U.S. Private Credit Update: State of the Market

Investment Banking

As if U.S. financial markets didn’t already have enough to digest between supply chain disruptions, labor shortages, inflationary pressures and the specter of rising interest rates, the war in Ukraine has thrown markets into disarray as investors struggle to cope with the new levels of uncertainty. Equity markets have felt this uncertainty as much as, if not more than, any other market with the VIX currently at 25 and having risen as high as 39 at the start of the conflict. The high-yield market, already suffering from a demand shift towards the floating rate leveraged loan market in the face of rising rates, has been essentially shut with only a handful of deals pricing over the past few weeks. The leveraged loan market, while holding up better than the high-yield market, has also been meaningfully impacted and would-be borrowers with the option of waiting to launch deals have remained on the sidelines. Many of those that have transacted have seen terms flex wider.

The private credit market, however, has been a very different story. This should not come as a surprise given the history and purpose of the private credit market. In reaction to the pullback by banks from middle-market lending as a result of the credit crisis of 2007-2009, private credit funds (or “direct lenders”), free from the regulatory-related costs and constraints faced by banks, rushed to fill in this lending gap. This market has grown tremendously in every way since then, but in a sense, it was born out of volatility and remains well-suited for periods of market dislocation like the present one.

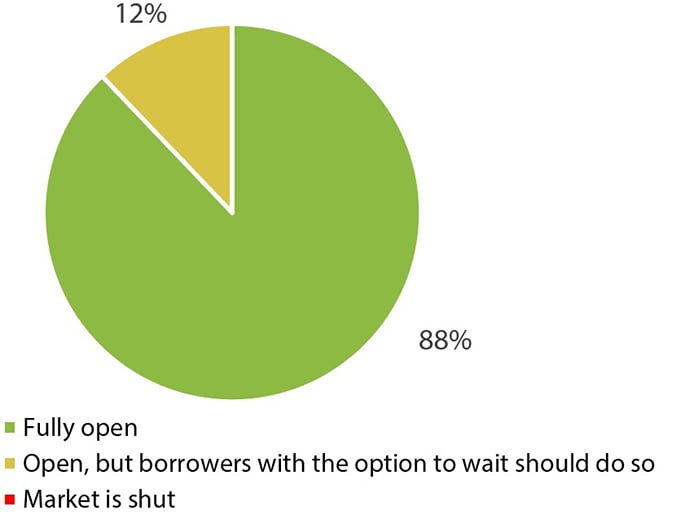

Baird’s Capital Advisory team surveyed a sample of active direct lenders focused on senior lending to middle-market performing credits (33 responses received) to quantify how the war has impacted this market. Eighty-eight percent of respondents categorized it as “fully open” and the remaining 12% as “open, but borrowers with the option to wait should do so.” Nobody responded that the market is shut.

How open would you say the private credit markets are at present?

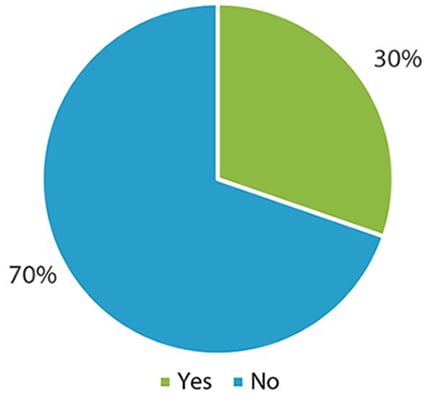

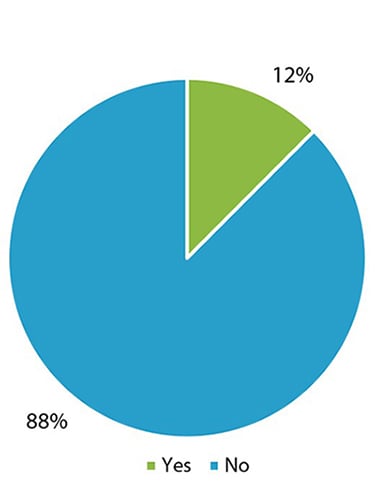

Needless to say, the war doesn’t affect all companies looking to issue debt uniformly. For companies directly impacted, whether by an increase in cost structure or other deterioration in financial performance, lenders will continue to underwrite on the basis of credit fundamentals. Credit agreement terms, both economic and non-economic, will reflect this new reality. But borrowers who have not seen, or do not expect to see, a deterioration in performance are still able to transact on the same terms as before the war. Most direct lenders are not presently requiring a pricing premium to reflect macroeconomic uncertainty and broader market volatility, as is the case for the leveraged loan markets. Additionally, few are tightening non-economic terms such as financial and negative covenants, prepayment premiums, required amortization/repayments, etc.

For borrowers with no direct link to Russia and that are generally not directly impacted by the war, are you requiring a pricing premium relative to pre-invasion to compensate for macro volatility and uncertainty?

For the same type of borrowers (no direct link), would you adjust any non-economic terms relative to pre-invasion?

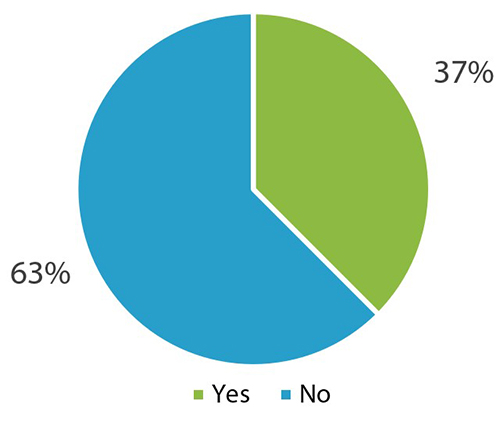

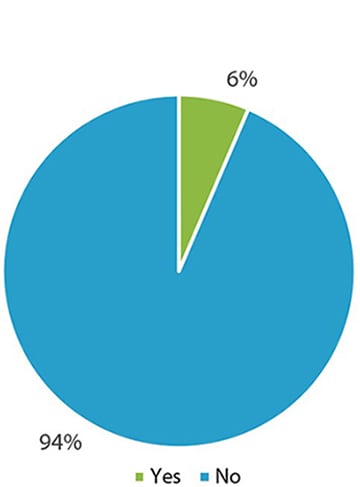

Less clear, however, is how lenders’ policies towards firms with only indirect links to Russian or Belarussian entities or investors will shake out. Most have not yet explicitly formalized how their ESG policies will address these credits, but nearly two-thirds of lenders surveyed would not lend to issuers with such links, even if indirect. Others noted that potential borrowers will be evaluated on a case-by-case basis in this regard. So, while formal policies are not yet broadly established, it is clear potential borrowers with any such links can expect at best, meaningfully less competitive tension in the private credit market and at worst, an inability to transact until all such links are eliminated.

Has your ESG policy with respect to potential borrowers with indirect links to Russian entities or shareholders been defined?

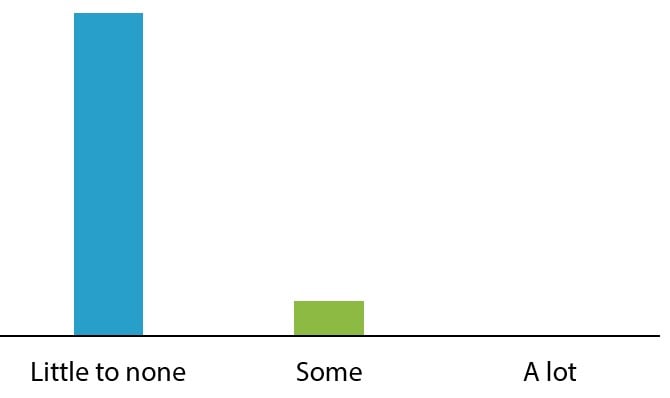

While it is impossible to predict how the geopolitical tensions will play out and whether conditions in the private credit market will deteriorate, many of the dynamics that have enabled this market to continue on “business as usual” to date are not expected to change because:

- There are no real-time markers of market value on these loans

- Direct lenders do not rely on liquidity in the market

- Portfolios have gone largely unscathed and lenders have therefore not seen a need to modify their allocation strategies

- Capital is aplenty, with North American direct lenders having raised $69 billion in 2021 to finish the year with $253 billion of dry powder 1

What proportion of your portfolio is directly impacted by the war, either as a result of increased costs or direct links to Russian entities?

Would you say your allocation strategy has been impacted by global events?

Borrowers in need of debt financing in the near-to-medium term can rest assured that execution risk for healthy credits in the private credit market remains low. Larger borrowers with access to the institutional leveraged loan markets will find that the relative attractiveness of the private credit market has increased, as it usually does during periods of market volatility. For such potential borrowers, Baird’s Capital Advisory team can help you evaluate your financing needs, educate you on the financing packages available across the various debt markets and execute an optimized solution.

1 Source: Preqin