2026 ECM Outlook: Preparing for an Active Issuance Year

U.S. equities delivered a third consecutive year of double-digit gains in 2025 amid episodic volatility, supported by stronger market breadth, improving corporate execution and moderating macro headwinds. As a result, the broader capital markets landscape improved meaningfully during open market windows, led by the most active IPO market in four years and steady follow-on volume. With a deep pipeline of IPO prospects and a renewed appetite for growth assets, issuers and sponsors are preparing for what could be one of the busiest issuance windows in several years.

2025 Recap: Broadening Market Strength

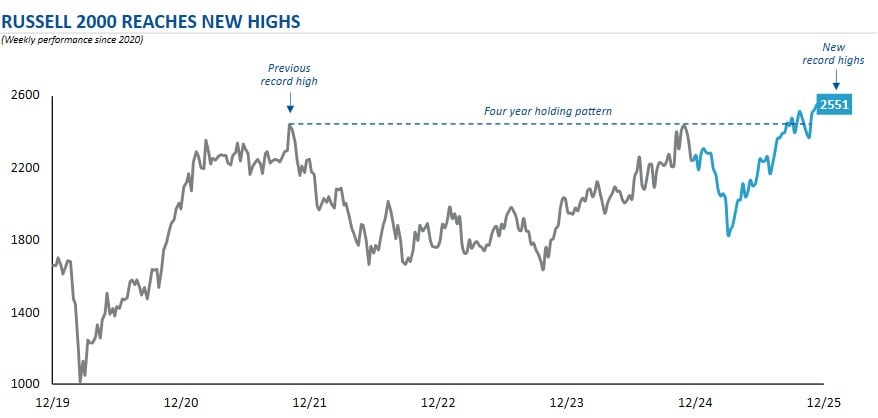

Equity markets reached record highs in 2025 as investors navigated conflicting macro signals and intermittent volatility. Major U.S. indices rebounded sharply from the tariff-driven selloff early in the year, with performance broadening across all 11 S&P 500 subsectors. Small-cap equities posted one of their strongest periods of relative performance since 2021, contributing to improved market breadth and risk appetite.

Source: FactSet. Chart performance as of the week ended December 12, 2025.

Corporate fundamentals remained resilient into year-end. The S&P 500 delivered 13.6% blended EPS growth in Q3, the fastest pace in three years and the fourth consecutive quarter of expansion. While the “Mag 7” continued to drive outsized earnings gains, the gap versus the broader S&P 493 narrowed in the second half as execution strengthened across a wider group of companies. Investors also began shifting focus from AI hype toward the practical realities of infrastructure investment and sustaining elevated capex levels.

The U.S. economy retraced toward a more normalized path as the year progressed. U.S. GDP annual growth moderated to ~2% but remained above trend and inflation eased below 3%, closer to the Fed's long-term target, supported by cooling goods and shelter prices. Consumer momentum softened slightly, particularly for middle- and lower-income households, as labor-market indicators showed signs of softening. Still, markets looked ahead with growing confidence toward a more stable and supportive macro environment in 2026.

2026 Outlook: Constructive Setup for Growth Assets

Investors and corporates are increasingly focused on the prospect of a more favorable 2026 backdrop. A more accommodative Fed and reduced noise out of Washington are expected to support a steadier market environment. The outlook is further bolstered by the expected demand boost associated with the One Big Beautiful Bill, which many view as a material tailwind for the U.S. consumer and broader economic activity. History is also favorable as over the last three decades, the second year of a presidential cycle has on average generated the strongest GDP growth, often experiencing a meaningful step-up from year one.

Broadening earnings growth, healthier market breadth and constructive capital markets fundamentals set the stage for an acceleration of offering activity. Collectively, these dynamics point to a constructive setup for risk assets and a supportive environment for capital markets activity.

IPO Activity Re-Accelerates

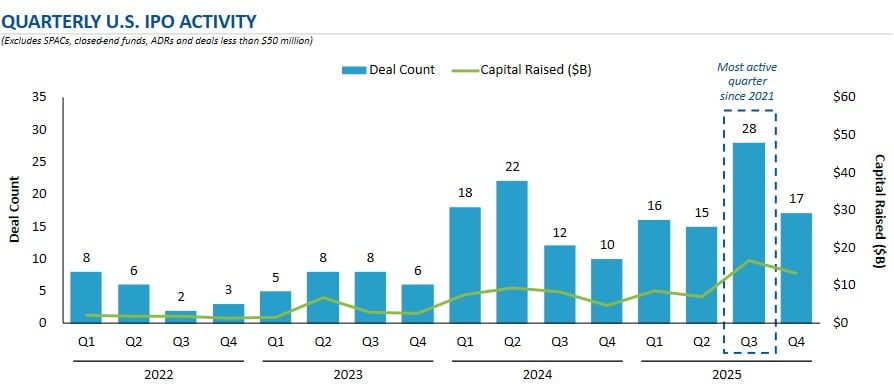

IPO activity accelerated meaningfully in 2025 despite multiple market shocks, marking the busiest year since 2021. Q3 was the most active quarter for IPOs in four years, supported by renewed investor appetite for growth, healthy pricing dynamics and strong aftermarket performance. Filing activity also reached its highest pace since 2021 as issuers sought to capitalize on constructive market windows.

Source: Dealogic as of December 16, 2025.

Momentum was interrupted by the federal government shutdown at the start of Q4, which materially delayed SEC processing and forced many companies to shift offerings into 2026. Despite the shutdown, nine IPOs priced using Section 8(a) exemptions, allowing registration statements to become automatically effective after 20 days absent SEC action. Many late-2025 IPO candidates transitioned to early-2026 timelines, and the first few weeks are expected to be particularly active, with several multi-billion-dollar issuers already preparing organizational meetings and early-look investor education.

IPO performance remained strong relative to the broader market, with 2025 IPOs returning an average +20% YTD vs. +15% for the S&P 500. Technology led activity, spanning software, e-commerce, fintech and digital assets, while Industrials contributed several defense-tech IPOs amid heightened geopolitical tensions. Small-cap issuance re-emerged, highlighted by Black Rock Coffee Bar, the first major restaurant IPO since 2023. Across sectors, issuers increasingly emphasized:

- Durable revenue growth

- A transition away from the “growth at all costs”

- Increased profitability or clear paths to profitability

- Margin discipline

- Clear competitive moats

- AI-driven tailwinds and strategic positioning

2026 is positioned to be one of the busiest IPO periods in several years, driven by a sizable backlog, increased investor appetite for new issues and improved IPO market fundamentals.

Follow-on Issuance Trends

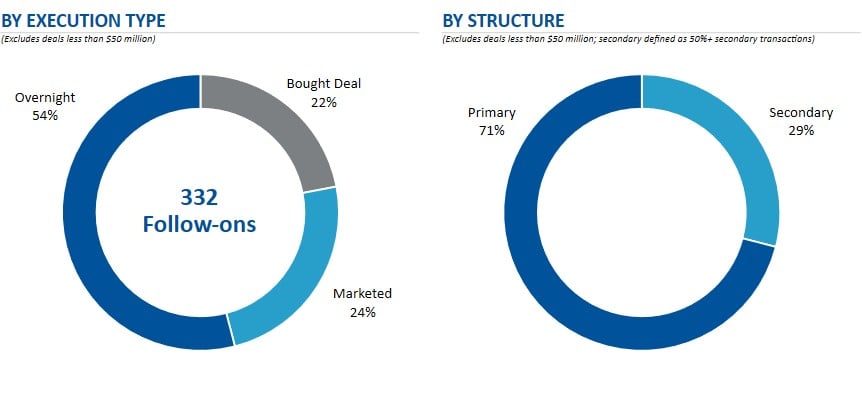

Follow-on issuance was relatively muted in 2025, with activity and capital raised declining (8%) and (8%) year-over-year, respectively. Healthcare represented nearly 40% of supply, followed by Industrials at 16%. Overnight offerings accounted for more than half of activity, reflecting issuer and sponsor preferences to limit market risk. Sponsor monetization remained a key driver, with secondary shares present in nearly 30% of transactions. Execution dynamics increasingly relied on confidential wall-cross processes to gauge investor sentiment, de-risk order books and build price discovery ahead of public launch. Despite lower follow-on volumes, execution remained highly effective, with issuers and sponsors raising capital as offering windows opened and closed.

Source: Dealogic as of December 16, 2025.

Baird ECM Highlights & Preparing for 2026

2025 was a year of strong momentum for the Baird ECM platform, reflecting Baird’s growing role as a trusted partner to both public and private companies. Baird served as an active bookrunner across numerous transactions and remained engaged broadly across a diverse range of product offerings, delivering meaningful value to clients at various financing lifecycles.

Baird also hosted several marquee public equities conferences throughout 2025, drawing participation from 1,900+ leading corporates and 2,300+ institutional accounts. In addition to public companies, over 45 private companies presented at Baird’s public equity conferences, leveraging the platform for early-look meetings and investor education.

Looking ahead, Baird’s ECM platform is well-positioned to help clients navigate what is expected to be an active issuance window. Baird encourages clients to prepare early and assess market readiness to maintain maximum flexibility in the year ahead. The Baird ECM team is available to discuss your objectives and outline steps that will support a successful financing process.