Baird’s 2021 Muni Market Outlook

How the election, the pandemic, and broader economic trends could impact the municipal bond market in the new year.

It’s impossible to overstate how much the world had changed in 2020, and with COVID cases on the rise, rioting in the Capitol building, a second presidential impeachment and new leadership in Washington, 2021 looks to be just as unpredictable. We spoke with Tom Tzitzouris, Strategas’ Head of Fixed Income Research, on how these factors might impact the municipal market and what longer-term trends he’s keeping an eye on.

The 2020 Election and Georgia Runoff

The election saw not only the presidency change hands, but control over the Senate as well. What impact do you expect that to have on the muni market?

During the run up to the November election, there was a lot of talk about a “blue wave” that could result in removing the filibuster and packing the Supreme Court. That’s not on the table – the November elections ended that possibility. But by winning Arizona and more recently Georgia, Democrats won complete control of the government, which could result in a pivotal change in fiscal policy:

- Stimulus. We expect a Democratic Congress will pass more stimulus, perhaps as early as February. This could help spur economic growth in 2021.

- Tax increases. We think the Democrats will agree on the corporate income tax bracket going to 25% or even as high as 28%, as well as a maybe a 2% increase in the upper marginal tax rate. That might create some economic headwinds in 2022 and 2023, but it does give state and local governments and municipal bonds a boost.

- State and local aid. We expect Congress will authorize direct aid for state and local governments as well as indirect aid such as Medicaid, education and infrastructure dollars – highways, roads, bridges, plus new investments in alternative energy and even affordable housing. My two cents: This infrastructure plan is a done deal for 2021.

- SALT deductions. We expect a new Democratic Congress to push for a reinstatement of the state and local tax deduction, which allows taxpayers to lower their adjusted gross income by deducting certain state and local taxes on their federal tax returns. 2017’s Tax Cut and Jobs Act capped the total SALT deduction at $10,000 through 2025.

Interest Rates for 2021

Where do you see interest rates headed in the new year?

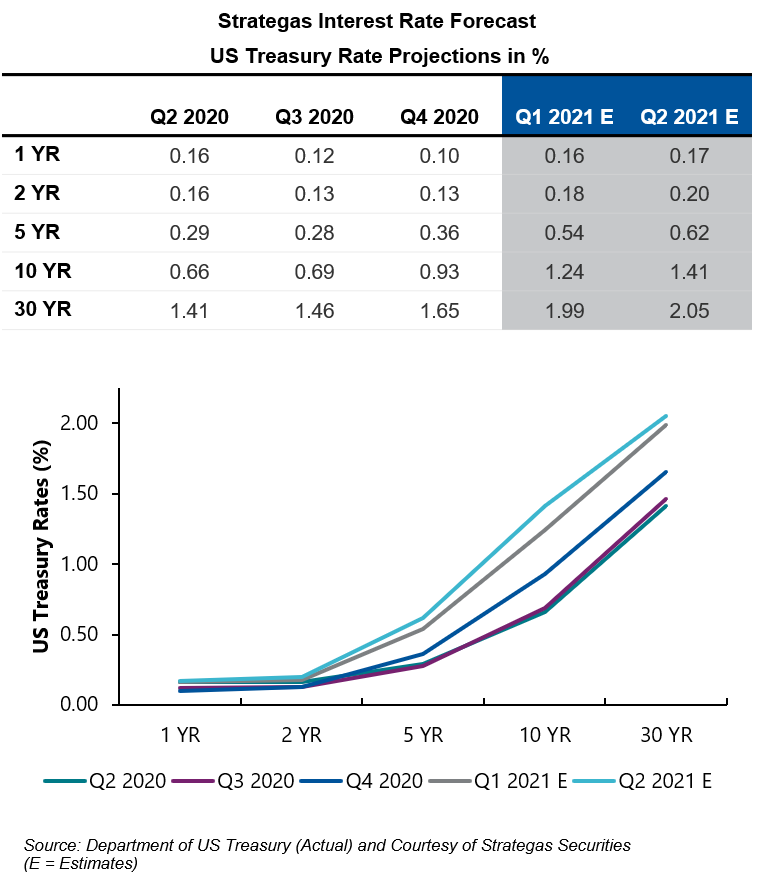

With the prospect of heavy stimulus and a reopening economy, the Democratic sweep in Georgia steepened the curve to new cycle highs. We see the difference between two-year and 10-year U.S. Treasury yields steepening to about 1.00% by end of Q1 and about 1.20% by end of Q2, with the 10-year accelerating much faster than the two-year. We anticipate the two-year yield will remain anchored, as the Fed is unlikely to show any appetite for raising the Fed target rate before the middle of 2023 at the earliest. This leaves the 5- to 30-year part of the curve as the outlet for an improving economy – we anticipate it will be pushed higher by the market and in line with investor optimism of an improving economy.

I believe the combination of stimulus and improving economic numbers will cause the 2- to 30-year yield curve to steepen into Q2, but at a slower pace than what we’ve seen so far in Q1.

Something else we’re looking out for is the possibility of more rapid steepening in Q3, but with the growing risk of a bond market mini-tantrum, or a pullback in Treasury purchases by the Fed by the end of the summer. As you might recall, when former Fed Chair Bernanke merely mentioned pulling back their Fed purchasing programs in 2013, the 10-year moved from 2.19% to 2.73% in less than three weeks.

It sounds like you’re expecting interest rates to increase from record lows – especially along the long-end of the curve – but still remain relatively low for at least the first half of the year. How might that impact muni investor behavior in 2021?

There are a lot of factors municipal issuers and investors need to consider when evaluating interest rate volatility: headlines, the pandemic, economic indicators, stimulus, global trade, tax policy and overall investor sentiment. We see some of these factors as positives: The stimulus and a strengthening economy, for example, will push investors’ confidence and risk appetite away from bonds and nudge long-term rates higher. We’ve already seen this dynamic play out this year, when the 10-year yield rose from 0.93% at the end of 2020 to as high as 1.15% to kick off the second week of the year. But other factors will still have their say, and headline risk always is a wild card that can cause swift market reactions. Despite the rise in interest rates, we anticipate both the 10- and 30-year will remain under 2.00% through Q2, which is still below where we started in 2020.

Regarding investor appetite for municipal securities, we anticipate really strong capital gains tax receipts across the states, as well as taxes on both investment-related income and ordinary income to increase to near all-time highs due to the stock market’s performance in 2020. This will trickle into local governments from their pension funds to tax-related revenues, helping to replenish reserves.

Another positive for state and local governments is the increase in property taxes. Housing continued its momentum over the past few years, not even blinking at the pandemic. Those receipts are going to be much, much better than we've seen on the housing side for at least a decade. While we might also see higher rates of delinquencies, reassessments will push property taxes much higher. So the anticipated lag in tax receipts could actually begin to rise this year and then again in 2022. That's something muni creditors are aware of – that tax receipts are not going to be anywhere nearly as bad as the worst-case projections we saw last year.

This combined with direct aid from Congress will support investor confidence from a credit perspective, likely keeping demand strong and municipal interest rates in check.

Muni Bond Supply and Demand

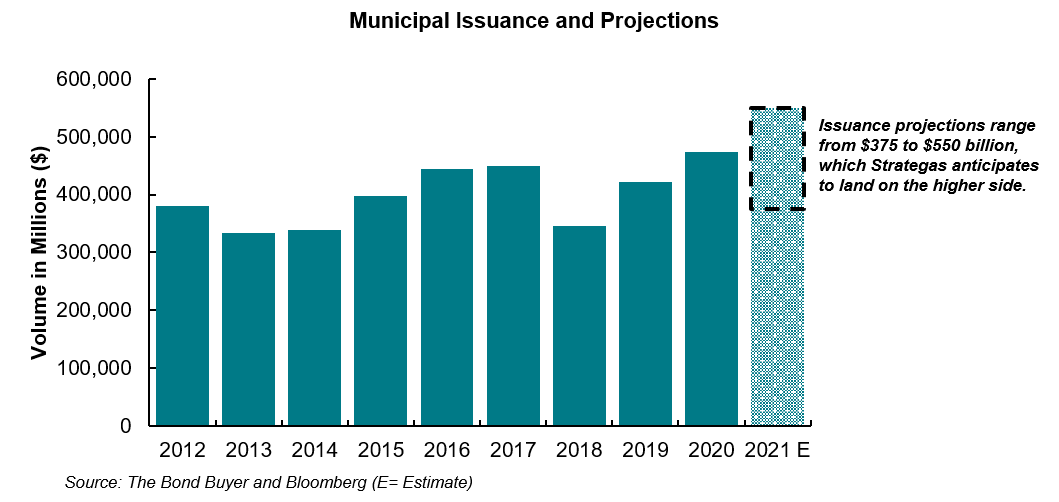

We’ve seen projections for 2021 muni issuance range from $375 billion to $550 billion. What is your take on issuance for 2021?

We expect it to come in on the high side of this range. We think demand will remain strong in part due to the prospect of higher tax rates, which would make the tax benefits of municipal securities even more attractive. As I mentioned above, more aid for states and local governments and an increase in tax revenues may help alleviate fears of default and ease credit fears, though they do not eliminate the need for states and local governments to plug budget gaps and meet spending promises. So I think confidence is going to be strong in the first half of the year.

While I think supply and demand will grow naturally, it also takes early planning. If Treasury or municipal yields really become unanchored or move higher at a much faster pace sooner than anticipated, that borrowing rate may be much higher than the 1.25% we’ve seen over the past year or so. But that scenario aside, all the pieces are in place right now to keep muni demand very strong for the first six months of the year.

Sector Trends

What sectors do you anticipate will face credit strains this year?

Areas that we expect to be cashflow-strained are healthcare, higher education and transportation. With new leadership in Washington, those concerns have transformed from higher default to higher issuance. That might require some state support or additional credit enhancement, but the market will digest it because there's federal aid now to back it.

There is also going to be a lot of traction for student debt forgiveness legislation, for better or for worse. The likelihood of $10,000 of student debt forgiveness via legislation, which seems to be the number I'm hearing, gives weaker institutions another year of survival. That will also keep some institutions from finding themselves having to close down in the very near term. So Democratic control supports the most highly stressed sectors and transforms them from a default risk in the next three to five years to a supply risk in the next six to 12 months.

The Biden Administration

What will you be paying attention to with the new Biden administration?

Cabinet and regulatory appointments. We like to say that “personnel is policy for regulation,” and with the Democrats winning control of the Senate, we anticipate President Biden will be able to get most of his appointments confirmed. This could include a more aggressive regulator to replace the current Vice Chair Randal Quarles, whose term expires this October.

A cabinet official I’m keeping a closer eye on is former Fed chair Janet Yellen as Treasury Secretary. It’s possible her agenda will be at odds with that of current Fed chair Jerome Powell. I see a lot of conflict between Powell and Yellen, especially on the need to extend out purchases, keeping the supply and demand balanced and long-term interest rates lower to make it easier for the Treasury to finance long-duration debt. And not for nothing, but Powell’s term as Fed chairman expires next February.

One of the biggest issues Yellen faces as Treasury Secretary is financing this large deficit of notes and bonds, both those purchased now and in the future, while the economy is accelerating and inflation is picking up. The Fed would have no justification to increase Treasury purchases, and because Fed policy has maintained their stance on keeping the front end of the curve well-anchored until 2023, the dollar is weakening. That's a really difficult environment to finance 20- and 30-year Treasurys.

The COVID Pandemic

The coronavirus pandemic has had a major health and economic impact in 2020, especially in large urban areas. Now that we’re in the early stages of a vaccine rollout, what do you expect for 2021?

It’s hard to say. The virus mutations and slower-than-anticipated vaccinations suggest that we’re likely to see a huge surge of infections over the next few months, no matter what. With the change of the season and increase in vaccinations, we hope to see a sharp decrease in infections by May, and that might signify the end of the virus as a public health threat.

As an economic threat, though, the virus and its impact might linger for decades, and this is what’s really unpredictable. What we do believe is remote work is here to stay. Larger, urban cities like Chicago, New York City or San Francisco face an uphill battle, especially with the decline in office space demand, which will have significant commercial real estate implications. These ramifications may trickle into their suburbs as people weigh the need to be close to their office or the risks of utilizing mass transit and working from home. In terms of demand for infrastructure, though, I think Houston is going to be the new Chicago, Austin is going to be the new San Francisco and Boise is going to be the new Austin – cities that are already fairly well-developed and are beginning to experience a population migration. That’s going to affect the landscape of the municipal credit sector for quite some time.

Indicators

What indicators are you looking at most closely in terms of the overall health of the economy?

There are some simple ones that I think are more coincident than leading, but still quite helpful. A steady or increasing supply of nonperforming loans, which are loans that are close to default, could be a very good indication that the credit rot is much worse than we thought. I say that because nonperforming banks had a huge incentive last year to really exaggerate their expectations for nonperforming loans. If for some reason they come in worse than expected, that's a really bad sign because those banks had every incentive to throw the worst case out there last year.

Commercial real estate delinquencies make me concerned on the credit side. If we're seeing a real decay in the commercial real estate space – not just retail, but across the office and hotel space – those delinquencies could continue to push higher. That's not going to be a positive sign for property tax collections in big cities and second-tier satellite cities.

We’re also keeping an eye on mid-sized East Coast city and town fiscal positions come June, housing prices, mortgage applications and even housing starts. Housing is going to be a big catalyst for higher Treasury yields. If we're looking at April or early May and the housing market is really struggling and people aren't buying for whatever reason, there won’t be a Treasury selloff in the third quarter. So housing starts are going to be a leading indicator.

Final Thoughts

Any final thoughts as we march into the new year?

First, while I think the first quarter is going to be really strong for municipals, I see it being weak for the broader U.S. economy. Two-thousand-dollar stimulus checks will help avoid the worst-case scenarios on consumer spending patterns and evictions. But when you look at the rioting on the Capitol building in Washington, a second impeachment and the rise in the number of COVID deaths, it's hard to be optimistic on the economy right now.

Second is the fact that we’ve quietly entered a new Cold War with China – a war that is being fought with a drastically changing social paradigm that is more like the late 1960s. I think that's a legitimate risk the Biden administration is going to face. 2020 showed us that no politician, no one in leadership is going to have the incentive to be hard on China. That's important because trade with China is going to be an issue again. What's more, China now feels that they can disrupt U.S. politics. That's a major change from 2020.