Markets & the Economy: Cause for Concern?

This content does not reflect any recommendations of Baird.

The S&P 500’s rebound rally showed, yet below the surface the market is emphatically executing an ‘early cycle’ playbook to position for a peppier economy and looser Fed.

Do investors have it right this time?

Add it to the ETF Line Up

New Launches: (week ending 12/12) a few highlights…

- AUAU~ Global X Gold Miners ETF

- SIOO~ VistaShares Target 15 SP100 Distribution ETF

- OAKI & OAKG from the Oakmark Global team (Global Large Cap & International Large Cap)

New Filings: Pacer, iShares, Bitcoin

AI stock picking ETFs filed…

- Pacer S&P 500 3AI Top 100 ETF

- Pacer S&P World 3AI Top 300 ETF

Strategy: AI picks top stocks for US or World portfolio

iShares files for Staked Ethereum ETF~ ETHB; their 4th crypto filing: Spot btc, eth, btc income and now this…

Bitcoin after dark: New filing for an ETF that will only hold bitcoin at night, buying it when the US market closes and selling it when it opens

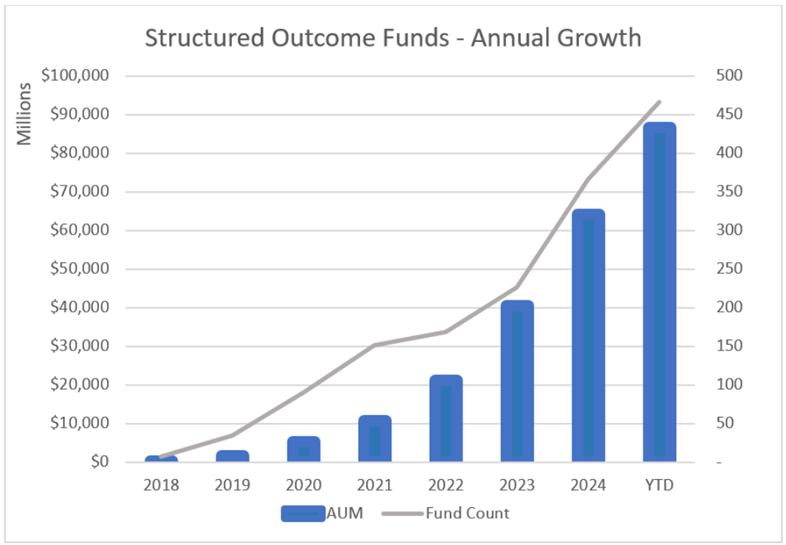

ETF Check Up: FlowShow

ETF Buzz…

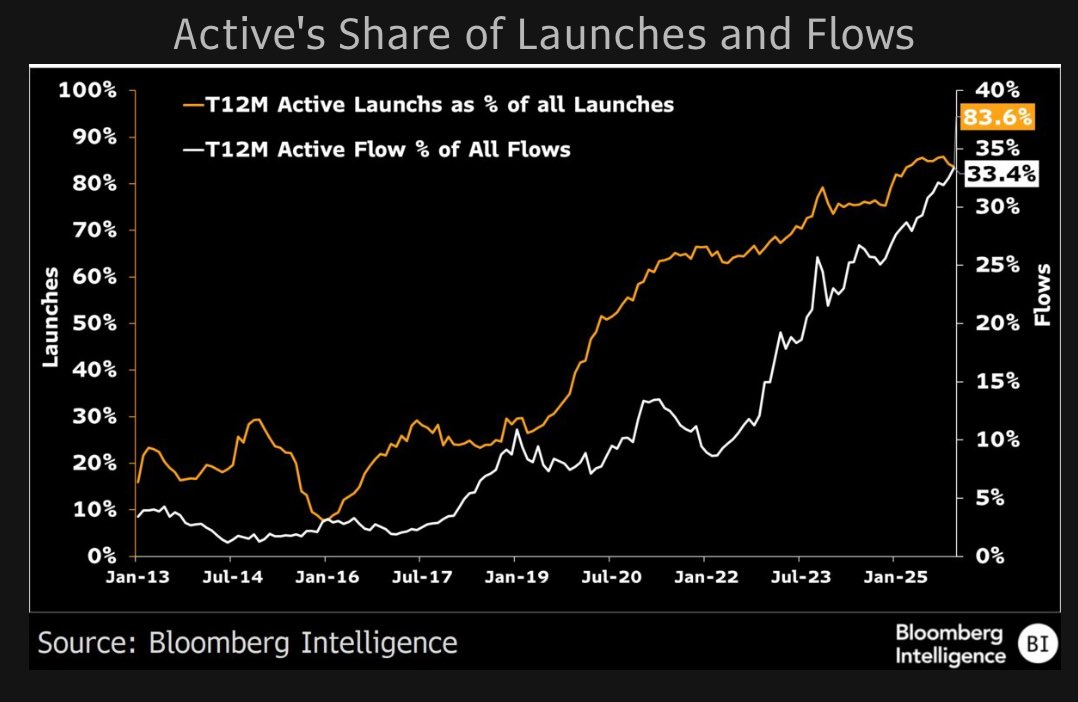

Active ETFs account for 33% of the flows and 84% of the launches…