Markets & the Economy: The Road Forward…

This content does not reflect any recommendations of Baird.

A fairly strong showing for the market which nonetheless felt like a struggle after a long calm climb.

Wall Street confronted ghosts of crises past: regional bank credit jitters, US China trade static, a purge in speculative froth.

Just a ‘normal seasonal pause’ or something more?

Add it to the ETF Line Up

New Launches: (week ending 10/24) a few highlights…

Defiance adding 4 new funds to their leverage suite…

- Defiance Daily Target 2x Long: IRE, MPL, QSU and AVXX

New Filings: Volatility, Crypto

5x daily leveraged ETFs filed based on the three most traded ETFs in the world…

- 5x SPY ETF

- 5x QQQ ETF

- 5x IWM ETF

More 5x and 3x leveraged ETFs filed on gold, gold miners, silver, semi’s and MAG 7 ETFs by Volatility Shares; will they ever make it to market?

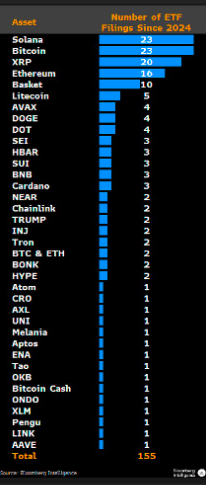

There’s now 155 Crypto ETP filings tracking 35 different digital assets…could easily end up seeing over 200 hit the market in the next 12 months

Here’s the list by coin…

Semi Shock: T Rowe Price filed for an Active Crypto ETF; Top 5 active manager by assets (traditional asset manager with roughly $1.8T in aum, only entered the ETF space in 2020)

ETF Check Up: Flowdown

ETF Buzz…

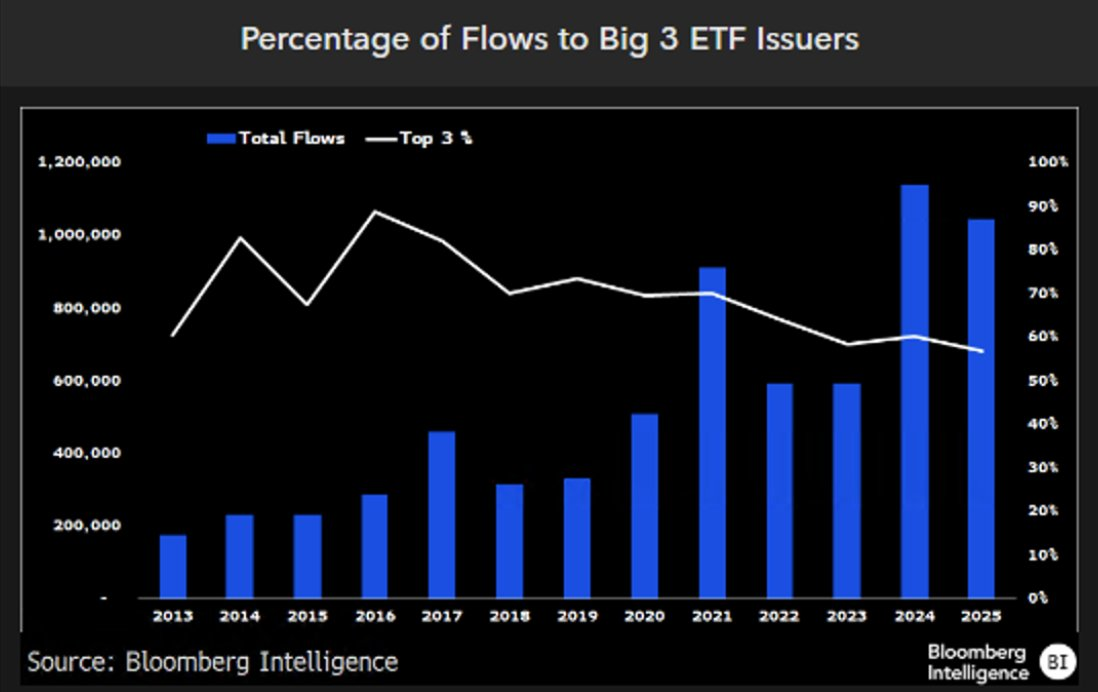

The Big 3 (VNG, BLK, ST Street) share of ETF flows is at 57% ytd, the lowest level in 10 years, which is arguably healthy and inevitable as the onslaught of new issuers take a toll…