Industrial ECM Year-End Update & Outlook

Baird Delivers Best Year Since 2021 and Sees Activity Accelerating in 2026

Our Industrial Equity Capital Markets team began 2025 poised to build on a successful 2024, which marked a decisive rebound from two years of tepid activity post-2021.

Despite brief volatility following "Liberation Day" and during the Q4 government shutdown, the Industrial sector demonstrated resilience. ECM activity surged, delivering the second-best year for IPOs and traditional follow-ons since 2015, eclipsed only by the historic volumes of 2021. Amid this dynamic market, our team successfully completed 20 transactions, raising over $13 billion in capital for our clients.

We enter 2026 with a clearer runway. Key uncertainties from 2025, including Inauguration Day, tariff headwinds and an elevated fed funds rate, are now largely in the rearview mirror. We are excited by our robust backlog and accelerating dialogue with clients preparing to tap the markets. Our team expects 2026 to deliver another step-up in new issuance activity, driven by the key factors outlined below by Baird’s senior leadership. Combined with a healthy market backdrop, these dynamics create the potential to set a new high-water mark in the year ahead.

- 38 Completed Industrial ECM Transactions

- ~$20 Billion in Capital Raised

- Bookrunner on 70% of Industrial Transactions

- ~60% of Transactions Contained a Secondary Component

- 35% Median Offer-to-Current for Baird Active Bookrun Deals (1)

Select 2025 Baird Industrial Transactions

2025 Market Recap: A Year of Two Halves

The year began with a sharp, brief panic following the announcement of the "Liberation Day" tariffs in early April. However, the market quickly recovered, erasing the post-tariff losses by mid-May and paving the way for a robust rebound. This momentum carried through the second half, demonstrating the market's underlying strength even as headwinds like the longest government shutdown in U.S. history caused a handful of issuers to shift equity plans into 2026.

Record Industrial IPO Activity

The Industrial IPO market delivered its strongest year since 2017, with 10 notable transactions raising a combined ~$6.5 billion. The trend toward larger, high-quality issuers accelerated, with 80% of 2025 IPOs having a market cap of over $1 billion at pricing with an average size of ~$4 billion.

Two highly successful, sponsor-backed transactions included Karman’s $581.9 million IPO in February for Trive Capital and Alliance Laundry’s $950.3 million IPO in October for BDT & MSD. Both deals demonstrated the power of a disciplined strategy, where a thoughtful initial price range drove significant valuation uplift during the roadshow with both deals being upsized.

Following back-to-back years of improving IPO activity, we believe 2026 will be a record-setting year, fueled by a significant backlog of high-quality, sponsor-owned Industrial assets viewing the public markets as the preferred exit route to capture premium valuations. This echoes the feedback our team received from institutional investors and Top CEOs that we hosted at Baird’s 55th Global Industrial Conference.

Near-Record Year for Follow-on Activity

The follow-on market had a healthy mix of primary and secondary offerings as select sponsors continued to seek liquidity. Block activity was more measured compared to peak years like 2021 and 2017, reflecting the early stages of sponsor monetization cycle for recent IPOs.

By subsector, Aerospace & Defense dominated the secondary market, accounting for nearly 50% of all follow-on activity in 2025. Baird’s ECM and Syndicate teams successfully executed several offerings within this sector, including the highly successful $575.0 million, 100% primary follow-on for Kratos in July.

Institutional participation in equity deals remained strong in 2025, as follow-on offerings averaged a 7% return in their first 30 days, underscoring investors’ appetite for new Industrial paper and the market’s capacity to absorb fresh capital.

With more rate cuts on the horizon and a resilient consumer underpinning economic strength, we enter 2026 expecting a highly supportive equity market, one not seen since the historic issuance run of 2021, even as political and Fed-related headlines linger in the background.

Baird’ Senior Leadership Outlook Soundbites

“The U.S. economy is poised to benefit from massive fiscal stimulus, the World Cup and the 250th anniversary of the signing of the Declaration of Independence in 2026. Recent moves in the market seem to portend good things for the industrial economy next year.”

- Jason Trennert, Chairman & Chief Investment Strategist, Strategas

“Real economy stocks are inflecting, suggesting the Q3 and Q4 2025 economic soft patch is in the rear-view mirror. Rates may pose a risk at some point down the road, but so long as 10-year yields remain south of 4.50% or so, the market can likely handle it.”

- Chris Verrone, Partner & Head of Technical & Macro Research, Strategas

“Institutional appetite for high-quality Industrial issuance has grown meaningfully over the past two years. At Baird’s recent Global Industrial Conference, investors expressed eagerness for new SMID-cap opportunities and remain actively seeking differentiated ways to deploy capital. We expect this buyside enthusiasm to translate into robust participation across both IPOs and follow-ons in 2026.”

– Jon Langenfeld, Head of Global Equities

“Looking to 2026, the conditions are in place for the most constructive issuance window in recent memory, supported by our engaged backlog and expected opportunities, combined with a receptive institutional investor base. This year provided a clear lesson that proactive engagement with the buy-side is a critical variable for success, leading to the highest quality shareholder base and the strongest aftermarket performance. We expect a significant number of large, sponsor-backed issuers to come to market in 2026, as PE increasingly views the public markets as an attractive alternative for further value creation and future liquidity.”

–Justin Holsen, Managing Director, Industrial Equity Capital Markets

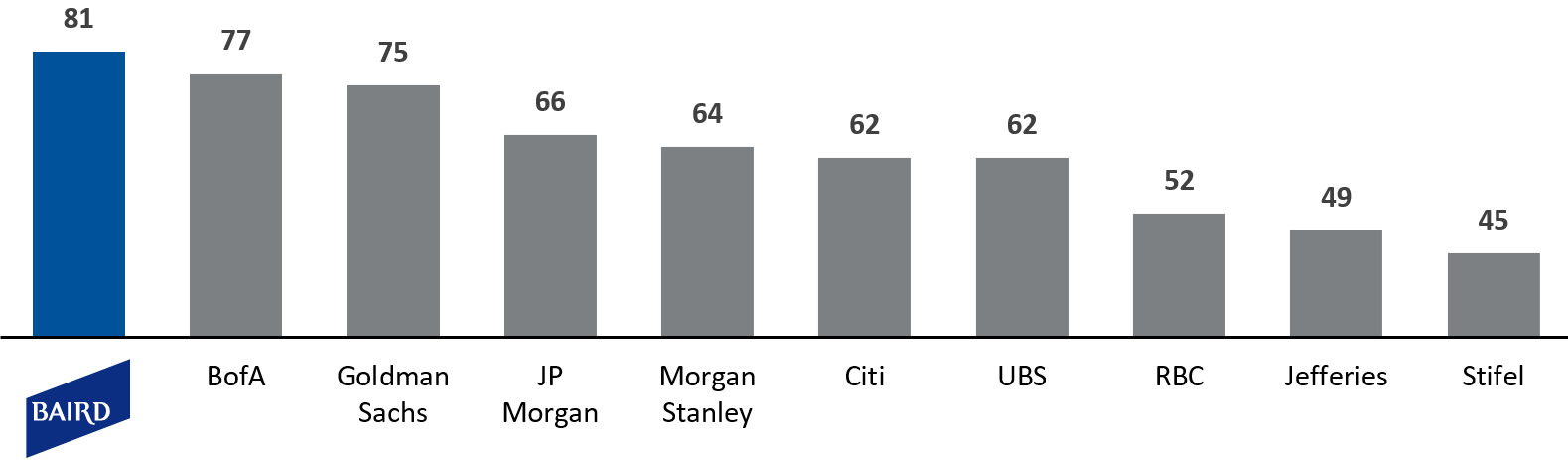

Leading Equity Underwriting Franchise since 2018 (2)

Interested in learning more? Connect with Baird’s Industrial Equity Capital Markets Team.

Justin Holsen

Managing Director

+1-414-298-7768

jholsen@rwbaird.com

Ryan Engelhardt

Managing Director

+1-414-298-2637

rengelhardt@rwbaird.com

Sandy Walter

Co-Head of Equity Capital Markets

+1-414-298-5118

swalter@rwbaird.com

Peter Kies

Managing Director

+1-414-765-7262

pkies@rwbaird.com

- As of December 19, 2025.

- Dealogic Industrial offerings as of December 19, 2025. Excludes ADRs, closed-end funds, SPACs, deals less than $15 million, Mining and Metal & Steel issuers and bought deals.