Markets & the Economy: Turmoil…

This content does not reflect any recommendations of Baird.

The bull market probably didn’t die last week…

But the recent turbulence offers a glimpse of its eventual demise- symptoms of underlying imbalances emerging and pre chronic conditions threatening to go viral.

Still just a routine-looking choppy phase in an uptrend?

Add it to the ETF Line Up

New Launches: (week ending 11/21) a few highlights…

- VSOL~ VanEck Solana ETF; waiving fee on first $1B AUM or until February 2026

- FSOL~ Fidelity Solana ETF; fee is 25bps (easily the biggest asset manager in this category with BlackRock sitting out)

- TSOL~ 21Shares Solana ETF; fee is 21bps and opening with $100m in AUM

Solana ETFs have taken in $2B as a group- not bad considering the ‘extreme fear’ right now

Granny Shots expands lineup of ETFs…

- GRNJ~ Fundstrat Granny Shots US Small & Mid Cap ETF

- GRNI~ Fundstrat Granny Shots US Large Cap & Income ETF

New Filings: Leverage

Leverage Shares filed for a 2x Long Kraken ETF~ KRKN…which I believe isn’t even IPO-ing until next year

ETF Check Up: Flow Show

ETF Buzz…

In a year defined by ‘wild child’ ETF launches, the top asset gatherer is the most vanilla (again)…

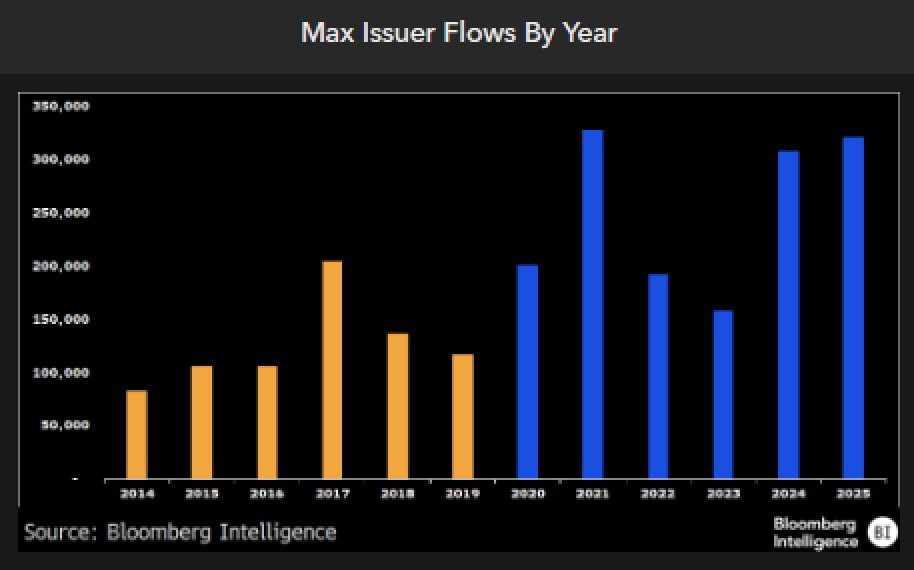

- Vanguard has taken in $326B in ETF flows this year; will break the record for flows by an issuer in a year (set by them in 2021 at $328B~ This will be their 6th year

Next Gen…

- A record 50% of ETF launches (908 total) this year use DERIVATIVES in some way, shape or form

- A record 85% are ACTIVE and a record 30% are LEVERAGED

Nice chart from @Todd_Sohn who posits the question of whether all the alt coin ETF launches marked the top?