Alternative Investments

An Asset Class Whose Time Has Come?

Rising interest rates, heightened volatility and a nearly 14% drawdown in the S&P 500 so far in this year's "nowhere to hide" market have brought a new focus and urgency to the question of what role alternative investments should play in individual investor portfolios.

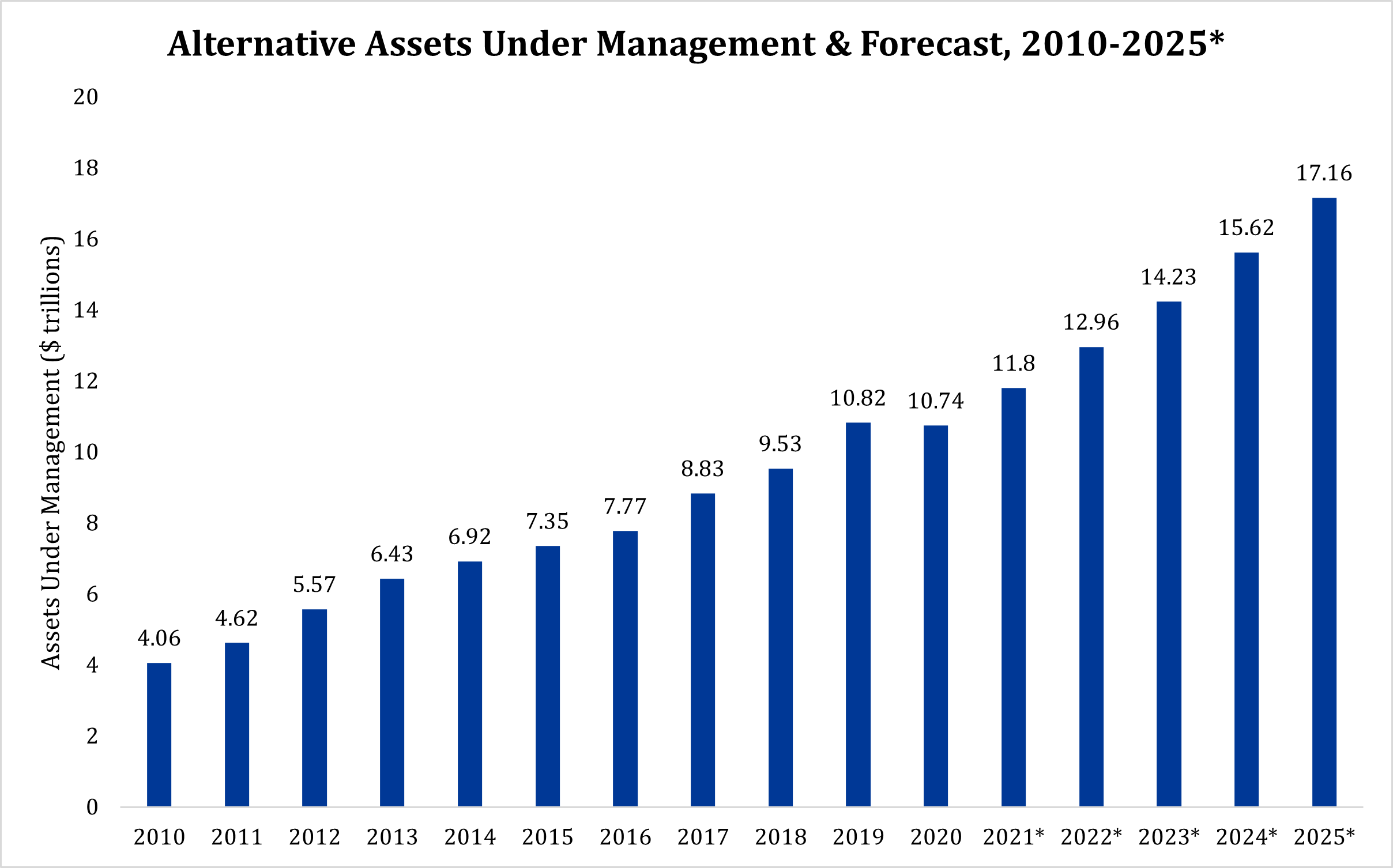

Institutional investors, pioneered by Yale University's late chief investment officer David Swensen, have been increasing their allocations to private assets and other alternatives for decades. Currently, the largest university endowments have approximately 58% of their portfolios invested in alternatives, according to NACUBO data. As a result, assets under management in alternatives have nearly tripled over the past decade.

Source: Baird, Preqin data. 2020 figure is annualized based on data in October. 2021-2025 are Preqin's forecasted figures.

Generally, what works for institutional investors eventually trickles down to high-net-worth individual investors. But there are challenges to investing in alternatives at the individual level, not the least of which are their complexity, limited access, increased risk and reduced liquidity. I asked Kathy Carey, head of Baird's wealth management research team, and teammates Nic Reisenbichler and Scott Osborne to share their thoughts on this topic.

John: Kathy... Let's start with you. There's been a lot of discussion recently about the fact that the traditional 60%/40% allocation of stocks-to-bonds may no longer be optimal, and that alternative investments should play a bigger role in investors' portfolios. Do you agree with that? Has the TINA market ("There Is No Alternative") been replaced by the TARA market ("There is a Reasonable Alternative")?

Kathy Carey (KC): For decades, the bond portion of a traditional 60/40 allocation provided attractive returns even as interest rates dropped from 15% in the early 1980s to less than 1% in mid-2020. In addition, bonds generally provided capital preservation when stocks sold off. This year, it hasn't worked that way. Bonds haven't done what they're known for. Through June, the traditional 60/40 portfolio is down more than 11%.

Looking into the future, we're not expecting that the high returns we've experienced in the equity markets over the past decade are sustainable. On the fixed income side, while we've seen rates rise recently, we're still in an historically low interest rate environment.

So yes, that might lead you to look elsewhere (besides bonds) to mitigate risk and provide income.

John: Scott, would you recommend individuals rethink their portfolio allocations?

Scott Osborne (SO): It varies by investor. There's no question we're in a period where things have changed. And those two things are wreaking havoc on portfolios. I'm not sure I would say the 60/40 portfolio is dead. I would say it's "temporarily hindered." In the environment we're in, alternatives certainly present investors with opportunities. But there are risks and drawbacks. One of those is they're more complicated to understand. They may not be appropriate for investors in retirement or who don't understand a lot about investing.

John: How would you describe alternative investments?

KC: Generally, alternatives are anything other than a traditional investment in stocks, bonds or cash.

Nic Reisenbichler (NR): There are two buckets in alternative investments: a liquid bucket and an illiquid bucket. The liquid bucket contains things like mutual funds and ETFs comprised of managed futures, market neutral, long/short equities or long/short credit strategies. In the illiquid bucket are things like private equity, private debt, private real estate and some types of hedge funds. There needs to be a combination, a balance, of these two buckets when you put together a portfolio for individual investors.

For illiquid investments, you generally need to be a qualified purchaser or accredited investor to invest in them. But there are some more liquid investments such as an interval fund, that with a little extra education, clients can understand what they are investing in. Some of those may be appropriate on the margin for the individual investors.

John: What are the major reasons individuals might consider investing in alternatives?

SO: There are a few reasons:

-

They can help diversify the risk of traditional portfolios, since alternatives do not generally move in sync with stocks and bonds.

-

They offer the potential for better risk-adjusted returns and can help offer investors more stable returns and a "smoother ride."

-

They have the potential to offer more attractive yield or income.

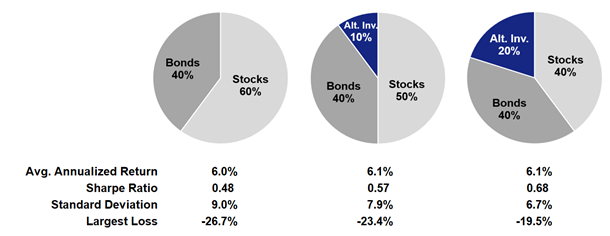

The charts below illustrate the potential benefits of moving 10% or 20% of a traditional portfolio into alternative investments:

Source: Baird. Performance figures are for the 20-year period ending December 2019. Past performance is not a guarantee of future results. Stocks are represented by the S&P 500 Index. Bonds are represented by the Bloomberg Barclays Aggregate Index. Alternative Investments ("Alt Inv") include a one third allocation to Hedge Funds (HFRI Fund Weighted Composite Index), one third to Managed Futures (Barclays CTA Index) and one third to Private Equity (Cambridge Associates LLC U.S. Private Equity Index®). See page 3 for a more detailed description of these indices. It is not possible to invest directly in an index.

John: What are the drawbacks?

SO: Most alternatives offer only limited or periodic liquidity. This means you might only be able to exit your position once per quarter, or once a year, or perhaps not for a decade. They may be less transparent, which makes them harder to understand and to monitor. Illiquidity and leverage can add to investment risk.

John: Are people looking for more income than getting from their bonds? Or are they looking for things that aren't correlated with equities?

NR: Yes to both of the above... but with an emphasis on income, and as an income alternative to fixed income. But given their increased risk, they shouldn't be a replacement for your US Treasury bonds. Fixed income always has a place in investors' portfolios, because, as they say, "A bad year in the bond market is a bad day in the stock market."

KC: We are seeing more interest from financial advisors in alternatives. This is the first time in a long time that we're having conversations about this asset class.

NR: Last year was a record year in terms of inflows into alternative investments at Baird. We've already surpassed that this year (in 2022). Private real estate has seen the most flows, along with private debt. And private equity is always popular.

KC: It seems people think they can understand private equity and real estate. Maybe that's where the interest in those two types of assets come from.

NR: We've also seen a big increase in managed futures.

John: One of the issues smaller investors have had in the past is access. It's harder for them to invest in the suite of strategies that large institutions can invest in. Since dispersion of returns between the best managers and worst managers is wider in private markets than in public markets, that has in the past translated to reduced return opportunities for high-net-worth investors. Is lack of access still a problem?

SO: It used to be a major issue. It was hard for high-net-worth investors to get access to funds if they didn't have $5 million or $10 million to invest.

Over time, platforms have been developed (like CAIS, which Baird uses) that allow individuals access to high quality managers across many different asset classes and product types. Also, product innovations like funds of funds or interval funds have allowed smaller investors to get access to top-tier managers.

KC: Still, manager selection is very important. You need to make sure appropriate due diligence and monitoring are performed to help avoid picking a manager that produces disappointing returns.

John: Is it fair to say there has been a "democratization" of alternatives over the past few years?

NR: Absolutely, because of platforms like CAIS or iCapital.

KC: I'll admit that when we first started working with CAIS, I had some questions about why some of the best managers wanted to dip into the retail space. But from their standpoint it makes sense because they diversify their investor base and potentially get assets that are a bit more "sticky" than those associated with institutional clients.

SO: There are more and more product types being offered to high-net-worth investors, so that's good news for those investors going forward.

KC: Yes, more opportunities. But because alternative investments are complicated, investors need to be educated. Since there are so many different types of alternatives, investors need to think hard about what they are trying to achieve to narrow the list of choices. If you want higher yield and income, it's best to focus on private debt and private real estate. If you want protection from inflation and rising interest rates, focus on private debt, private real estate and managed futures. If you want equity-like returns with lower risk, look at equity-oriented hedge funds.

Thank you, Kathy, Nic and Scott.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.