Markets & the Economy: 2026 Playbook

This content does not reflect any recommendations of Baird.

A high torque rotation into economically sensitive stocks post Fed offsetting another wobble in the AI theme.

The market’s been pressing its bets on a reacceleration into 2026, as ‘run it hot’ policies kick in.

Is the stampede into value looking a bit panicky yet?

Add it to the ETF Line Up

New Launches: (week ending 12/19) one highlight…

- RONB~ Baron First Principles ETF; run by the only active manager (out of thousands) to beat the QQQ’s over the past 15 years

New Filings: Vanguard

- BNPL~ VegaShares Buy Now, Pay Later ETF; will invest in banks, savings & loans, diversified financial services co’s and mortgage banks

Vanguard filing for a Developed Markets ex-US Growth Index ETF; interesting and pretty specific for them (that’s how big US growth is getting-people likely requesting something that tracks everything but that)

ETF Check Up: FlowShow

2026 Crypto Predictions from Hashdex…

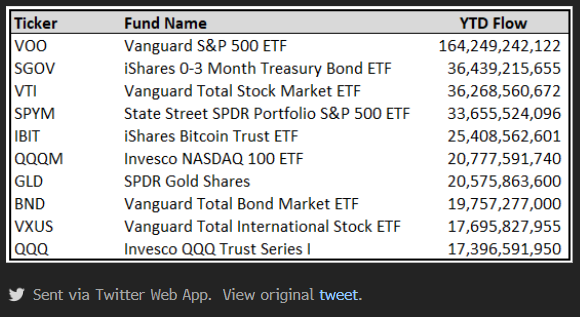

Top 10 ETFs by inflows this year…

- Vanguard SP500 ETF absolutely killing the annual inflow record

- Notable that iShares Bitcoin ETF is #5 and SPDR Gold ETF is #7 on the leaderboard

Investors clearly still pursuing May 7 exposure…

Fun Fact: It’s Last-Minute Shopper’s Day