Markets & the Economy: Reversal Possible?

This content does not reflect any recommendations of Baird.

The stock market has scaled its way to record highs in more than four months, feeding off a deep reservoir of worry filled during the April tariff panic that has not yet fully been depleted. How does it differ from the last time we were here? Can stocks remain resilient?

Add it to the ETF Line Up

New Launches: (week ending 7/11) a few highlights…

- SPXM~ Azoria 500 Meritocracy ETF

- GEOA~ WisdomTree GeoAlpha Opportunities Plus Fund

- XOEF~ iShares SP500 ex Top 100 ETF; latest in their ‘build ETF’ lineup of super specific exposures

- XDIV~ Roundhill SP500 NO DIV ETF; gives you SPX but without dividends

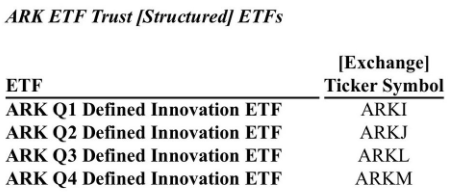

New Filings: ARK, Truth Social

ARK filed for some ‘structured’ aka buffer ETFs…basically its ARKK but with 50% downside limit and then on upside you get everything except the 1st 5% gains (speaks to the demand for defined outcomes there is out there)

Trump’s Truth Social filed for an index based crypto ETF…Truth Social Crypto Blue Chip ETF

- Will initially hold approx. 70% btc, 15% eth, 8% sol, 5% cro, & 2% xrp

ETF Check Up: FlowShow, IBIT, Emerging Markets, Exchanges

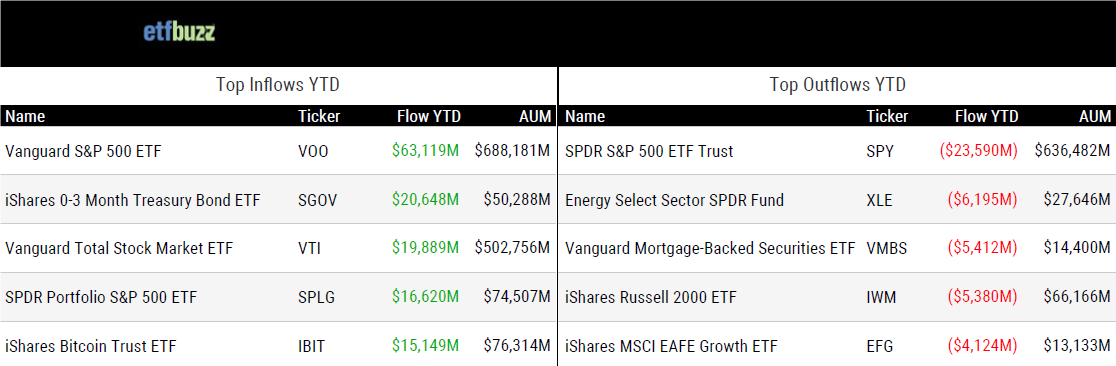

ETF Buzz...

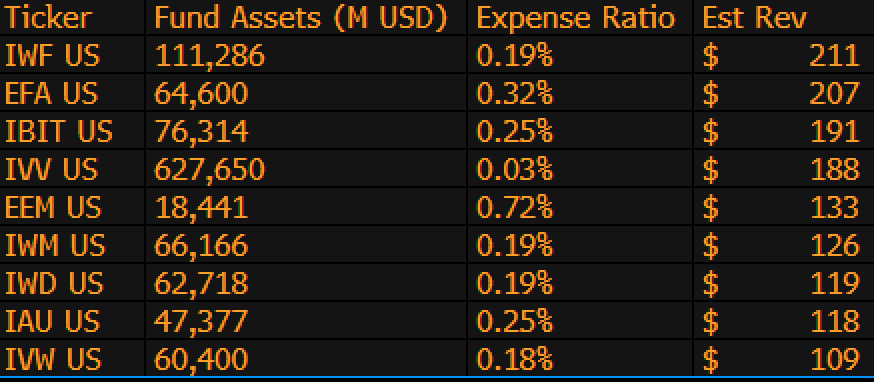

IBIT is now the 3rd highest revenue generating ETF for BlackRock out of 1197 funds…

- Only $9B away from being #1; another insane stat for a 1.5yr old ETF

Top 10 list for BLK (how about the forgettable IWF at top spot…)

IEMG getting some ‘big bites’ after months living in oblivion…

- 3rd biggest flow getter in the past month

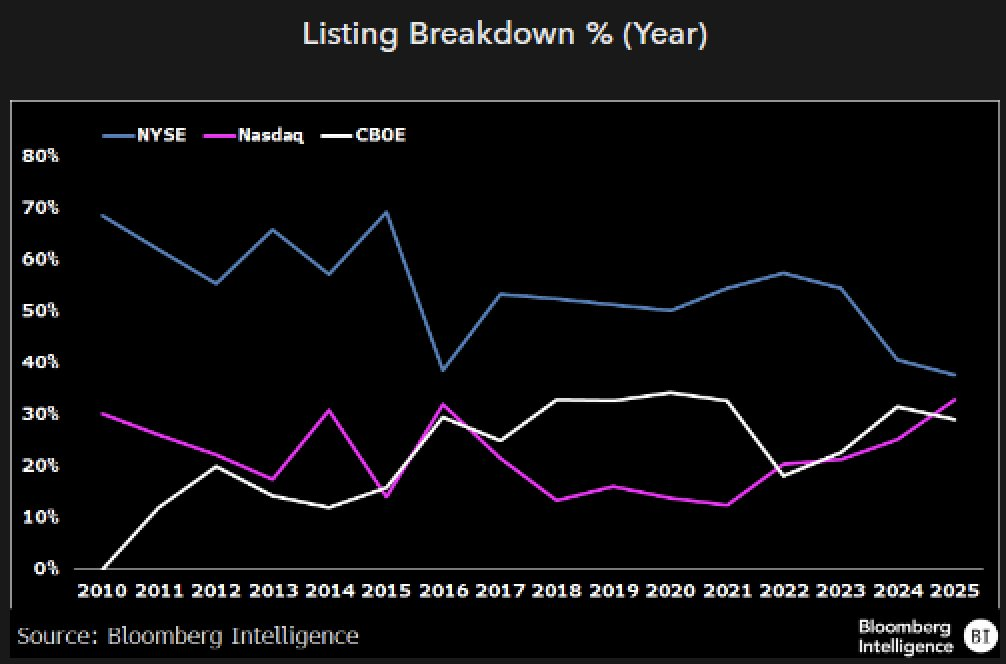

NYSE could lose its crown in new ETF listings for the 1st time ever this year…

- Nasdaq and CBOE are closing in – in what is looking to be a record year for ETF launches (possibly 1000)