Markets & the Economy: Can an old bull learn new tricks?

This content does not reflect any recommendations of Baird.

As the bull market moves through its fourth year, its animating narrative has changed:

This content does not reflect any recommendations of Baird.

As the bull market moves through its fourth year, its animating narrative has changed:

New Launches: (week ending 1/30) a few highlights…

New Filings:

BlackRock files for a Bitcoin ETF that also pays out cash every month~ iShares Bitcoin Premium Income ETF

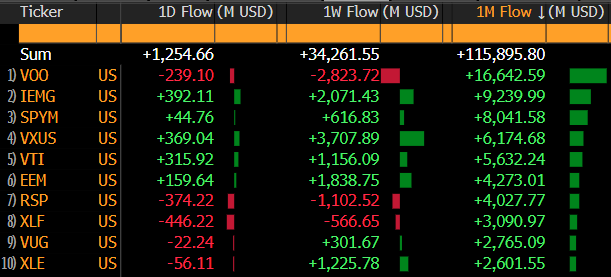

ETF flows for January: $115B~ the avg January is around $40B and the all-time record is $88B (set last yr)

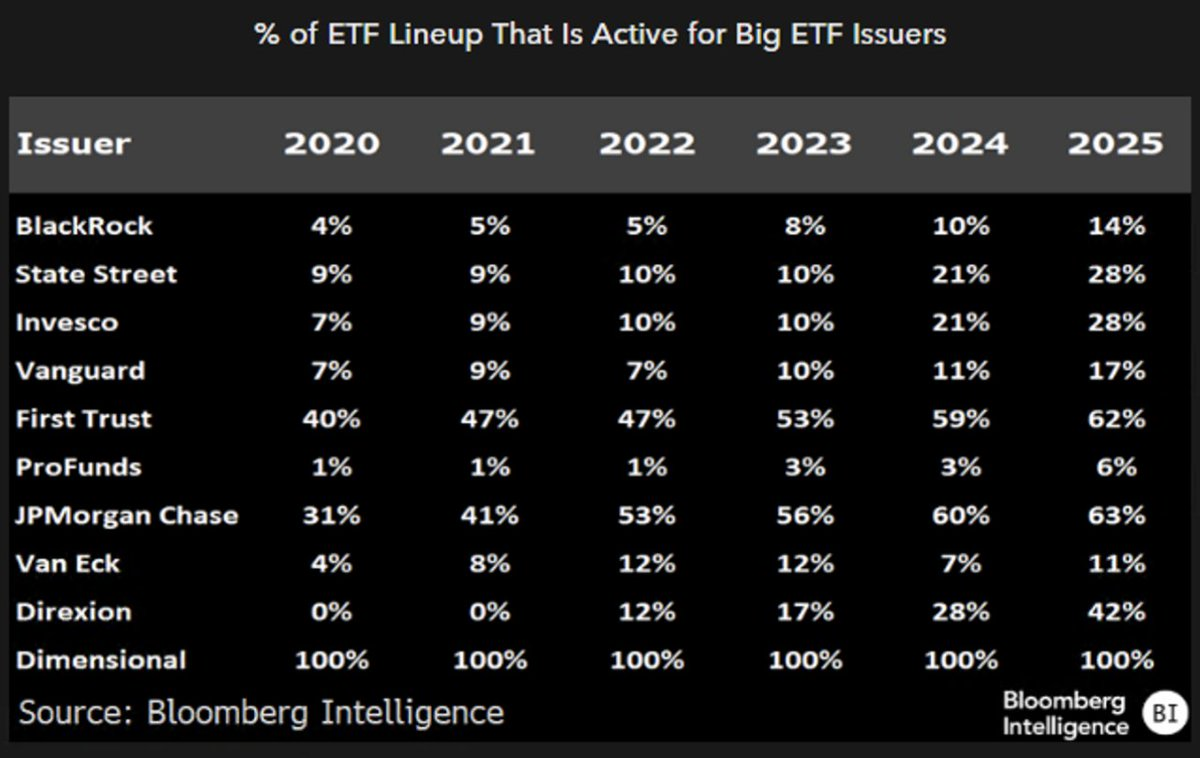

Active ETFs are so hot right now even the ‘Passive Giants’ are flooding the zone w products…% of each issuer’s lineup that is active, huge surge over the past 5 yrs

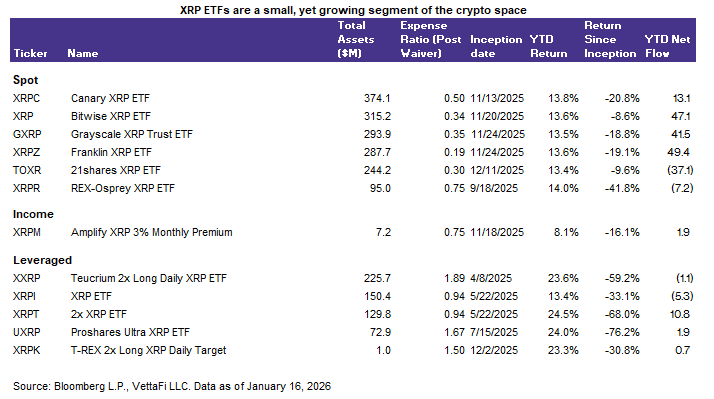

ETZ Buzz…