Putting WHealth Planning Into Action

This is the third post in a four-part series on the intersection of wealth and health. To continue the conversation, be sure to check out these other posts:

In a recent blog post, I talked about the three-body problem when it comes to the intersection of wealth and health. One of the challenges of planning for a long and vital life is that we don’t know how long we’ll live (longevity), what health challenges we might face (“healthspan”) or the costs of the care necessary to sustain our vitality (financial well-being). It’s a bit like financial planning for a vacation – but one in which you don’t know where you’re going, how long you’re going for or what you’ll do while you’re there.

While these WHealth challenges might be unknown, they’re not entirely out of our control – we can take steps like eating healthfully, exercising and getting restful sleep to maximize our longevity and healthspan. Even mindset plays a part: When we’re young, we tend to downplay any health issues and assume that we’ll be back to full health in short order. As we get older, though, that reality starts to change. Downplaying the effects of aging jeopardizes not only our ability to live long and healthy lives but also our financial well-being. That’s why we need to treat aging like we would any other predictable event.

But we could also go a step further: By embracing WHealth planning, you could take a data-centered approach to current and projected health and then use sophisticated financial planning tools to give you an idea of what to plan for and how much it will cost.

WHealth Planning: Discovery

The WHealth planning process starts with “discovery” – the planning equivalent of what doctors do when you walk into their offices for the first time. Many conditions, including heart disease, diabetes and some cancers, are grounded in genetics and lifestyle. By learning the medical history of your parents, grandparents and siblings, you can stay alert to and potentially prevent many age-related disorders that are expensive to manage. For both your physical and financial health, it’s far better to be proactive with regular screenings and checkups (which typically are covered by insurance) than to have to pursue treatment after the fact. You can start with the basics:

- Your family. Who are the important people in your life? Do you have people you care about from a previous relationship? In the case of illness or incapacity (be it yours or a loved one’s), who should be contacted or involved in care?

- Your health and wellness. What is your current health status? Do you or your family have health predispositions that could require attention in the future?

- Your health care concerns. How do you feel about the potential of going into a nursing home? How prepared are you for the possibility of a spouse dying before you, or of your parents or other relatives needing care?

- Your current wellness regimen. Do you get enough exercise and sleep? How adept are you at managing stress?

- Unexpected health events. Do you have health care directives? What kinds of insurance do you have or have thought about getting?

And this is only the start – a comprehensive discovery process will look at every aspect of your physical and emotional well-being and evaluate both your current health and what obstacles you might need to watch for as you age.

One of the reasons this process is so important is the human tendency to assume a longer and healthier lifespan than reality would suggest. A 2020 study from the Society of Actuaries Mortality and Longevity Program Steering Committee found that humans tend to underestimate their own life expectancy by a median of 2 years, with 28% underestimating by five or more years.

WHealth Planning: Modeling

Another related human characteristic is our tendency to procrastinate, especially when it comes to making uncomfortable decisions around our health or mortality. Many people wait until a crisis forces them to focus on what needs to be done. This lack of planning prevents them from benefiting from simple and proven actions that can be taken now, enabling them to determine tradeoffs between current and future needs so they can reach their goals over time – without sacrificing quality of life.

This is where having a trusted financial advisor is critical. Using resources and processes such as Monte Carlo simulations, a financial advisor could help high-net-worth individuals better predict their future financial needs. A Monte Carlo simulation is a sophisticated analytical tool that conducts thousands of simulations based on variables that are input. The results of the simulations, while not predictive, can tell you the likelihood of various potential outcomes, which can be instrumental in building a robust and proactive financial plan.

While historically Monte Carlo simulations have been used in financial planning, they could be used in WHealth planning just as effectively. With this tool, your advisor could input assumptions based on the health discovery process described above to model different scenarios and estimate “most likely” or base case future healthcare costs. These assumptions could then be used to assess your ability to pay these potential healthcare costs without compromising the resources available for your other lifestyle expenses. Your advisor could also use these simulations to run what-if scenarios if these “base case” assumptions change, such as if you or a loved one unexpectedly gets sick, becomes incapacitated or experiences cognitive decline, which would likely increase care costs significantly over what was assumed in the base case.

Another way your advisor could also help with WHealth planning is by projecting healthcare costs. The Society of Actuaries recently forecast that healthcare costs in the U.S. will rise by 2.9% over the Consumer Price Index in the short term and 2.1% over CPI for longer horizons. Assuming inflation averages 3%, that equates 5% to 6% every year over the long term – which means your investment portfolio needs to earn at least that much just to keep pace. This kind of data can better prepare you for when unexpected health issues arise.

WHealth Planning Modeling in Action

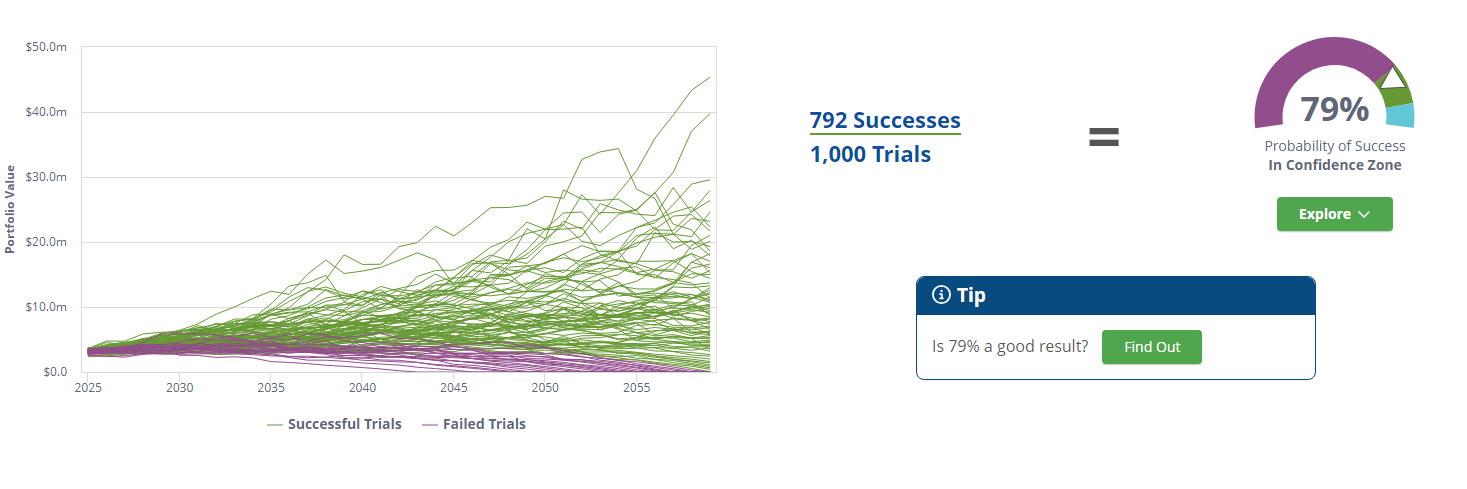

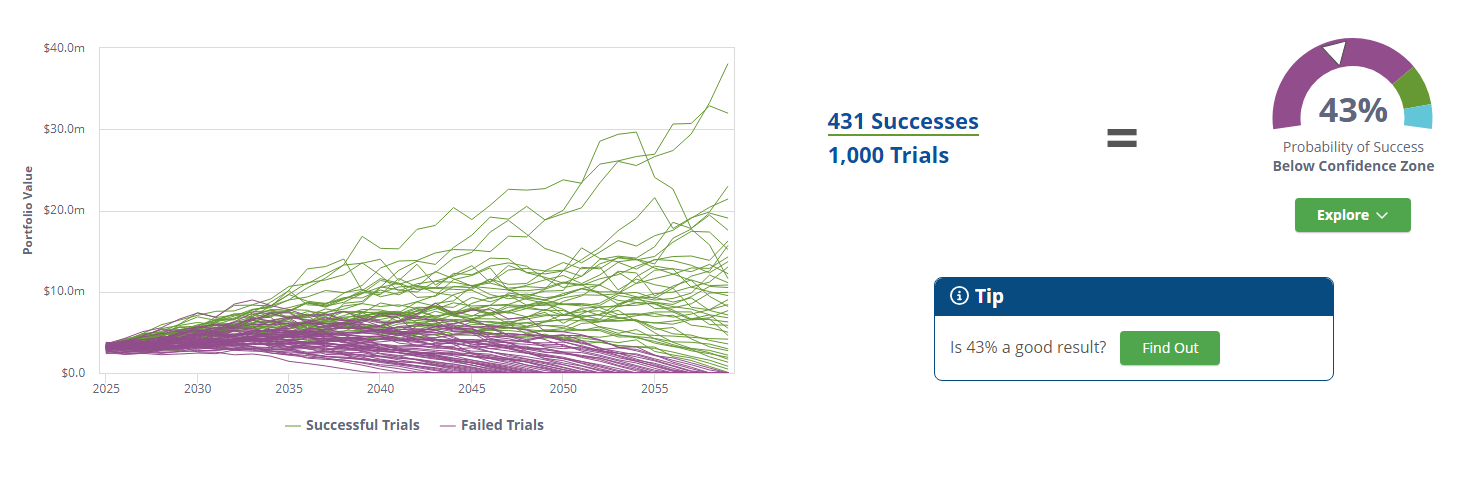

There is tremendous power in understanding what these and other what-if scenarios look like. The simulations below show two very different hypothetical WHealth planning outcomes for a 60-year-old man whom we’ll name James Stevenson.

In the first scenario, James works until age 67 at his currently $125,000 salary, at which point he retires, elects to start receiving Social Security benefits and enrolls in Medicare. His annual healthcare expenses are based on national averages, and his balanced investment portfolio performs smoothly, year over year, according to long-term expected capital market averages. The simulation shows that in 79% of the possible outcomes, he will not outspend his resources.

But what if James were to suffer a debilitating health event? The second scenario shows what happens if that were to pass seven years down the road, at age 67, requiring James to spend $50,000 more each year than he expected to on incremental care. In this case, the probability that he won’t outlive his resources drops to 43%, leaving him with the prospect of having to modify his lifestyle as he ages.

If we modify the last scenario to include a market downturn, the probability of a good result drops to only 16%. The technical term for this is sequence of returns risk – the risk that comes from withdrawing funds from a portfolio early in a period of lower or negative returns. In this case, it translates into a very clear likelihood that James will run out of money.

Why WHealth Planning Matters

Financial planning is the centerpiece of the value proposition today’s advisors provide to their individual clients. But while the profession has been around for more than half a century, it is dramatically different than it ever has been. Because people are living longer and focused more than ever before on their healthspan, advisors are increasingly incorporating health and wellness considerations into their financial planning process.

There is tremendous power in understanding what these and other what-if scenarios look like – not only can they reinforce the importance of investing in your health and wellness, but they also lead to an exploration of how to transfer or insure against the financial risk of health events. That’s the topic of the next post in my WHealth blog series.

The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action. The views and opinions expressed here are those of the speaker and do not necessarily reflect the views or positions of the firm.