Markets & the Economy: ‘The Most Hated Bull Market’…

The market wants a Fed rate cut, but doesn’t want to need it…

This content does not reflect any recommendations of Baird.

Indexes at records, valuations full, crypto melting up, credit spreads tight and buzzy IPOs ripping on Day one. Can the market’s strong run continue?

Add it to the ETF Line Up

New Launches: (week ending 8/22) a few highlights…

Defiance launched 5 new Leveraged Long + Income funds on HIMS, HOOD, PLTR, AMD & SMCI (a few noted below)

- HIMY~ Defiance Leveraged Long + Income HIMS ETF

- HOOI~ Defiance Leveraged Long + Income HOOD ETF

YieldMax on the tape with another leveraged fund; SLTY~ YieldMax Ultra Short Option Income Strategy ETF

New Filings: Vanguard, Baron

Vanguard filed for Active Equity ‘Wellington’ ETFs (not *the* Wellington fund); Fees will be between 30 to 40bps which will be the highest cost Vanguard ETFs to date~ win-win for ETFs and Vanguard?

- VDIG~ Vanguard Wellington Dividend Growth Active ETF

- VUSG~ Vanguard Wellington US Growth Active ETF

- VUSV~ Vanguard Wellington US Value Active ETF

ETF Check Up: Ether

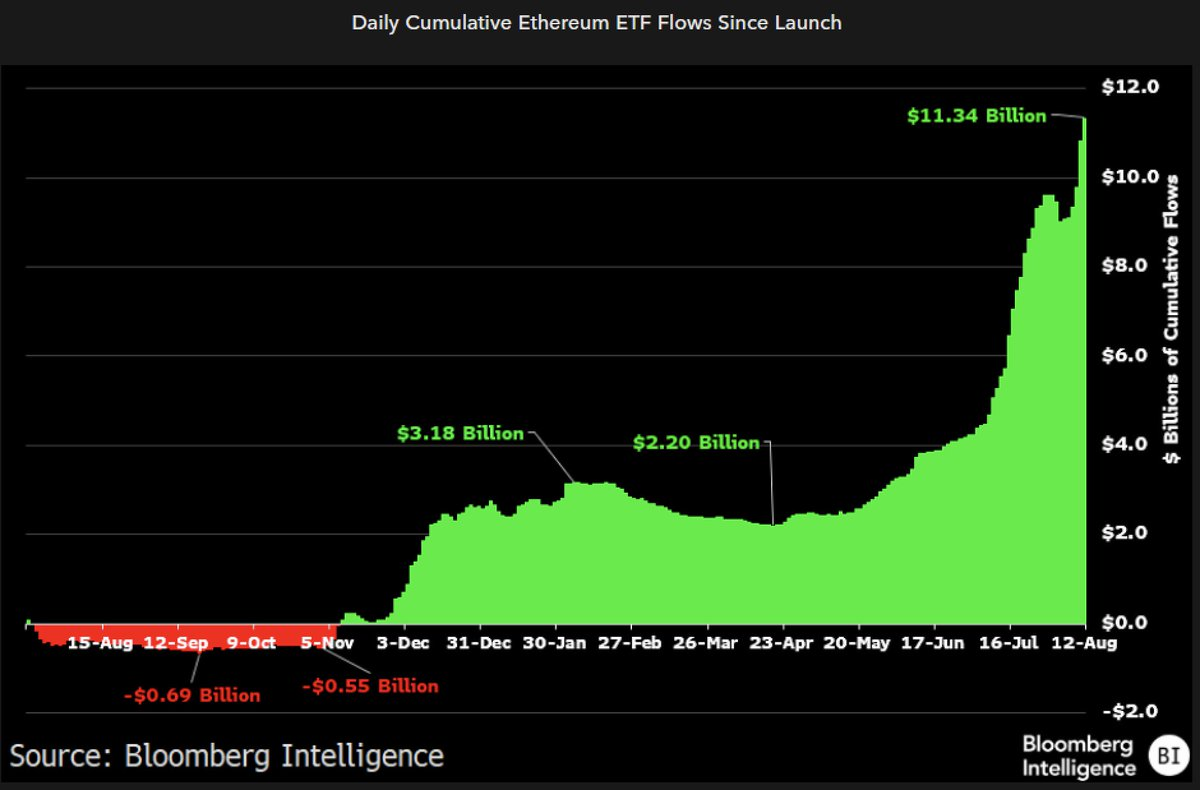

Ether ETFs packed one year’s worth of flows into about 6 weeks…asleep for 11mths and then BOOM!

- Ether ETFs turn Bitcoin into ‘Second Best’ Crypto asset in July