Industrial ECM Mid-Year Update

Baird’s Equity Capital Markets team had a strong start to 2025 in the Industrial sector, successfully completing eight transactions and raising ~$4 billion in capital. Building on this momentum, the team expects continued strength in Industrial activity throughout the remainder of the year.

In this update, the team reflects on key equity market trends and themes from the first half of 2025. Baird’s senior leadership also shares their perspectives on the outlook for the rest of the year, including expectations for new issuance and sponsor-backed activity.

Select Transactions

Key Mid-Year Takeaways

- Despite market disruptions due to tariff policies in April, the IPO market remained resilient through the first half of the year, with 30 offerings over $100 million pricing, trading up ~17%, at the median, from the offer price.

- Sizable, sponsor-backed assets, including Karman Space & Defense, CoreWeave and SailPoint successfully priced IPOs opening the market for other large PE-owned businesses, including McGraw Hill and NielsenIQ, who both recently filed publicly for an IPO.

We expect for a broad class of Industrial IPOs to come to market over the next year as we have seen increased interest from scaled, best-in-class PE-backed Industrial technology platforms considering the IPO as a preferred exit option as they evaluate the public valuation paradigm relative to the private sector.

Mike Lindemann, Co-Head of Global Industrial Investment Banking - The dual-track process continues to be a widely used strategy to preserve optionality and foster competitive tension while enabling price discovery to support a premium valuation.

Issuers and sponsors are fully embracing the dual-track process when considering an exit. We have seen some choosing the public exit alternative to capture long-term upside, despite the trade-off of reduced liquidity for sponsors in the near-term.

Justin Holsen, Managing Director, Industrial Equity Capital Markets - In the secondary market, sponsors continue to seek liquidity and monetization of their investments, as exits have stalled and capital deployment has slowed, with ~35% of follow-on offerings YTD including a secondary component, above the 5-year median of 24% (’19-’23).

- Investors have navigated a volatile year, marked by the initial post-Liberation Day panic, followed by a robust relief rally and now a cautiously optimistic sentiment. Notably, history offers some encouragement: in the past five instances where the S&P 500 experienced a first-half drawdown of at least 5%, the index has delivered an average gain of approximately 12% in the second half.

Despite all the geopolitical surprises and headlines out of D.C. in the first half of 2025, this remains a market led by Financials, Technology and Industrial stocks – a leadership profile not particularly consistent with a weakening economy. Since the start of the year both 10-year yields and oil are also lower, offering additional support for an already resilient economy.

Chris Verrone, Head of Technical & Macro Research, Strategas

Baird’s Senior Leadership Outlook Soundbites

“While it is possible to have a recession when profits are declining, there has never been a recession when profits are rising. As it stands now, consensus estimates forecast a 9% increase in S&P 500 operating profits in calendar year 2025. That may ultimately prove to be too high, but we believe that some resolution of tariff threats and the budget bill could lead to a meaningful increase in business confidence in the second half.”

- Jason Trennert, Chairman & CEO, Strategas

“Institutional investors looked through trade and tariff uncertainty as Industrial stocks outperformed the market in the first half of 2025. Investors continued to show their willingness to deploy capital across both IPOs and follow-ons by withstanding periods of elevated volatility.”

- Jon Langenfeld, Head of Global Equities

“Despite higher-than-expected market volatility during the first half of the year, our industrial clients, along with their PE owners, continue to express strong interest in the public exit alternative, with conversations accelerating in recent weeks for those with meaningfully scale ($300M+ EBITDA). Performance across these assets has shown to be resilient even with the added uncertainty from new tariff policies. Several of our larger clients continue to be in sectors benefiting from secular tailwinds including automation, data center build-outs, electrification, defense technology, energy efficiency and flow technology advancements. These clients acknowledge the opportunity the public markets can offer in terms of valuation, access to growth capital and M&A.”

- Joe Packee, Co-Head of Global Industrial Investment Banking

“We continue to see strong buy-side demand for early access to management teams, reflected in the robust participation across discovery and testing-the-waters meetings. We expect this momentum to continue through the rest of the year, as investors strategically position themselves for significant participation in crossover rounds, cornerstone investments and IPO allocations.”

- Justin Holsen, Managing Director, Industrial Equity Capital Markets

Baird Industrial ECM Highlights since 2024

Bookrunner on ~70% of Industrial Transactions

>$8.5 Billion in Capital Raised

~50% of Transactions Contained a Secondary Component

28% Median Offer-to-Current for Baird Bookrun Deals1

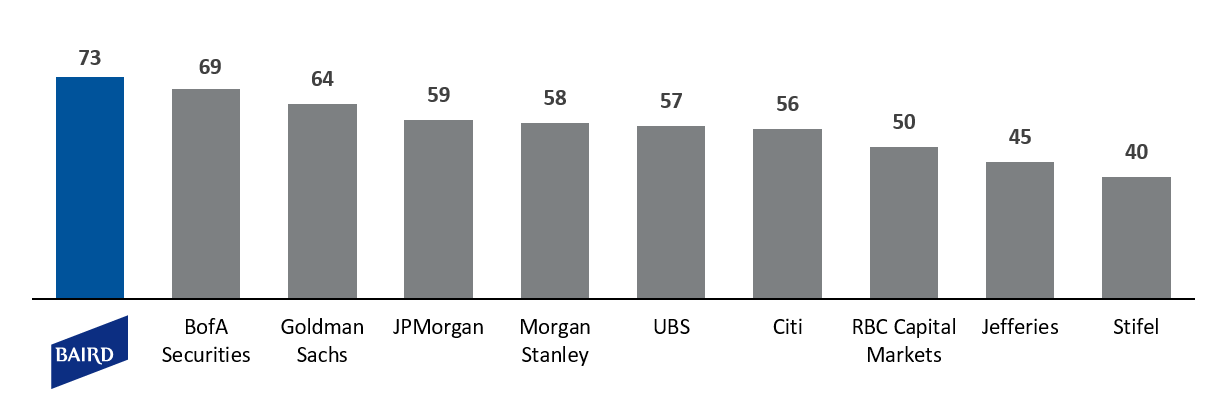

Leading Equity Underwriting Franchise Since 20182

1As of July 7, 2025.

2Dealogic Industrial offerings as of July 7, 2025. Excludes ADRs, closed-end funds, SPACs, deals less than $15 million, Mining and Metal & Steel issuers and bought deals.