everyday life, the events that fall under the fat part of the curve are the ones that happen to most of us, like catching a cold or dealing with seasonal allergies. But those events way out on the tails? They’re rare and often much more serious. When it comes to health, these might be life-threatening conditions we don’t see coming – ones that require high-cost therapies to treat.

This is where the concept of “tail risk” becomes important. These are the unlikely but potentially devastating situations that could significantly impact both your health and your finances. A core principle of WHealth planning is preparing for those possibilities before they happen.

What Are the Major Sources of Health Risk?

Let’s start with the most obvious tail risk – a serious medical event. Physician and longevity expert Peter Attia identifies what he calls the “Four Horsemen” of chronic disease:

- Cardiovascular disease, like heart attacks or strokes

- Cancer

- Neurodegenerative diseases, such as Alzheimer’s, Parkinson’s and multiple sclerosis

- Metabolic diseases, like type 2 diabetes

In addition to being scary on their own, these diagnoses can come with steep price tags. In the United States, the average emergency room visit costs around $2,500, and a typical hospital stay lasts nearly 5 days, racking up close to $13,000. The average annual healthcare cost per person? Roughly $14,500.

Another major concern is the potential need for long-term care – services that help people with daily activities like bathing, eating or getting dressed. Unlike rehab, this care can continue for years, and depending on the type and intensity, can cost tens of thousands of dollars per year. And if a diagnosis like Alzheimer’s is involved, those costs usually escalate over time: While the average person lives four to eight years after an Alzheimer’s diagnosis, some live up to 20 or more.

Then there’s the issue of disability, losing your income during your working years due to illness or injury. Many people focus more on life insurance, but statistically, you're more likely to become disabled than die prematurely.

While each of these scenarios can bring about significant expense, you may be able to transfer that financial risk away from yourself and onto a third party – like an insurance company.

Building a Safety Net Through Insurance

Insurance can feel like a waste of monthly premiums – until you experience an expensive health event that’s covered by your policy. In that event it can be a literal lifesaver. Let’s break down the three types of insurance you should seriously consider:

Health Insurance and Medicare

Most people under age 65 get group health insurance through their employer. Once you hit 65, that coverage usually switches from employer-based coverage to Medicare – and navigating Medicare is not for the faint of heart. Here's a quick breakdown:

- Part A covers hospital stays (deductible: $1,676)

- Part B covers outpatient care (monthly premium: roughly $185)

- Part D covers prescription drugs (deductible: up to $590; out-of-pocket max: $2,000)

These expenses are only the start: Premiums for Parts B and D increase if your income exceeds certain thresholds, plus there can still be significant out-of-pocket costs. That said, these expenses are a fraction of what you would pay without insurance: If you needed emergency treatment for coronary heart disease, hospitalization alone would cost roughly $30,000, while heart surgery (such as pacemaker implantation, vascular bypass or valve replacement) would cost tens of thousands more.

Disability Insurance

Disability insurance is intended to replace income if you can’t work due to illness or injury – something far more common than an early death. The Centers for Disease Control and Prevention reports that nearly 30% of adults in the United States have some type of disability, including 44% of those age 65 and older.

Many employers offer group disability policies as an employee benefit, and the ideal coverage replaces at least 60% of your income. However, employer-sponsored plans can have limitations or cover only a portion of income. If there are gaps in coverage, or if you want to ensure portability, consider paying for an individual disability plan to supplement group coverage.

Long-Term Care Insurance

The Department of Health and Human Services estimates that 70% of adults reaching age 65 will require long-term services and support in their lifetime. The expense for this kind of care can often catch people off-guard: For example, both in-home care and assisted living facility services can each cost more than $70,000 per year, and a private room in a nursing home can cost more than $125,000 per year. To make matters worse, Medicare typically doesn’t cover this type of care.

A 2023 congressional report found that only 8.7% of long-term care was covered by private insurance. The rest came from personal savings, family support or public programs such as Medicaid with strict eligibility requirements. Two other options that are gaining in popularity are life insurance and annuity policies that you can draw from for long-term care: If you don’t end up needing the care, the benefits from the insurance end up going to your heirs.

Don’t Forget About Savings

Beyond insurance, everyone needs a rainy-day fund – but when planning for healthcare, especially later in life, you should consider upgrading that to a “stormy decade” fund. Many financial advisors recommend saving six months to two years of living expenses in liquid reserves. This buffer is especially crucial if you’re withdrawing from retirement accounts and want to avoid pulling funds during a market downturn.

One of the most tax-efficient ways to save for health-related costs is through what’s known as a health savings account. If you’re enrolled in a high-deductible health plan, you likely have access to one. Here’s what makes an HSA so powerful:

- Contributions into an HSA are made pre-tax, lowering your taxable income

- The funds in the account grow tax-deferred

- Withdrawals from an HSA are tax-free when used for qualified healthcare expenses

In 2025, the contribution limits are $4,300 for individuals and $8,550 for families, and in 2026, those numbers are boosted to $4,400 for individuals and $8,750 for families. Additionally, people over 55 are eligible for an additional $1,000 “catch-up” contribution. And the best part? These tax-advantaged HSA funds roll over from year to year, which means you can start saving for your retirement healthcare expenses now, even if retirement isn’t for another 20 years.

Final Thoughts

Medicare and other insurance decisions are complex but manageable with careful planning and expertise. WHealth planning helps you tailor the right strategy and policies to your individual needs. If there’s one place where WHealth planning shines, it’s here – helping you prepare emotionally and financially for the “tails” of life’s bell curve.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action. The views and opinions expressed here are those of the speaker and do not necessarily reflect the views or positions of the firm.