Markets & the Economy: Is a Rate Cut Warranted?

With the Fed signaling that interest rate cuts may be on the horizon, what does that say about the state of the economy?

Add it to the ETF Line Up

New Launches: (week ending 8/29) a few highlights…

A new KAT in the ETF jungle; Scharf’s Funds arrive with scale approx. $900m in assets

- KAT~ Scharf ETF

- GKAT~ Scharf Global Opportunities ETF

New Filings: Vaneck, Fundstrat

VanEck files for the 1st 100% liquid staking token ETF…

- VanEck Jitosol ETF; this is simply a spot Solana ETF with some potential benefits

Tom Lee plans 2 new funds; expanding his ETF lineup with small-cap & covered call strategies

- Fundstrat Granny Shots US Small & Mid-Cap ETF

- Fundstrat Granny Shots US Large Cap & Income ETF; taking aim at JEPI

ETF Check Up: Flow Show

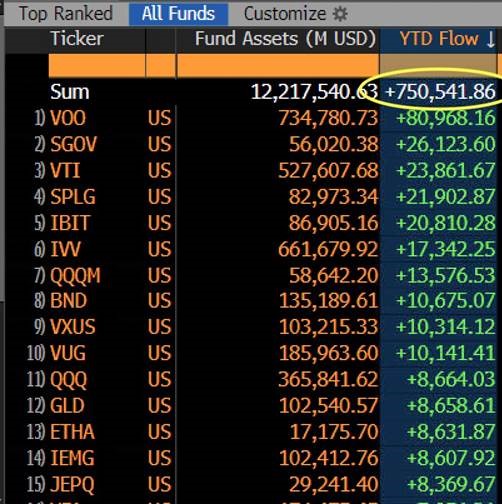

‘Trilly’ Special: As we head into the end of the 3rd quarter, ETFs are at $750B which puts them on pace to clear ONE TRILLION for the 2nd year in a row

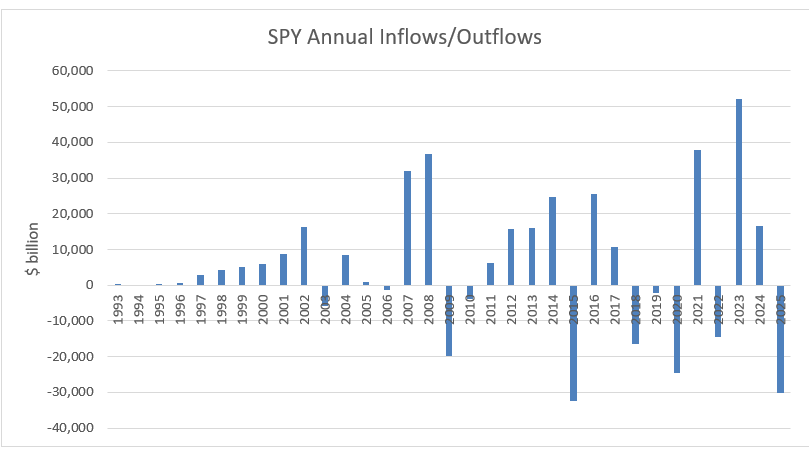

SPY on track for worst year of Outflows…

- Investors have pulled $30.2B from SPY so far in 2025; if the year ended today (8/29) that would mark its 2nd largest annual outflow, trailing only the $32.2B pulled in 2015

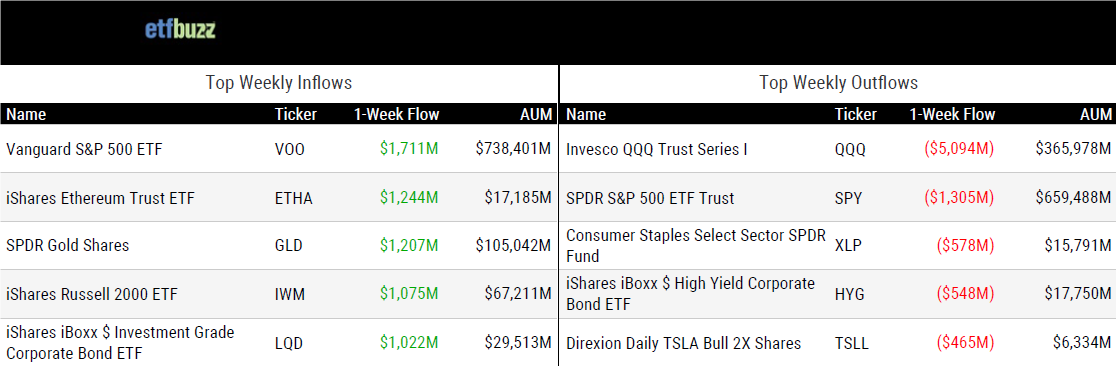

iShares Ether ETF is #2 out of all 4400+ ETFs in inflows over the past week…

- Only behind Vanguard’s VOO; heavy hitters on this list