Markets & the Economy: Wall Street’s 2026

This content does not reflect any recommendations of Baird.

The market’s benign churn has left a sort of bland baseline bullishness for 2026 intact.

Possible swing factors…

Would a ‘broader’ market truly be better?

Can huge onrushing demand for AI capital be met?

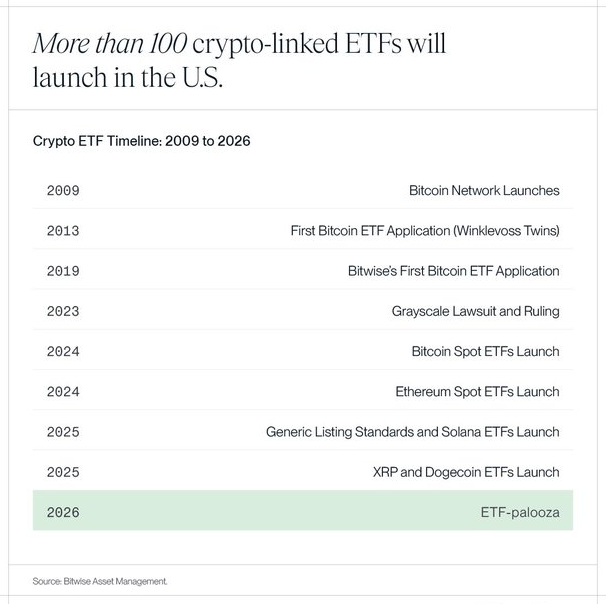

Is bitcoin now ‘normal’ money with less speculative juice?

Add it to the ETF Line Up

New Filings: JPM, Bitwise

JPMorgan filed yield versions of JEPI & JEPQ ETFs…which also give out distributions that will be return of capital

- JPMorgan Equity Premium Yield ETF

- JPMorgan Nasdaq Equity Premium Yield ETF

New cryptocurrency ETF filed…

- Bitwise Sui ETF

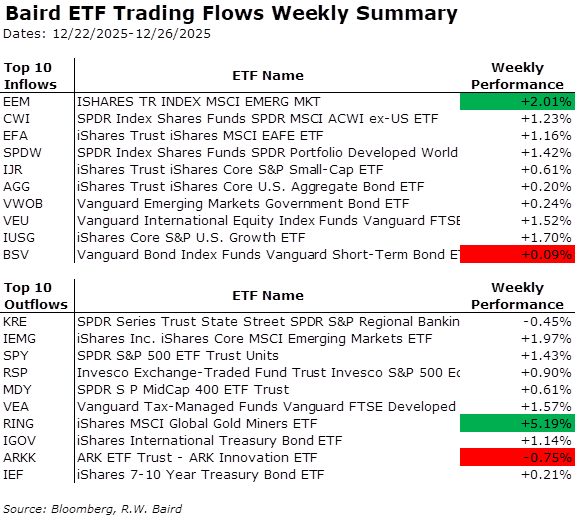

ETF Check Up: Flowdown

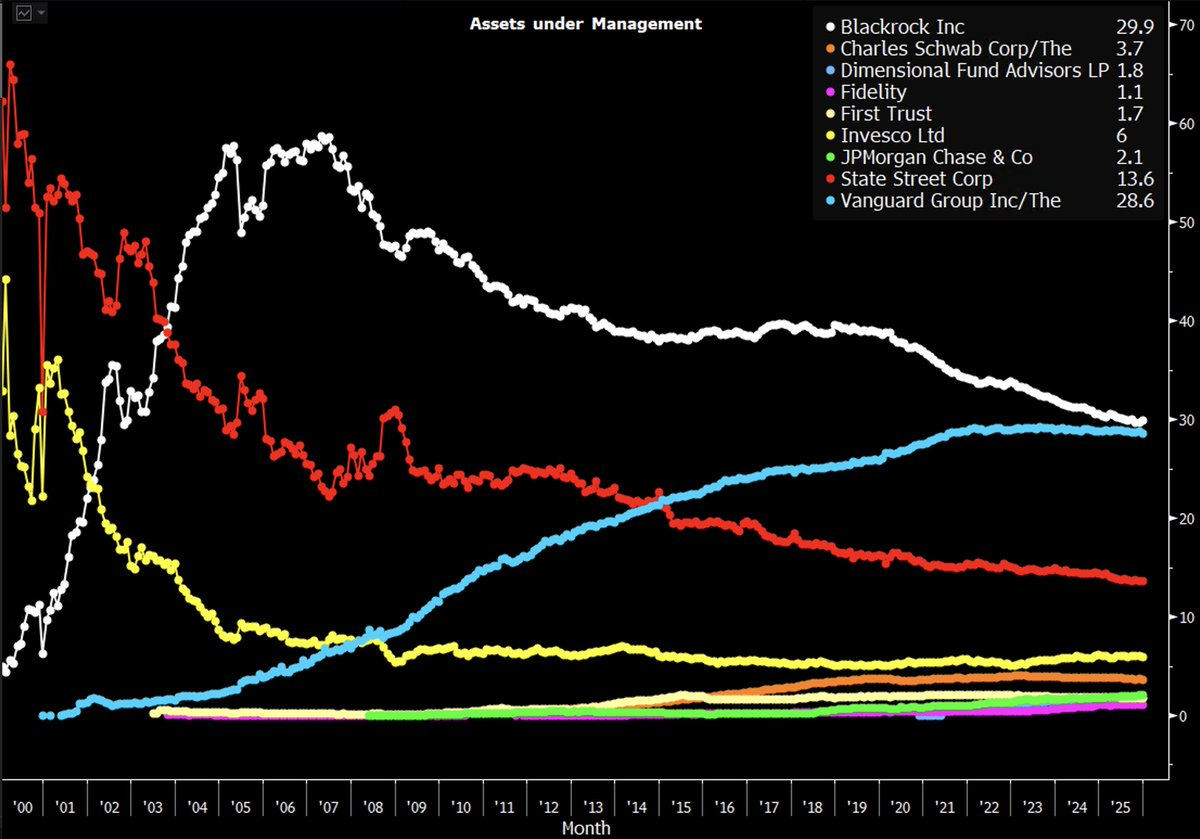

BlackRock held its 1% lead over Vanguard in US ETF market share this year…

ETF Buzz…

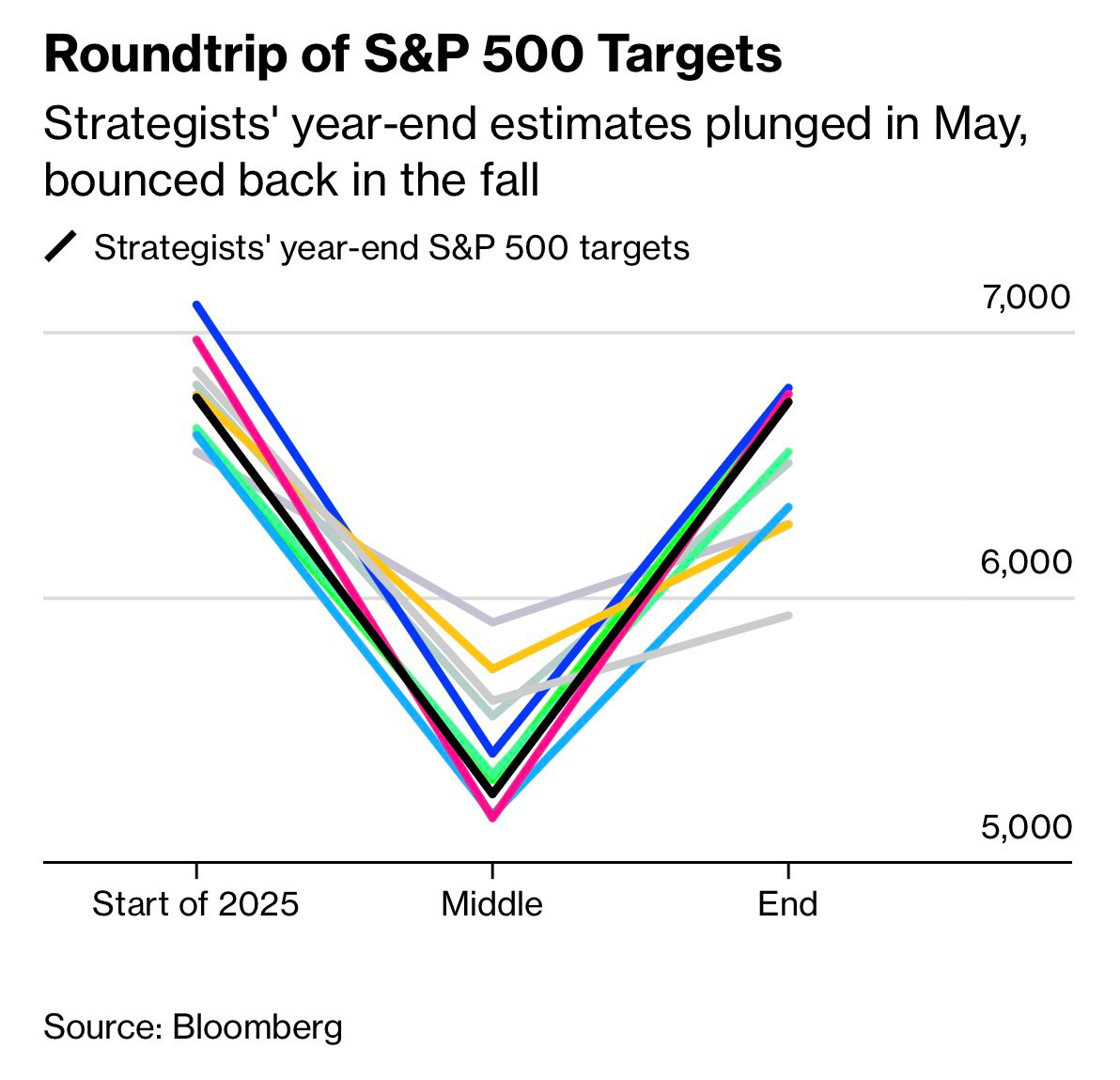

Chart of the Year Candidate…

- Wall Street strategists’ year end target on SP500 at different points throughout year~ Nobody. Knows. Anything