Is Now the Time To Refinance Your Mortgage?

After two years of steadily rising interest rates, rates are beginning to move downward again, prompting homeowners to wonder if maybe they can get a better deal on their mortgages. However, there’s a lot more to refinancing than just the interest rate. Before you call up your bank, here are three key financial considerations that should factor into your decision-making.

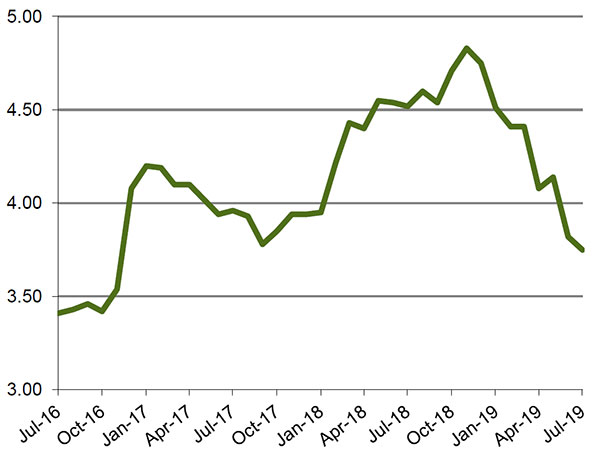

Mortgage Rates: July 2016 - July 2019

Source: 2019 Primary Mortgage Market Survey

Consideration 1: The Term of the Loan

The whole point of refinancing your home loan is to reduce your monthly mortgage payment. Let’s say you have a $300,000 mortgage with 25 years remaining and an interest rate of 4.7%. In that case, your monthly payment is about $1,700. If your bank offers you a new 30-year mortgage at 4.0% on the same size loan, your monthly payment will fall to about $1,430, a savings of $270 per month. Sounds good, doesn’t it?

But keep in mind that while you’re lowering the monthly payment, you’re also extending the life of the loan by another five years. That longer term will end up costing you more than $5,000 over the life of the loan. If you opt instead for a 25-year loan at the same 4.0%, you’d not only lower your monthly payment by about $100, but you’d save more than $35,000 in interest over the life of the loan.

If you do decide to refinance with the original 30-year term, consider making the same payments as you did on the original loan. Using the example above, if you made the same $1,700 payment on a new 30-year loan with a 4.0% interest rate, you’d save $58,000 over the life of the loan and pay off your mortgage nearly three years sooner.

Consideration 2: Closing Costs

While a lower interest rate is a good start, there are expenses associated with refinancing that need to be accounted for, such as an appraisal, loan application fee and title search fee. These fees vary by lender, but expenses of $1,000 or more are commonplace. A loan origination fee also might apply, which is typically 1% of the loan balance. In the example above, these fees would mean an additional $4,000 or more in closing costs, which may limit – if not negate – the benefit of refinancing in the first place.

In some cases, lenders will allow you to roll these expenses into the new loan rather paying them upfront. However, choosing this option means paying that amount plus interest over the life of the loan. For example, say you rolled the $4,000 closing costs into our $300,000, 30-year loan. That increase in the loan amount would cause the monthly payment to go up almost $20 and add nearly $2,900 in interest – on top of the original $4,000.

Consideration 3: Taxes

The Tax Cuts and Jobs Act of 2017 changed the way the IRS treats mortgage interest in two significant ways. Interest on a home loan had always been tax-deductible so long as the loan remained under a certain threshold. The TC&JA reduced that threshold from $1 million to $750,000, though that reduction only applies to loans taken out after December 14, 2017. If you’re refinancing a loan that was taken out before that date, you would be grandfathered under the higher limit.

The other major change under the TC&JA is that interest on a home equity loan is no longer tax-deductible. If you’re refinancing an existing mortgage, any increase in the size of the loan would be considered a home equity loan, and the interest on that increase would no longer be deductible. That would include any closing costs that are rolled into the new loan.

This rule also applies if you were to complete a "cash out" refinancing, where you would replace your existing mortgage with a new one for more than you owe and take the difference in cash. Most of the time, the interest on this refinancing will be non-deductible. The only exception is if you use that extra cash to make home improvements – in that case, that portion of the loan would be eligible for a tax deduction, though it would be subject to the lower $750,000 debt limit.

Falling interest rates are certainly a good reason to take a second look at your mortgage. Just make sure you're not lured into a loan that ends up costing you more than expected. Your Baird Financial Advisor can help you determine how refinancing your mortgage would impact both your taxes and your larger financial plans.

Not a Baird client? Find a Financial Advisor.