Markets & the Economy: "Unnerving a Bull Market"

This content does not reflect any recommendations of Baird.

The transition into February has been characterized by heightened volatility & uncertainty…

An unusually kinetic markets backdrop- momentum blowoffs in metals and memory chips, dollar bouncing from multiyear lows, hundreds of billions in AI fundraising in the wings- has so far spared the core equity indexes…

For how long?

Add it to the ETF Line Up

New Launches: (week ending 2/6) a few highlights…

- RCAT~ Defiance Daily Target 2x Long RCAT ETF

- BTYB~ VistaShares Bitbonds 5yr Enhanced Weekly Distribution ETF

- XSPI~ NEOS Boosted SP500 High Income ETF (along with a Boosted Btc & Nasdaq 100 ETF)

- USMD~ CoreValues America First Technology ETF

- UFOD~ Tuttle Capital UFO Disclosure ETF; buy stocks they believe will benefit from UFO disclosure and alien technology

New Filings:

HSBC ($3T aum) enters US ETF market with a physical gold ETF filing that uses tokenized shares on a blockchain together with tradition shares and thus called a ‘hybrid’ ETF

- HGT~ HSBC Hybrid Gold ETF

New ETF issuer filed 41 ETFs; thematics, buffers, New York, Venezuela and more…

ETF Check Up: FlowShow

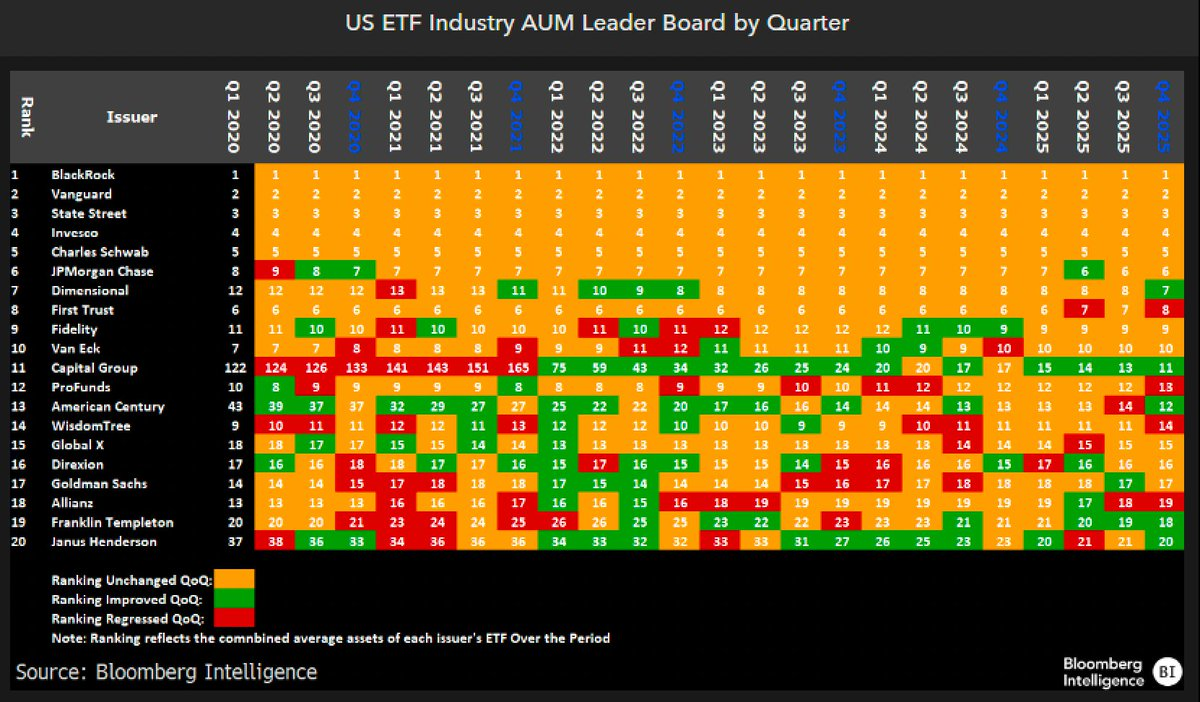

Vanguard is destined to overtake BlackRock as US ETF asset king (est next year or two)…

- Narrowed its gap from 47% away to 6% away in 5yrs

- BUT BlackRock’s rule as revenue king is very secure (Vanguard in 4th place in that dept)

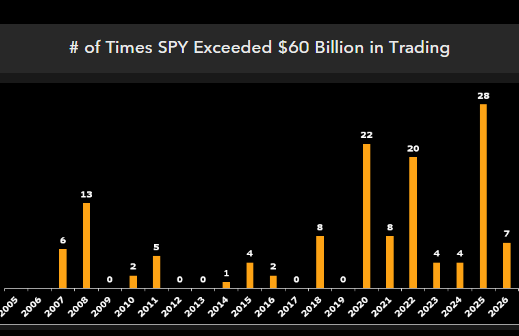

SPY saw over $60b in volume (aka the freak out zone) 28 days last year…which is by far a record

- It’s already done it 7x this year=gains in stocks is more hard won than in past years

- Mostly due to the Trump effect, avalanche of news flow and partially due to inflation…