Strong Buyer Demand to Drive Global M&A Market in 2022

Investment Banking

The global M&A market should continue to thrive in 2022, fueled by robust demand from well capitalized acquirors. Financial sponsors are primed for another busy year of buying and selling, while corporates will address strategic imperatives to position their businesses for post-COVID realities and emerging secular themes. Although expected to be strong, this year’s deal value metrics appear unlikely to reach the records set in 2021, when unique dynamics greatly expanded the supply of attractive targets. Throughout 2022, the combination of aggressive buyers and a more normalized target supply should further boost valuations for premium assets.

Implications of Stellar 2021 M&A Market

A review of the M&A market’s blowout 2021 sets the stage for expectations in the new year. Selected highlights for 2021 include:

- Global deal value reached a record of $4.7 trillion, 30%+ above the prior single-year high in 2015.

- Peak spending on M&A was powered by the U.S. market, where 2021 deal value of $2.8 trillion exceeded the previous record by 40%+.

- Billion-dollar-plus transactions were the primary driver of new highs for deal value, with the U.S. transaction count for this segment more than double the 2016-2020 average.

- The global middle market also contributed significantly to record deal values, as the number of transactions with disclosed value in the $100 million to $1 billion range increased 30%+ from the average of the previous five years.

The M&A market’s banner year reflected the combination of pent-up buyer demand with the unusually high number of companies available for sale. The inflated supply of targets included many businesses whose sale processes were postponed during 2020 due to COVID. In addition, numerous assets were put on the market earlier than originally planned with an eye toward avoiding anticipated tax increases in the U.S.

While still substantial, the supply of targets should be more normalized in 2022, largely due to the M&A market experiencing less benefit from the resumption of delayed processes. Relative to 2021, this year also should see reduced impact from engagements being pulled forward due to tax considerations, although the potential for tax increases to materialize during 2022 could continue to cause a meaningful number of sellers to bring companies to the M&A market ahead of schedule. As an offset to subsiding supply tailwinds, certain factors should deepen 2022’s pool of targets, including some processes contemplated for the latter part of 2021 being deferred until this year due to overcrowding in the M&A market or based on company-specific performance pressures such as inflation, supply-chain challenges, and labor shortages. The potential for the valuation environment to remain favorable (as discussed in the next section) could also draw more targets to the M&A market.

Wider Valuation Gap for Top Assets

Another outcome of last year’s deal frenzy was the significant increase in purchase price valuations realized by premier businesses, with potential for further multiple bifurcation in 2022. Strategic buyers and financial sponsors entered 2021 armed with access to massive amounts of capital, enabling their aggressive pursuit of prized assets with strong growth prospects, with these dynamics also in place as 2022 begins.

Analysis of Baird Global Investment Banking’s sellside advisory transactions demonstrates that the valuation premium achieved by top targets widened during 2021. We compared EBITDA multiples in the 75th percentile (a proxy for the highest-quality assets) to median purchase price multiples as a means of gauging the relative demand for upper-tier businesses.

Among key findings from this analysis:

- In 2021, the median EBITDA multiple for the 75th percentile was about five turns (~5x) above the median multiple across Baird’s sellsides; during 2018-2020, the 75th percentile multiple was about three turns (~3x) above the median multiple for the group.

- Accordingly, the valuation premium for the 75th percentile rose by two turns (2x) in 2021, reflecting heightened demand for the most highly regarded businesses, even amid the larger supply of targets.

- Last year’s increased premium occurred in the context of higher valuations for Baird’s sellsides in 2021, when the median EBITDA multiple was one and a half turns (1.5x) above the 2018-2020 figure for a comparable mix of deals by sector.

- We believe wider premiums applied to the highest-quality assets throughout the M&A market, as the valuation premium for the 75th percentile expanded substantially across our sellsides in the Consumer, Healthcare, Industrial, and Technology & Services sectors. For example, the valuation premium for the 75th percentile of our Industrial sellside multiples in 2021 was 2.5x, up from 1.5x in 2018-2020, rising by 1x even as the median multiple for our Industrial sellsides increased by nearly a turn last year relative to the 2018-2020 level.

We expect highly valued businesses to maintain or expand upon their valuation premiums during 2022. As noted above, the supply of M&A targets during 2022 likely will be less than the elevated levels of last year. At the same time, M&A demand among corporates and PE firms should remain near peak levels. As a result, supply-demand forces should tilt in favor of sellers, supporting purchase price valuations and potentially lifting upper-tier multiples even further.

Financial Sponsors Sustaining Momentum

Private equity firms should be leading players in the M&A market following a highly successful 2021, when disclosed deal value for financial sponsor acquisitions nearly doubled and disclosed deal value from sponsor M&A exits was more than twice the year-ago level.

Favorable factors for financial sponsor activity in 2022:

- Dry powder for global private equity topped $2 trillion for the first time in 2021 according to Preqin, reflecting a new peak for aggregate capital raised in a single year.

- PE firms are well positioned for another powerful wave of fundraising during 2022 following an unusually strong year for exits (through both M&A and equity offerings) along with mostly positive performance for portfolio companies in existing funds.

- Sponsors should have more capacity to focus on new platforms and add-ons after devoting a lot of attention to executing on M&A exits, which increased 60%+ in the U.S. and Europe during 2021.

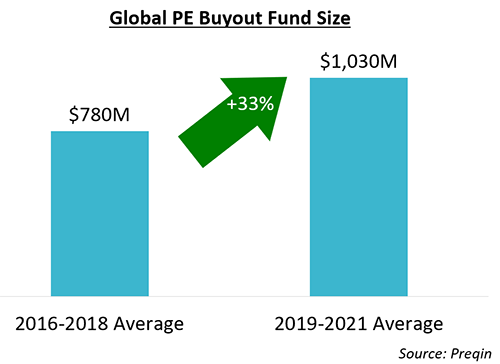

- The average size of buyout funds launched in 2019-2021 exceeded the mean of the prior three years by 33%. The significant number of firms that raised much larger funds on condensed cycles should be among the most aggressive buyers in 2022.

- While actively evaluating targets, sponsors will continue to be disciplined in selecting which companies to pursue. In our processes, many sponsors have expressed the need for a distinctive angle and sufficient familiarity in order to focus on an available asset.

- Although 2021 was highly productive for exits, sponsor selling activity should remain substantial given the strength of the 2016-2018 fund vintages. According to PitchBook, U.S.-based sponsors still own nearly 70% of the companies acquired in 2016.

- Sponsors that withdrew sale processes in 2021 due to overcrowding or other factors are likely to bring these portfolio companies to the M&A market during 2022.

Lending markets are poised to support financings for sponsor M&A during 2022. After generating record fundraising in 2021, direct lenders should become an even larger presence in both the middle market and upmarket, including a growing number of $1+ billion unitranche financings. While the U.S. Federal Reserve recently signaled monetary policy tightening during 2022 given recent inflation trends, increases in benchmark and lending market interest rates should be gradual and would be from historically low levels.

Although not representing traditional control-stake M&A, two additional private equity trends are worth noting:

- We expect further growth in the number of firms utilizing continuation funds to maintain ownership of portfolio companies past the end of existing fund lifespans, deferring exits via traditional M&A or an IPO.

- Growth capital should continue to emerge as a force after impressive expansion during 2021, particularly in view of strong investor interest in high-growth technology businesses. According to PitchBook, last year’s deal count and capital invested both doubled 2020 levels for later-stage $50+ million minority raises. Investors in these funding rounds primarily included financial sponsors along with other institutional investors, with the technology and services sector representing over half of the total invested in 2021.

Corporates Primed to Deal

After demonstrating renewed M&A appetite during 2021, strategic buyers should remain aggressive in pursuit of identified targets this year. Over the course of 2021, the disclosed deal value for global strategic M&A activity rose nearly 60% to a record level of $3.3 trillion. Periods with high levels of corporate M&A activity often are followed by continued strength as companies respond to deal-making within their peer groups. For example, after the prior peak year for strategic acquisitions in 2015, disclosed value for such deals in 2016 was higher than in any year from 2008 to 2014, exceeding the annual average for that period by nearly 50%.

The fundamentals are in place for strong corporate M&A demand throughout 2022. Recent surveys in the U.S. and Europe indicate that the confidence levels of corporate management teams are in the upper portion of historical ranges, reflecting relatively good visibility to upcoming results amid a constructive demand backdrop. Executives have compelling reasons to pursue targets, including to combat recent competitor M&A activity as well as to position for secular themes (e.g., AI, digitalization, IoT, sustainability) and the new normal now faced by businesses and consumers post-COVID.

Strategics are well prepared for an active year of buying due to entering 2022 extremely well capitalized:

- Corporate cash levels remain elevated, rising far above pre-pandemic totals to $7 trillion during 2021.

- Company profits reached new heights in 2021, when S&P 500 operating income exceeded the prior high of 2019 by an estimated 25%+.

- Hefty cash stockpiles are also a function of record issuance in the global investment grade and high yield bond markets during 2021, as issuers took advantage of historically low interest rates.

- A boom year for equity offerings contributed to balance sheet strength; on a global basis, record proceeds from IPOs during 2021 were more than 50% above the previous annual peak.

- With equity markets near all-time highs, many public companies are in position to use their highly valued stock as M&A currency in accretive transactions.

In addition to remaining a top driver of M&A demand, corporates could become a larger source of target supply if the conglomerate breakups announced late last year signal a broader trend ahead. During Q4 2021, General Electric, Johnson & Johnson, and Toshiba were among corporate leaders announcing intentions to split into multiple companies in an effort to achieve higher overall valuations. While those planned transactions involve spin-offs, we expect many corporates to use the M&A market to achieve corporate breakups through the divestiture of business units, as in the case of Unilever recently announcing the sale of most of its global tea business to CVC Capital. Financial sponsors should continue to represent a key set of buyers for corporate assets, as sponsors were acquirors for 600+ corporate divestitures over $100 million since 2019.

Regional Drivers

Additional geographic factors should be considered in projecting M&A activity.

Selected key M&A themes in Europe for 2022:

- This year should feature M&A activity across a broader range of sectors, including those recovering from the impact of COVID. In the second half of 2021, European M&A activity shifted back toward the Industrial and Consumer sectors, lagging the U.S. by six to nine months.

- Despite normalization of activity by sector, we still expect the share of Technology sector M&A to be higher than pre-COVID levels, with significant contribution from growth equity. As in the U.S., prolific investments in technology have led Europe to unprecedented acceleration in middle-market growth equity deals, a trend that we expect to extend through 2022.

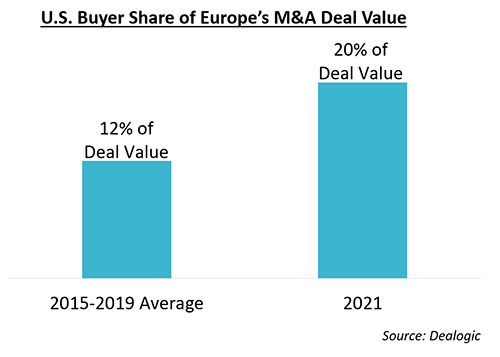

- Europe-based targets should continue to generate strong appetite from U.S. acquirors. Transatlantic M&A activity flourished in 2021 despite COVID, international travel restrictions, and repeated national lockdowns. U.S. acquiror contributions reached record levels at 9% of total European deal count and 20% of disclosed European deal value in 2021, with the deal value share well above the 2015-2019 average of 12%. We expect this share to remain high in 2022, driven by elevated U.S. public company valuations (enabling valuation arbitrage when acquiring in Europe) and a shift to localized operations to serve customers and de-risk supply chains across regions.

- SPACs should become a bigger factor in Europe’s M&A market based on recent developments:

- M&A announcements since last June included 15 merger transactions valued at $51 billion involving U.S. listed SPACs and Europe-based companies, with more sizable deals likely to come in 2022 as 500+ U.S. listed SPACs seek targets.

- We also expect an increasing number of mergers from European listed SPACs in 2022. After seeing massive levels of capital flock to U.S. listed SPACs, European stock exchanges, including the LSE, recently adjusted listing rules to be more SPAC friendly.

- Interest rates should remain low even as higher than expected inflation puts pressure on central banks to raise base rates. A rate increase by the ECB likely would lag a benchmark hike from the U.S. Federal Reserve by 6-12 months, with this scenario supporting a low cost financing market for M&A deals.

Japan’s outbound M&A should rebound further after 2021’s modest recovery from low levels:

- Last year’s outbound activity remained far below the pre-pandemic levels of 2018-2019 due to travel restrictions, as potential buyers from Japan struggled to engage in competitive M&A processes in the U.S. and Europe.

- A brighter outlook for 2022 reflects pent-up demand following two subpar years and with the underlying drivers of Japan’s strong pre-2020 outbound M&A remaining intact, including low economic growth and large amounts of corporate dry powder.

- We expect North America and Europe to continue to be the most favored destinations for Japanese buyers, as these regions represented over 60% of Japan’s outbound M&A since 2018.

- Japan’s outbound M&A revival should feature targets broadening from the Technology space to include greater share from other sectors such as Industrial.

In 2022, China’s outbound buyers will seek fertile ground for deal-making after a challenging period:

- Outbound M&A from China will continue to be limited by scrutiny from governments in the U.S. and Europe, particularly when involving targets and technologies viewed as important to national security. In 2021, the number of Technology sector acquisitions by Chinese buyers for targets based in North America or Europe was 25% below the 2016-2020 average.

- Chinese buyers are increasing outbound M&A in the Healthcare sector, where disclosed deal value reached a four-year high in 2021, driven by pursuit of drug innovations, global expansion, growing medical aesthetics markets, and rising demand for high-quality hospital services and elderly care services.

- Newer areas of focus include targets that enhance the ESG profiles of buyers, consistent with the efforts of China’s government to reach future benchmarks for emissions and carbon neutrality.

- Opportunities for investment also include corporates and PE firms located in China acquiring the China-based businesses of multinationals seeking to revamp their portfolios in the current geopolitical environment.

Additional Considerations

Several factors that are also relevant to the M&A outlook merit discussion:

- As 2022 progresses, M&A activity should ramp up from a potentially slower start to the year.

- Market participants could take a breather in early 2022 from the frenetic pace of last year. Many financial sponsors are recharging after a strenuous period that included record metrics for buyside and exit deals. In addition, the increasingly prominent direct lender universe will need to refocus on new origination opportunities after putting their pencils down at the tail end of a hectic year.

- Sellside engagements for a meaningful number of targets might begin later in 2022 due to recent challenges caused by external issues such as inflation pressures, supply-chain disruption, and labor shortages. Such companies will want to demonstrate stronger financials before launching sale processes in order to get credit from prospective buyers for expected improvement in performance.

- For many sponsors and corporates seeking targets, available businesses must offer an attractive ESG profile to warrant a full valuation. The marketing and communications materials of leading companies, sponsors, and investors frequently feature their heightened ESG standards. Accordingly, investors and acquirors in the public and private markets are focused on the ESG initiatives of existing and potential holdings. Given the likelihood that ESG requirements rise further over time, buyers often are looking beyond simply checking the ESG box and are strategically seeking targets that enhance their sustainability story over the longer term, particularly since these businesses should be well positioned for any future sale from an ESG perspective.

- Although SPACs will remain a player in segments of the M&A market, we expect the diminished impact seen in the latter part of last year to carry through 2022.

- In the U.S., SPAC buyers represented 33% of all $1+ billion deals announced in the first seven months of 2021 but only 21% in August-December.

- With the fuse getting shorter on the timing requirement for the 500+ SPACs still seeking targets and given the challenges faced by many SPACs that have announced a merger, SPACs could broaden their horizons to target more mature businesses that are better suited to operate as public companies. The large majority of announced SPAC targets were unprofitable in 2021.

- Notable variables with potential to influence the M&A market during 2022 include:

- Global economic conditions, which have been affected by cost and price inflation as well as supply chain problems; nevertheless, recent demand appeared strong in the U.S, where real GDP is estimated to have risen about 7% in Q4.

- Impact of higher inflation on interest rates, as any significant increase in debt pricing would weigh on leverage multiples and deal valuations, even as M&A financing should remain widely accessible in the middle market and upmarket given the growing market presence of direct lenders.

- Stricter Federal Trade Commission regulations in U.S., as concerns about extended antitrust reviews and potential deal terminations could limit the appetite for transactions that would combine leading companies in certain sectors.

- Return of widespread lockdowns or restrictions driven by new COVID variants.

While unexpected issues are certain to arise during the year, we anticipate relatively smooth sailing for the M&A market over the course of 2022. Please contact Baird’s Global M&A team to discuss your M&A plans for the new year and over the longer term.