Markets & the Economy: Rough Start to Q4

This content does not reflect any recommendations of Baird.

Markets finally received the wake up call they had been ignoring. After a couple of weeks of relatively low volatility, the VIX has nearly spiked 2x since 10/6 & stocks paid the price.

What’s the markets next move into year end?

Baird in the News

Rich Lee, Head of Program Trading & Execution Strategy, weighs in on the squeeze of AP balance sheets as ETF launches continue to soar…

Read the full article on marketsmedia.com

Add it to the ETF Line Up

New Launches: (week ending 10/17) a few highlights…

- LMNX~ Defiance Daily Target 2x Long LMND ETF

Calamos unveils 3 Laddered Protected Bitcoin ETFs: CBTL, CBXL & CBOL

New Filings: Gabelli, VanEck

Sports biz ETF filed. ZERO fees for 1 year!

- GOLS~ Gabelli Opportunities in Live & Sports ETF; invests in Co’s that own sports teams, owns sports real estate business, in sports merchandise…

VanEck filed some good ol’ fashioned sector ETFs, actively managed:

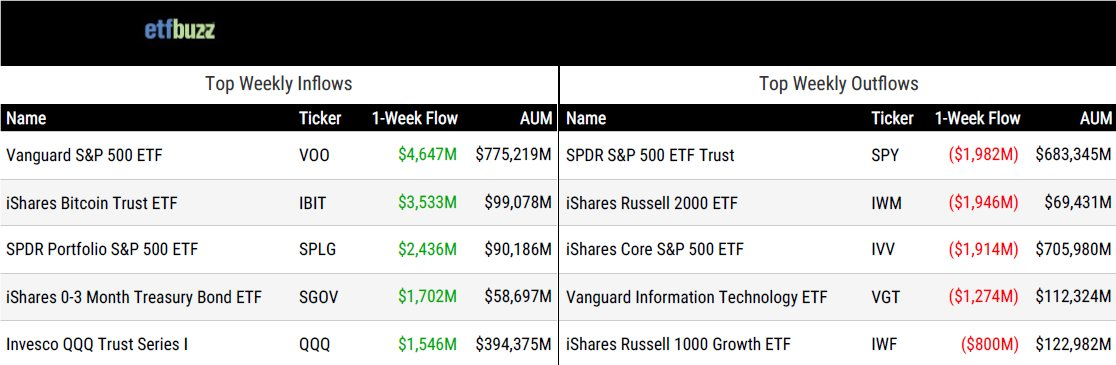

ETF Check Up: FlowShow

ETF Buzz…

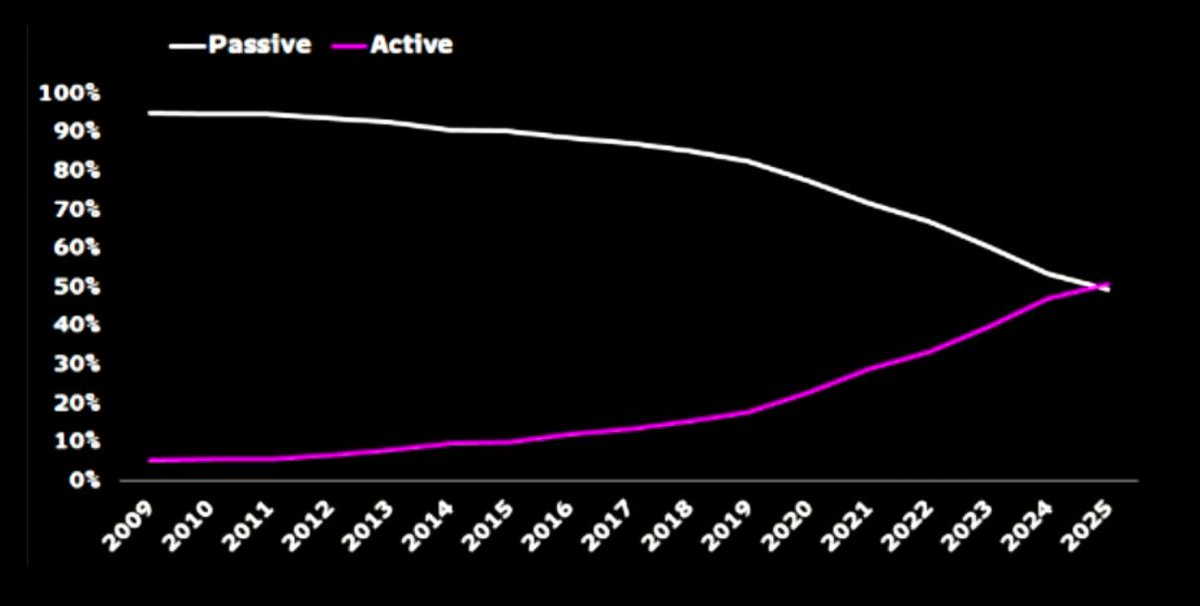

The Flippening, ETF style there’s now more active ETFs than passive ones…that said active only has 10% of assets but growing fast

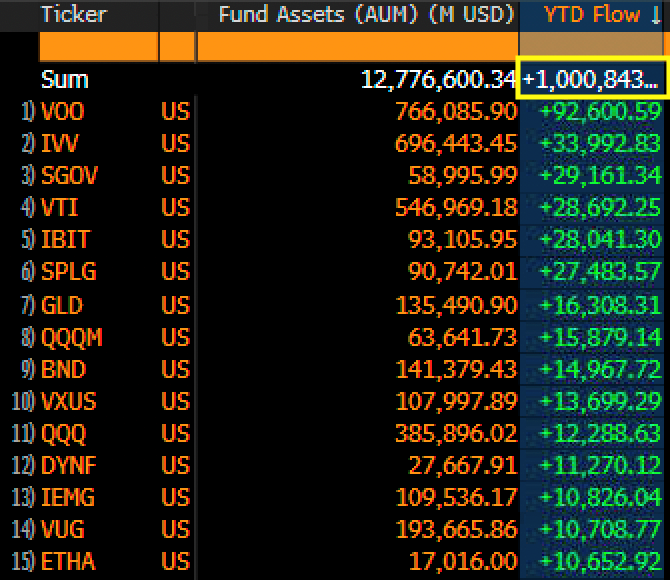

ONE TRILLION and 2.5 months to go..