Markets & the Economy: Fresh Momentum…

This content does not reflect any recommendations of Baird.

Wall Street is having a mild AI-nxiety attack.

The simmering unease about a possible AI bubble began boiling over…

A proper warning of an undisciplined capital burning binge or a dose of caution to refresh the rational exuberance?

Add it to the ETF Line Up

New Launches: (week ending 10/3) a few highlights…

- TRIL~ Defiance Trillion Dollar Club Index ETF; holds US Co’s & crypto ETFs tied to assets valued at $1T

- CRCO~ YieldMax CRCL Option Income Strategy ETF

- CHPX~ Global X AI Semiconductor & Quantum ETF

New Filings: 2x GRNY

Filing for a 2x Granny Shots ETF $GRNY from T-REX~ that’s now 3 ETFs from other issuers linked to his ETF or Co.

ETF Check Up: Flow Show, Multi Share Class

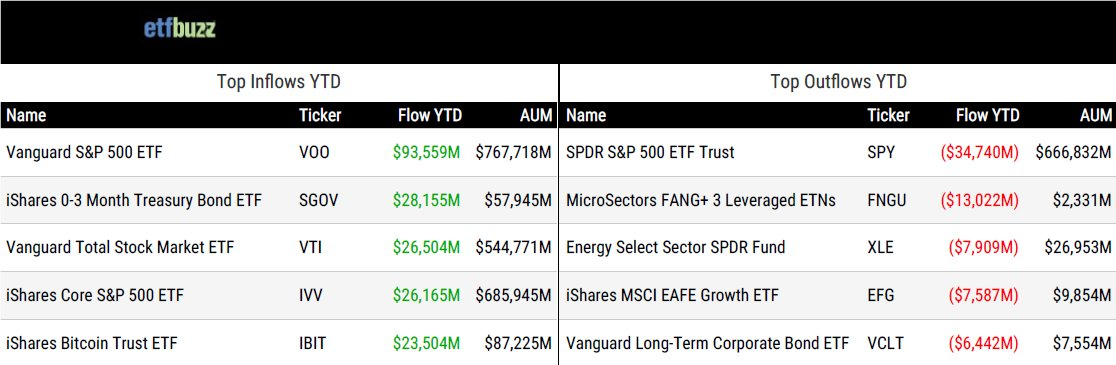

ETF Buzz…

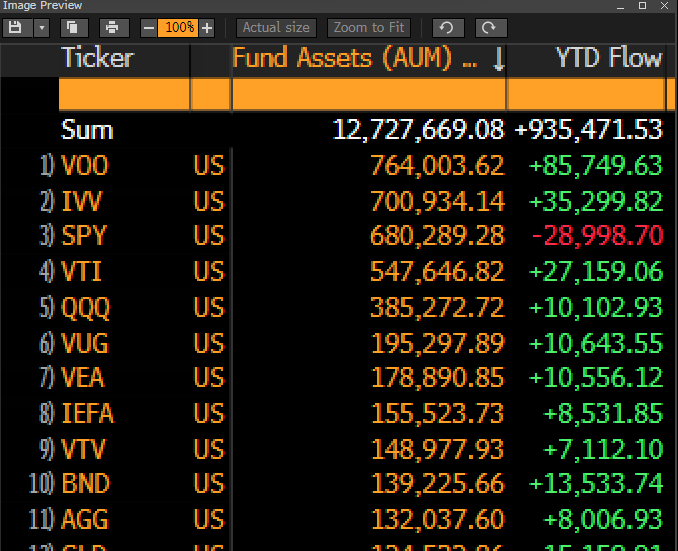

SPY is now 3rd in assets…

- Likely going to be the new order of things for awhile: VOO, IVV and SPY and then a pretty big gap to VTI

- Notably SPLG (the fourth SPX ETF) is rising fast already $86b seemingly taking the cash SPY losing

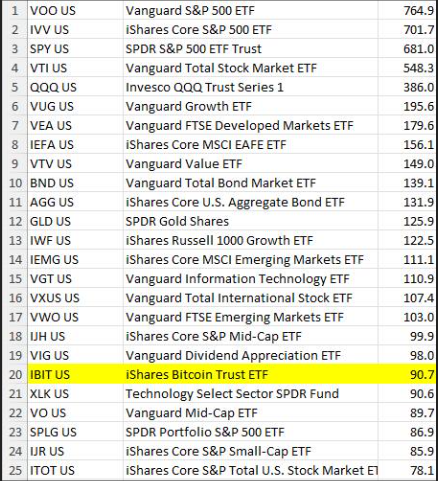

BlackRock’s IBIT has reached a significant milestone, entering the Top 20 ETFs with $90B in assets, surpassing XLK

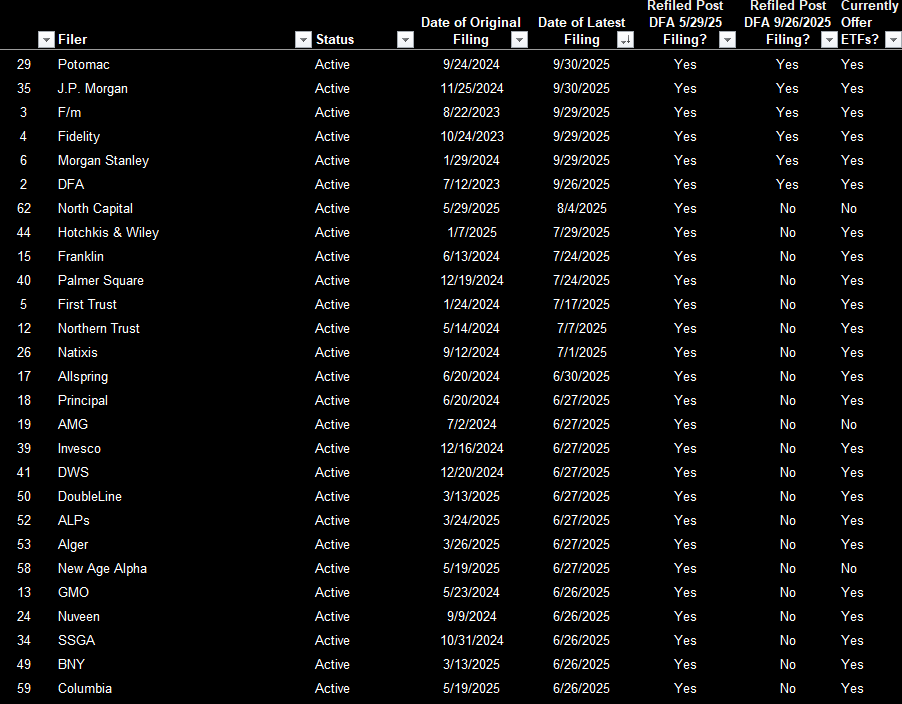

SEC moving forward with approval of multi-share class structure…

- Will allow fund Co’s to launch ETF share classes of existing mutual funds~ currently 79 asset managers in filing

Top 20 recent filings…